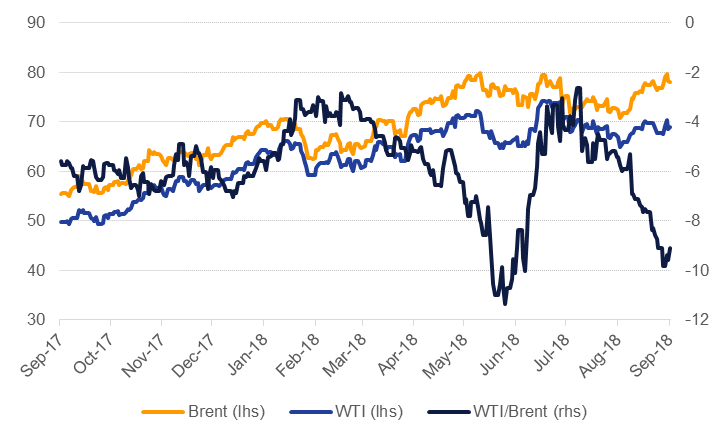

Oil markets nudged higher last week as the market absorbed agency forecasts and analysis from the EIA, IEA and OPEC. Brent futures closed up 1.6% after having breached USD 80/b mid-week. Brent ended the week just above USD 78/b. WTI managed to recover some, but not all, of the previous week’s losses and closed up 1.8% at just under USD 69/b. For Brent and WTI, USD 80/b and USD 70/b appear to be the topside barriers at the moment as both grades have struggled to break above and hold levels above those prices in the past month and a half. The risk of Brent re-touching USD 80/b in the short-term appears high but we would expect it could bring oil prices back into the focus of US president Donald Trump who has targeted OPEC several times this year.

The IEA warned of a tighter oil market ahead as the drop-off in production from Iran and Venezuela isn’t offset by increased output elsewhere. The agency left its demand growth projections for 2019 intact at 1.5m b/d, a slight uptick on this year but did highlight that collective demand growth in India and China would slow next year. The US government appears concerned enough about how tight the oil market will get that it is directly appealing to Saudi Arabia and Russia to keep oil markets well supplied to avoid a price blowout. That the US would be trying to engage constructively with Russia on this issue should be a signal to markets that the US is expecting strong compliance to sanctions on Iran with +2m b/d of exports at risk of disruption.

Forward curves highlighted the pending shortage in international markets. The backwardation in Brent markets continues to expand, hitting USD 0.87.b on the 1-3month spread while in WTI the spread closed the week at USD 0.32/b. There is a risk that WTI moves back into contango, at least in the front of the curve, but with a slowdown in production expected for 2019 the flip of the curve may not linger for too long.

US exploration and production companies put 7 new rigs into operation last week, the largest increase since early August. Meanwhile investors have split their views on Brent and WTI. Net length in WTI fell more than 27k lots last week thanks to some long positions being closed and an increase in short positions of more than 7k contracts. The upside conviction in Brent, by contrast, appears quite strong: net length rose by 23k contracts thanks to a third weekly increase in long positions and some short positions being closed.

Inventory data was mixed last week. US crude stocks dropped by 5.3m bbl but overall inventories rose by more than 10m bbl thanks to builds across the rest of the barrel, including a more than 6.1m bbl increase in distillate stocks, the largest weekly gain since the end of 2017. Singapore inventories were uniformly lower with total stocks at their lowest level since 2013.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research