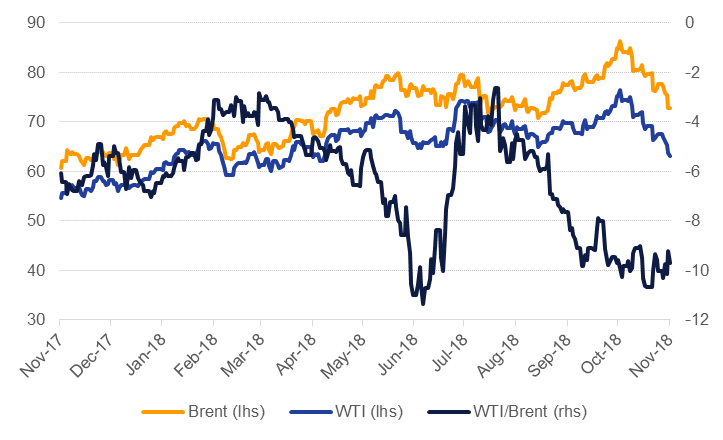

Benchmark oil futures fell for the fourth consecutive week, unwinding nearly all of the gains the market experienced from the end of August. Brent futures fell 6.2% to close at USD 72.83/b while WTI lost 6.6% to end the week at USD 63.14/b. On a year to date basis, Brent futures are up 8.9% since the start of 2018 compared with gains of nearly 30% ytd one month ago while WTI is now up just 4.5%ytd after having been up 26% a month ago.

A convergence of bearish factors are to blame for the reversal. At the end of the week the US state department indicated that it would be giving eight countries waivers from sanctions to continue importing crude from Iran. There has been no official list yet but the market is expecting that at least India, South Korea and possibly Turkey and Iraq will be exempt. Waivers will only last for 180 days and importers would still be expected to cut back on their lifting of Iranian barrels. US sanctions on Iran’s energy trade come into effect from November 5th and Iranian exports and production had been declining steadily in advance. Market surveys of Iranian exports show a decline of more than 1m b/d as of October from May, when the US withdrew from the JCPOA (the Iran nuclear deal).

Beyond the waivers surveys of OPEC production pointed to strongly higher output in October. Reuters estimates show a monthly increase of 390k b/d largely down to sizeable jumps in output from the UAE (200k b/d), Libya (170k b/d) and Saudi Arabia (120k b/d). Given the sharp reversal in oil prices (including the front end of the Brent curve dipping into contango) along with weakening demand projections for 2019 a sustained increase in production from major OPEC producers can’t be taken for granted. Our view following on from the June OPEC meeting was that members would adjust production more responsively to short-term signals rather than seeking a fixed level of market share.

Investors have surrendered on long positions in both Brent and WTI. Net length in both contracts has fallen five weeks in a row and is near their lowest in the last year. Bearish positions on Brent have been expanding, more than 24k shorts were added last week, while overall open interest in speculative WTI positions declined last week. With both curves threatening to stay in contango more longs could exit the market and add to selling pressure, a self-fulfilling trend that usually requires a significant shift in fundamentals in order to come to an end.

But producers and investors aren’t holding all the pain. Refining margins across all major refining centres all suffering and are threatening to push negative. Sagging refining margins at a time of weak crude prices sends a very telling message to us that demand is underperforming. Gasoline cracks in particular are particularly soft: the Singapore/Brent gasoline crack is barely holding at USD 2/b. Distillates have been the relative out-performer as the market is pricing a surge in diesel demand by the end of 2019 related to the IMO 2020 rules coming into effect.

Source: Emirates NBD Research

Source: Emirates NBD Research

Click here to Download Full article