The OPEC+ ministerial meeting on Thursday will be the fixation for oil markets this week and comes amid particularly strong market conditions. Oil prices managed to withstand the deterioration in risk assets at the end of last week highlighting the fundamental support currently at play in the market. The more than 25% gain in oil futures so far this year amid supportive conditions has prompted more chatter about oil prices returning to USD 100/b. Based on our current read of the market we think those calls are wrong and that a sustained hold of prices around USD 100/b is unlikely.

We outlined previously that we believe OPEC+ has room to moderately increase production from Q2 2021 without causing a cataclysmic sell-off like the market experienced in Q2 2020 (Decision time for OPEC and allies February 2021). As ever, the discussion will focus on the level of output to return to markets and how it will be allocated. We will evaluate any changes to our market balances and price assumptions in response to any decision that comes out of OPEC+ later this week.

However, there is considerable uncertainty around what would happen if OPEC+ decides to keep output levels unchanged—i.e., they continue to underserve the market. Oil market balances are already in deficit and we expect they will record an average stock draw of around 800k b/d this year. Any prolonged cuts from OPEC+ would help to widen that deficit provided that demand remains on a steady course thanks to economies reopening and vaccinations to Covid-19 proving effective.

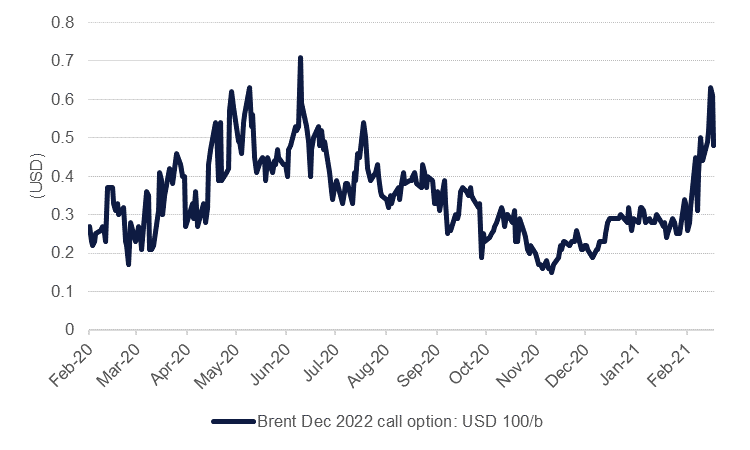

Would prices respond aggressively though? A near-term squeeze in response to OPEC+ underserving the market seems probable but we don’t believe it would be sustained and that expectations for oil prices to push as high as USD 100/b, as some activity in the options market appears to anticipate, look misguided to us.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

