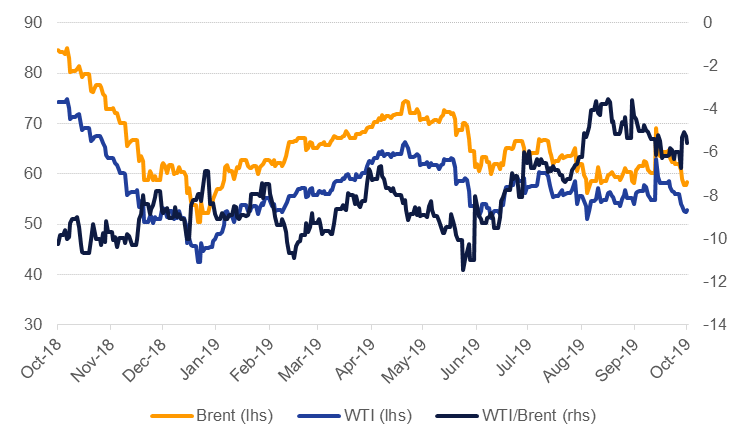

Oil prices extended their losses last week as markets remain caught up in the negative sentiment affecting nearly all markets. Brent futures fell 5.7% last week to settle at USD 58.37/b while WTI closed down 5.5% at USD 52.81/b. Both contracts are now more than 3% below their pre-Aramco attack levels as markets have fixated on a poor outlook for the global economy and how it will feed into demand for oil.

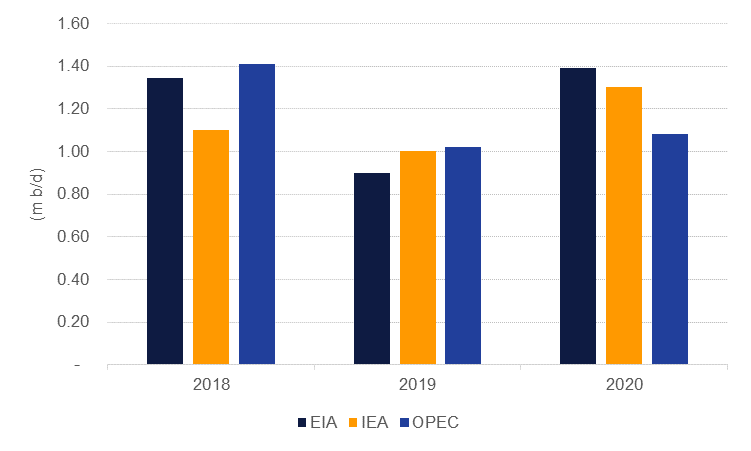

This week markets will be watching agency forecasts from the EIA, OPEC and IEA. All of the forecasting bodies have been warning about slowing demand growth and the potential for a return to stock-builds in 2020. The IEA’s director general has openly cautioned the agency may lower its demand forecast for 2019 as the impact of weaker economic growth becomes more apparent in oil markets. However, with 2019 mostly now a matter for historians the outlook for 2020 becomes much more critical. All three agencies expect an acceleration in demand growth for 2020 with the EIA forecasting the fastest improvement (0.9m b/d in 2019 to 1.39m b/d in 2020) while OPEC is projecting much more modest growth. All of the agencies are likewise projecting faster non-OPEC supply growth in 2020.

Source: Emirates NBD Research. Note: September estimates.

Source: Emirates NBD Research. Note: September estimates.

Part of the consensus view for faster oil demand growth next year is based on fuel switching in the global shipping industry as a consequence of IMO 2020 regulations taking effect from January. Lower viscosity fuels—whether marine gasoil or low sulphur fuel oil—imply greater volumes required given the size of engines remaining unchanged. However, we are cautious how much of an uplift IMO 2020 will provide to oil markets considering how weak global trade remains. In the first seven months of 2019 trade growth has been negative on average, according to the CPB World Trade Monitor, and the slowdown has been accelerating. New tariffs from the US on EU-origin goods will add a further drag on trade growth beyond the reciprocal US-China tariffs already in force.

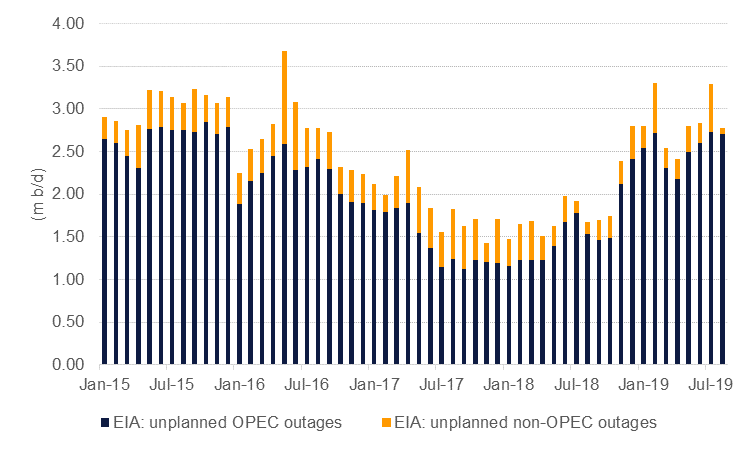

These will also be the first reports to assess the impact of the Abqaiq and Khurais attacks and implications for global spare capacity. In September the IEA estimated total OPEC spare capacity at 3.21m b/d of which 2.27m b/d was held in Saudi Arabia. Aramco has reportedly restored capacity to over 11m b/d since the attacks and it expects to hit 12m b/d by the end of November. A lower estimate for Saudi’s spare capacity will raise anxiety over how well oil markets could cope with another shock to supply: the EIA already estimates unplanned outages in OPEC countries at over 2.5m b/d, near recent highs. While current demand conditions don’t warrant prices pushing higher in the near term, the market should not grow complacent over the limited capacity of producers to respond to sustained outages.

Source: EIA, Emirates NBD Research

Source: EIA, Emirates NBD Research

Investors have continued to cut long oil positions with total net length in WTI declining by more than 60k lots last week, the largest single-week decline since August 2017. Demand concerns and a diminishing backwardation in the WTI curve are cutting the economic incentives to be long oil. The front of the WTI curve flattened significantly in the last fortnight, ending at USD 0.07/b in backwardation in the 1-2month spread.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.