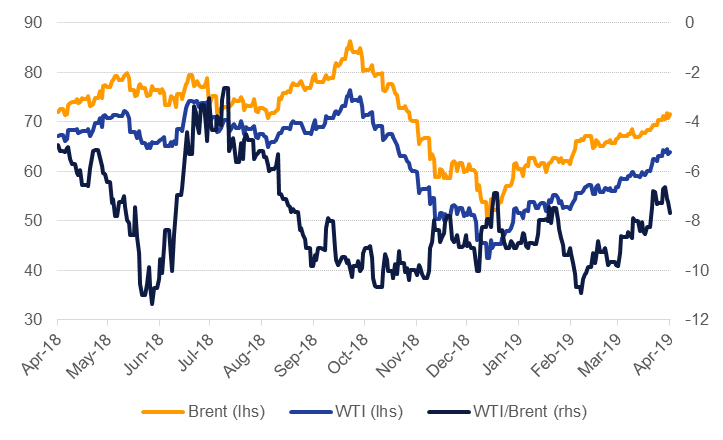

Oil markets continued to push higher, lengthening their year-to-date gains. WTI futures rallied 1.3% last week to close at USD 63.89/b while Brent futures closed at USD 71.55/b, up 1.7% on the week. WTI has risen more than 40% ytd while Brent has gained 30% so far this year. Oil’s gains come despite downgrades to global growth forecasts from the IMF and the potential of escalating trade tensions between the US and EU.

The escalation in political instability in Libya is a short-term supply risk as the LNA controls access to several key production facilities in the country. On top of the uncertainty over whether the US will extend waivers to its Iran sanctions in May, the Libya risk will be fueling discussion within OPEC+ on whether the current production cuts will be extended from June into H2 2019. Russian officials in recent days have been very outspoken in questioning whether output cuts can be ended even if it risked sending prices lower. Our view has long been that production from OPEC+ would increase in the second half of the year to compensate for the ‘over’-tightening of the market that has resulted from producers cutting output more than required and involuntary outages in producers like Iran, Venezuela and Libya.

The IEA cautioned in its latest oil market report that risks to demand growth were on the downside despite some good signs of growth from China, India and the US. The IEA’s projection for demand growth remains at 1.4m b/d, an acceleration from the 1.3m b/d estimated for 2018.

The potential interruption to supplies from Libya saw Brent curves tighten relatively more than WTI. Front month Brent time spreads closed the week at USD 0.49/b in backwardation while the same spread in WTI closed the week in a contango of USD 0.13/b, after having started the week in a very tentative backwardation. Dec spreads in both markets remained in backwardation last week: WTI Dec 19/20 closed at USD 3.89/b while Brent closed at USD 3.34/b.

Investors continue to anticipate a further tightening of crude balances and have extended their net long positions in Brent and WTI. Net length in Brent rose by 9.5k contracts last week while in WTI, 30.7k net long positions were added. Relative to shorts, positioning in both markets is at its longest since October last year, just ahead of a major downward move in prices.

The US drilling rig count rose again last week as exploration and production companies added 2 new rigs. Long dated WTI prices (rolling 12 month contract) have been relatively steady since the start of 2018, anchored around USD 60/b. Prices at that level offer enough opportunities to hedge current production and spend on new projects and activity in the US shale patch continues to attract the involvement of oil majors, most recently with Chevron’s plan to buy Anadarko.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research