Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Oil demand growth is expected to improve in 2020 to around 1.2m b/d from closer to 1m b/d this year according to projections from the IEA. Unlike 2019 when virtually all the demand growth was contributed by emerging markets, a recovery in OECD Europe and Asian demand means developed markets will record growth of nearly 300k b/d. Nevertheless, the fixation for oil markets remains on what happens in China, India and other large, and growing, consumer markets in emerging economies.

China’s demand growth will decelerate as the economy undergoes a slowdown in industry and contends with an uncertain outlook for trade given its standoff with the US. Manufacturing in China—as assessed by purchasing managers’ indices—has been in decline for most of 2019 and official data covering industrial production and fixed asset investment are near multi-year lows. China’s economy needs more than just a positive outcome of trade talks with the US to turnaround the slowdown in growth but so far the government has been reticent to unleash substantial fiscal stimulus that has historically been highly supportive for oil consumption.

In India, oil demand growth has decelerated to below trend levels as the economy endures a protracted slowdown. Demand growth has risen by an average of 2.2% in the first 10 months of 2019, less than half the pace it recorded in the same period of 2018. Diesel consumption in particular has slowed significantly as industry has slumped despite government efforts to support the economy and lower rates from the Reserve Bank of India. Anticipation of government stimulus to support the economy should help to set a floor under oil demand in 2020 but it seems unlikely to match the pace of growth experienced in 2014-18.

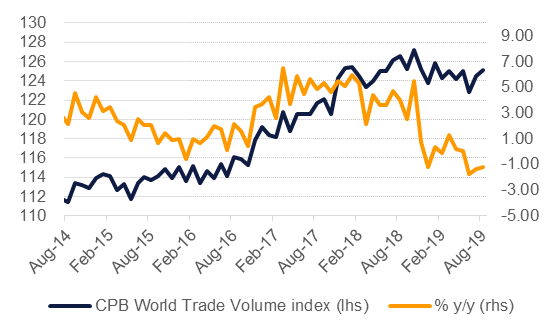

Oil consumption in 2020 was meant to get a boost from the impact of changes to marine fuel specifications—IMO 2020—that would see high sulphur fuel replaced by lower, cleaner fuels such as gasoil. More gasoil would be needed on a volumetric basis to compensate for the displaced high sulphur fuel oil, hence contributing to faster overall demand growth: the IEA had initially estimated as much as 3m b/d of fuel switching would occur. However, the demand boosting impact from IMO 2020 is being negated by the general slowdown in global trade. Merchandise trade has been slowing steadily since Q3 2018 and has been in contraction since June 2019. With few signs that a lasting and meaningful trade deal between the US and China will be reached trade volumes are likely to linger at their current low levels well into 2020.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

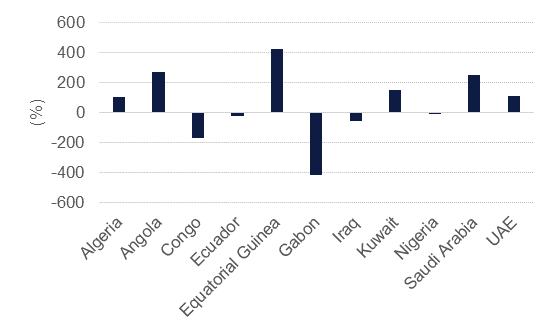

Faced with a demand scenario beset by downside risks, OPEC has few enviable choices for 2020. OPEC next meets in early December and a rollover of its current production cut strategy appears the most likely outcome. Aggregate compliance by OPEC members with their 800k b/d portion of the cut agreement has been strong—at nearly 140% on average in the first 10 months of 2019. However, like past rounds of cutting most of the burden has fallen on Saudi Arabia and other Gulf producers: Saudi Arabia has recorded average compliance of 255%, the UAE more than 110% and Kuwait 133%. Among other large producers compliance has fallen far short. Iraq and Nigeria have failed to comply with their targets this year and we see little chance that there will be a sudden convergence on target levels. Iraq faces mounting social unrest that could pose a threat to oil export facilities but as of yet we have not seen a material impact on production. Nigeria has actually received a higher target given that production has increased substantially.