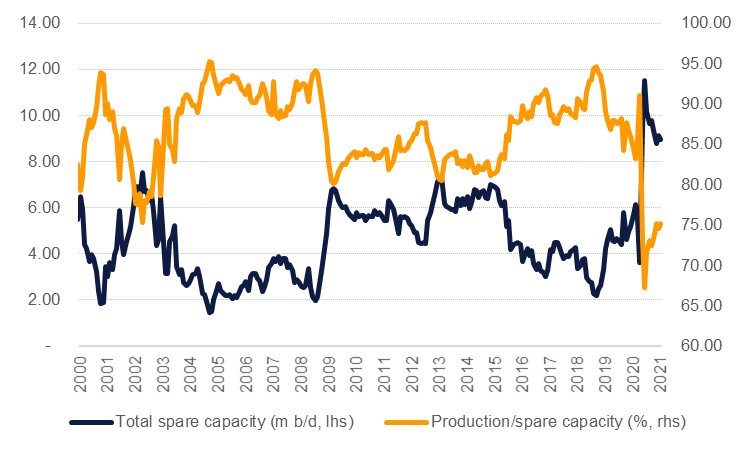

For starters, the OPEC+ cuts can be unwound immediately on policy decisions alone. Among the core OPEC producers who have withheld output there is nearly 6m b/d of production capacity that is currently being held on the sidelines, the largest share of which is in Saudi Arabia. Adding in capacity from Iran and Venezuela, where output is currently being hindered by sanctions and trade restrictions, takes the total capacity of OPEC itself up to 9m b/d. Put another way, OPEC (including Iran and Venezuela) is producing at 75% of its total capacity. We acknowledge that getting Iranian and Venezuelan oil back into the market would be more challenging than other OPEC producers given geopolitical considerations but nevertheless, the capacity is there to act as a buffer against any price spike.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Beyond OPEC there is scope for output to increase elsewhere too. Russia’s production is currently running around 1.2m b/d below its peak level in the past year and oil producers there have perennially pushed back against keeping output restrained indefinitely. In the US, where producers normally run at full capacity, production in January (when it was unaffected by freezing weather conditions) was running at roughly 2.2m b/d below peak levels. Taken all together, OPEC, Russia and the US have more than 12m b/d of capacity that could return should either policy or prices prove accommodative. Not all of this capacity can return or is likely to return given damage that may have affected some wells or underinvestment but even if we discounted the total by 25% that would still leave the market with more than 9m b/d of spare capacity.

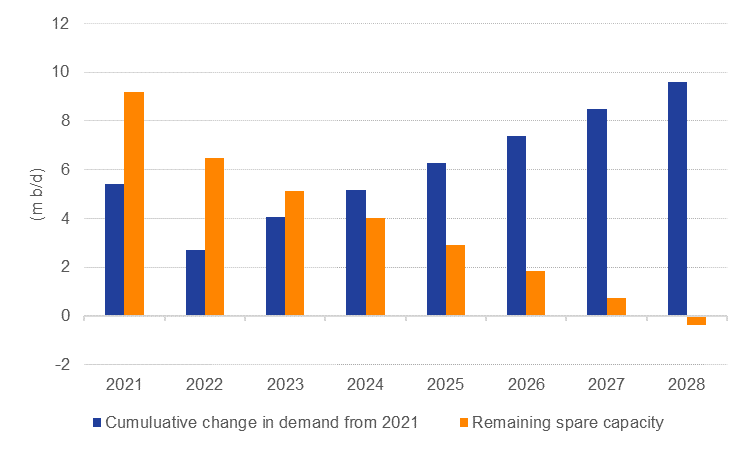

Taken in isolation, the level of spare capacity (even if discounted) loses its significance. When put in the context of the near- to medium-term demand growth outlook, the supply currently offline weighs against oil prices sustaining exclamatory levels of USD 100/b. Demand is likely to rebound sharply this year—the IEA projects a recovery of 5.4m b/d y/y in 2021 compared with an 8.7m b/d drop in 2020. But if we were to imagine a scenario where the pace of demand growth dropped by half over the next two years (still putting it well above long-term averages) and then returned to trend levels of a little more than 1m b/d per year then the current level of spare capacity would be able to absorb most of that additional demand even if all other supply assumptions (modest and slow recovery in non-OPEC supply) held steady.

Source: IEA, Emirates NBD Research. Note: demand growth assumes above trend in 2021-23 and then returning to pre-pandemic levels in the long run.

Source: IEA, Emirates NBD Research. Note: demand growth assumes above trend in 2021-23 and then returning to pre-pandemic levels in the long run.

The current spare capacity also leaves to one side planned capacity increases from GCC national oil companies. ADNOC in the UAE has long-standing plans to increase capacity to 5m b/d by 2030 while Saudi Aramco announced last year it would raise its capacity target to 13m b/d.

A higher oil price also begets higher oil production. As we have outlined in the past (Should Texas join OPEC? March 2020) the underlying reserve base in the US shale patch does not change if the oil prices is USD 5/b, USD 50/b or USD 100/b but will be developed when capital conditions for exploration and production companies prove accommodative. Those conditions may never materialize but if that’s the case then it’s likely because either demand has deteriorated again (not a positive price dynamic) or restrictions on production (whether capital or regulatory) make room for OPEC+ to increase output and match demand growth (price neutral).

Moreover, while inventories are declining they are still large and can also help to meet immediate demand growth. We estimate that commercial OECD stocks in Q1 will still account for more than 70 days’ worth of demand, far above their long-run average of closer to 60 days. By the end of the year inventories should have moved closer to normal at around 63 before getting back to long-term trend levels next year.