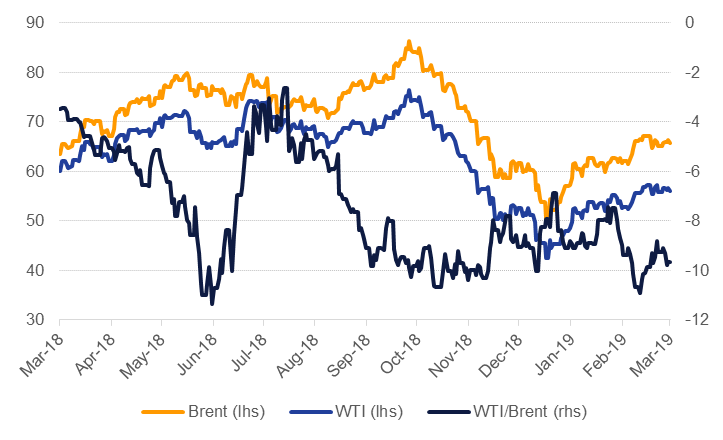

Oil markets managed to drift higher in a week that was missing any real catalyst to push prices out of their current range. WTI added 0.5% over the five days to close at USD 56.07/b while Brent futures managed a 1% gain to end the week at USD 65.74/b. The economic backdrop for oil and commodities is looking increasingly negative. US jobs data tanked in February (just 20k jobs added), the ECB has had to reverse course on withdrawing stimulus and Chinese exports fell 21% y/y in February. With a week set to be dominated by uncertainty over Brexit votes in the UK, a return to risk off-positioning could take some of the shine off crude.

The EIA, OPEC and IEA will release their latest market reports this week where all eyes will be on whether demand growth is revised lower in line with weakening growth projections: the OECD cut its economic growth forecasts so the IEA’s projections for an acceleration in demand growth look set to be revised lower. OPEC is signaling to the market to not expect much as next month’s meeting as they still don’t view the crude market as balanced. The UAE’s energy minister, Suhail al Mazrouei, said the production cuts would remain in force until the market is balanced, which we don’t expect will occur on current demand projections until the middle months of the year. OPEC will risk

Time spreads ran out of steam last week with longer dated December spreads stablising. Brent Dec 19/20 held around USD 1.65 for most of last week while the same spread in WTI was slightly weaker. Near dated spreads, particularly in Brent don’t tell a particularly compelling story of tightening, holding in a negligible backwardation. Time spreads in the Dubai market performed a little better but are still off recent highs. The 1-3month spread for Dubai closed the week slightly below USD 0.6/b in backwardation, compared with around USD 0.7/b a month earlier.

The drilling rig count in the US fell again last week, the third week running. Exploration and production firms cut 9 rigs last week although they were still up 38 rigs y/y. Investors in WTI though appeared more positive than producers. Net length in WTI expanded by 21.4k contracts last week, the second week in a row of gains, while net length in Brent fell for the first time this year as speculators cut long positions by more than 5k contracts.

Inventory data last week told a choose-your-own-adventure story. US crude stocks rose sharply—up 7.1m bbl—while total crude and product stocks dipped slightly thanks to draws across most products. European gasoline remains swamped but total stocks in ARA have been below recent highs. In Singapore total product stocks pushed higher once again even as there was a marginal dip in light products.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research