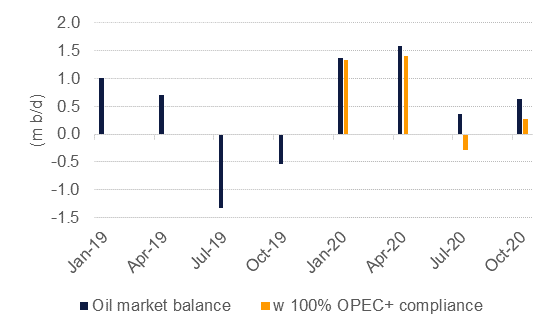

Even if OPEC members achieve a compliance rate of 100% we still project sizeable inventory builds in 2020. Getting support from other producers who are party to the production cuts—such as Russia—would help but even a wholly compliant scenario still results in stockbuilds of an average of around 700k b/d in 2020. As OPEC struggles to achieve consensus among its own official members we doubt they will be able to convince participants outside the bloc to converge on cut targets.

Source: IEA, Emirates NBD Research. Note: Jan-Oct 2019.

Source: IEA, Emirates NBD Research. Note: Jan-Oct 2019.

OPEC’s outlook for 2020 highlights the challenge of using production cuts to impact oil market balances and prices. OPEC lacks enforcement mechanisms to punish producers who breach target levels. An increase in production by one party aimed at pushing prices lower—to penalize recalcitrant members—is felt by all, including the enforcer. Indeed, such an increase in output could end up backfiring further as all members raise output to keep their market share intact.

Source: IEA, Emirates NBD Research. Note: assumes 100% compliance with December 2018 production cut targets.

Source: IEA, Emirates NBD Research. Note: assumes 100% compliance with December 2018 production cut targets.

OPEC+ may deepen its current round of production cuts from its target of 1.2m b/d to 1.5m b/d or 1.75m b/d. Even at higher cuts of 1.75m b/d, spread proportionately in line with the December 2018 cut agreement, OPEC+ would still endure market surpluses of nearly 800k b/d in H1 before a deficit finally emerged in H2 2020. Were all members of OPEC to fully comply with their share of a new higher cut target the trajectory for oil production would be mixed: Saudi Arabia’s production would actually rise from 2019 levels while the UAE and Iraq would see lower volumes. We won’t completely rule out the possibility OPEC would agree to deeper cuts but we are doubtful that it would be effective in raising prices that would come close to meeting fiscal breakeven levels in most OPEC producers (we project a fiscal breakeven level of USD 88/b in Saudi Arabia for 2020). The most likely outcome for OPEC+ at their early December meeting is to maintain production cuts in place and hope for either demand to improve significantly or for alternative producers to falter.

What OPEC+ agrees in early December and what it actually delivers in terms of barrels in 2020 are likely to end up diverging, as this year’s compliance levels indicate. We expect to see persistent overcutting from Saudi Arabia, although the scale will be tempered compared with 2019. Production from the Kingdom should actually increase slightly to 9.92m b/d on average, an increase of 1.5% from average output in 2019. In the UAE, we expect production to rise by 2% as ADNOC aims to increase total capacity to 4m b/d by the end of the year from around 3.4m b/d at present. Iraqi production will also push higher, in breach of the country’s OPEC commitment and reaching close to total capacity of 4.9m b/d. Total production from MENA OPEC producers will remain flat y/y as higher volumes from Saudi Arabia and others are offset by another annual decline in Iran.

OPEC’s share of global oil supply will fall to 34.6% in 2020, down from 35.4% this year and by far the lowest level in recent years. The prospects for growing market share only look to be in place from the mid-2020s onward.

OPEC+ risks becoming a passive player in oil markets next year, enduring uncertain demand and boxed into a corner as a result of its heavy-handed production cut strategy. The dynamics for oil supply in 2020 will largely be a function of producers outside of OPEC+. The US will again dominate non-OPEC supply growth as production from shale basins increases and pipeline and export terminal investments offer new avenues for US crude to enter global markets.

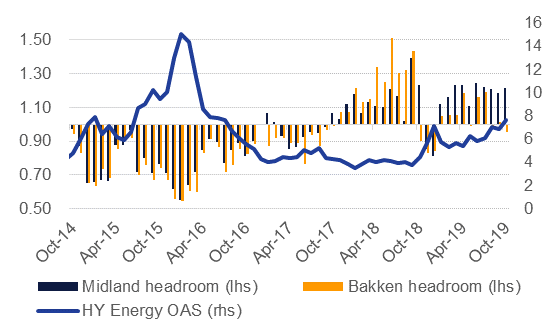

Source: Bloomberg, Emirates NBD Research. Note: 'headroom' = wellhead price - breakeven costs.

