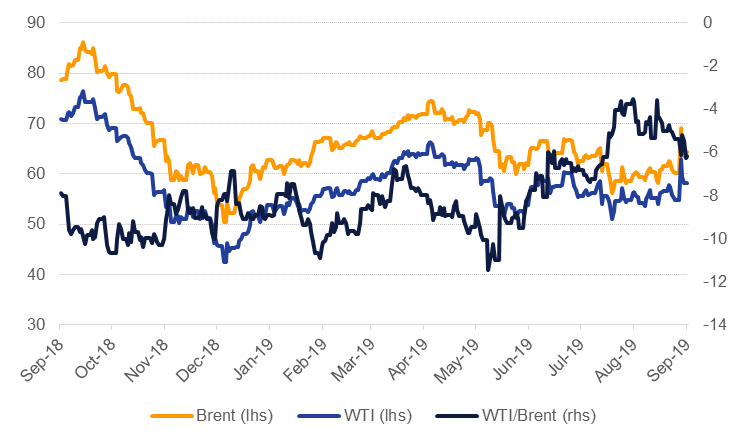

Oil markets remained on edge following the attacks on Saudi Aramco facilities last weekend and closed the week higher. Brent futures gained 6.7% over the week to settle at USD 64.28/b while WTI rose 5.9% to close at USD 58.09/b. The leadership of Saudi Arabia’s energy industry—the energy minister and Aramco officials—have been trying to reassure markets that supplies will remain stable and the enormous surge at the start of last week’s trading faded over the rest of the week.

The pace of repair work to the damaged sites and resumption of Saudi production at pre-attack levels will be the critical variable markets will be watching over the next few weeks. Distortions in physical market pricing will give the best clues as to how quickly production returns to normal, on both a volume and quality basis. In the immediate aftermath of the attack prices for crudes from alternative origins jumped and time spreads widened: ESPO/Dubai moved from less than USD 5/b pre-attack to more than USD 7/b while the 1-3 month backwardation in the Dubai curve rose to nearly USD 3/b from less than USD 2/b a week earlier. If Aramco can indeed repair its facilities and restore production by the end of September we would expect some of the recent widening in spreads and premiums to shrink.

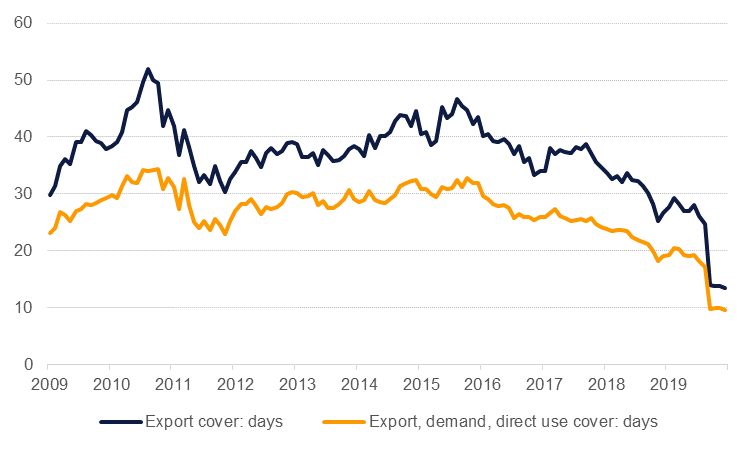

A major question for markets remains how well Saudi Arabia can continue to serve its export markets while production is interrupted. The Kingdom has said it will make use of inventories to meet its export commitments. As of July—the latest data reported by JODI—Saudi Arabia held a little less than 180m bbl in inventories which would allow it to cover roughly 18 days of exports (at 6.9m b/d in July), direct use and refinery demand (3m b/d). In a scenario where Aramco restores production back to 9.6m b/d (pre-attack levels) by the start of October, we estimate that stocks will drop by 73m bbl in September alone provided export levels are unchanged and demand dips slightly. Even in that best case scenario inventory cover for exports and local demand will narrow to around just 10 days for the final months of the year, making oil markets feel much tighter than headline balances would otherwise indicate. Hence, there is immediate pressure to restore production and likely increase output over the coming months to rebuild the draw in stocks.

Source: JODI, Emirates NBD Research

Source: JODI, Emirates NBD Research

Forward curves for both Brent and WTI adjusted upward to reflect greater uncertainty over supplies going forward. Brent time spreads settled in a backwardation of USD 1.08/b in the 1-2 month spread while 1-12 month spreads closed in a backwardation of more than USD 5.40/b at the end of the week. Longer dated WTI spreads widened but Dec 20 futures are still holding relatively close to USD 50/b, a level which does not offer much headroom for capex spending in the shale patch. The re-emergence of a wider backwardation in Brent should help to attract roll-yield investors into the market even if other fundamentals still point to soft conditions for oil in the near term. Net length in WTI had expanded in the week prior to the attacks, up by 12k contracts, but Brent net length fell thanks to speculators closing out long positions.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.