Source: Bloomberg, Emirates NBD Research. Note: 'headroom' = wellhead price - breakeven costs.

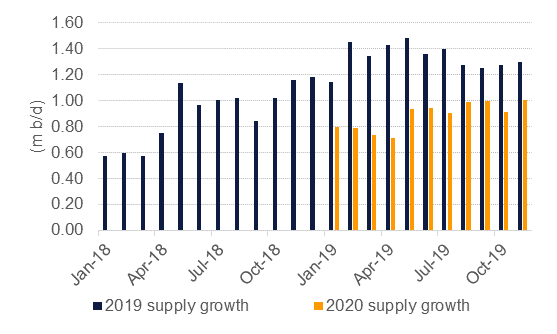

Growth, while still robust from the US, is likely to slow. The oil drilling rig count in the US has recently pushed below 700 rigs for the first time since Q2 2017 and the pace of annual supply growth from shale basins has moved from more than 1.8m b/d in mid-2018 to around 900k b/d in the most recent projections from the EIA (December 2019).

There are also definite signs of stress in the US oil market. Credit conditions are beginning to deteriorate as investors and lenders amp up demands for repayment over growth while pricing for US crude appears anchored in a range between USD 50-60/b, not offering much margin headroom for some shale basins. But the pain appears localized and not at this stage systemic. Bakken producers are running up closer to breakeven costs while producers operating out of the Permian or Eagle Ford regions of Texas are displaying some better conditions.

The EIA itself projects supply growth of around 1m b/d in 2020, taking US crude oil output to 13.3m b/d. But the agency has had a patchy record in terms of forecasting supply additions, generally under-projecting: its initial forecasts for 2018 supply growth were less than 500k b/d while output ended up increasing by 1.6m b/d. We doubt that scale of revision is on the cards for 2020 but past attempts to call an end to the surge in US shale production have consistently fallen flat thanks to efficiencies and discipline pushing costs down.

Source: EIA, Emirates NBD Research

Source: EIA, Emirates NBD Research

The US won’t be the only source of new supplies in 2020 as the start-up of new fields in the North Sea will see Norway record substantial growth while Brazil will also add considerable volumes. The call on OPEC—the amount needed from the bloc to balance markets—will fall to 28.9m b/d in 2020, down by 1.1m b/d y/y and a decline of roughly 1m b/d from October levels.

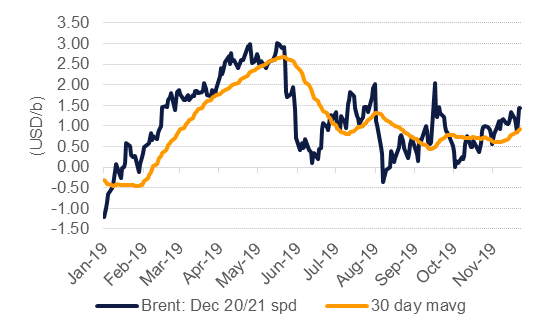

Our baseline supply and demand assumptions mean the oil market will move into surplus in 2020 with a particularly bloated H1 of an average stockbuild of 1.5m b/d giving way to a surplus of around 0.5m b/d in H2 2020. On an oil fundamentals basis alone, the scale of stockbuilds should imply prices moving lower in 2020 and longer dated spreads have been weakening. Brent spreads for December 2020/21 have managed to hold in backwardation for most of the year although the size of the spread has narrowed substantially since a strong performance in H1.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

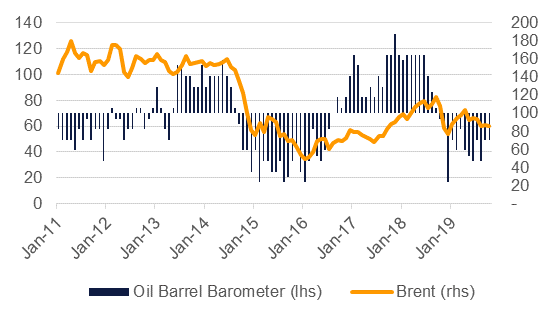

Stretching the analysis beyond oil market fundamentals also firms up the view for softer prices ahead. Earlier this year we introduced the Oil Barrel Barometer, an index to capture market variables and provide a snapshot or ‘nowcast’ of market conditions. Whether based on Brent or WTI the Oil Barrel Barometer (OBB) has been pointing downward for most of the year, implying negative price action when it falls below a level of 100. Moreover, our oil market heat map is flashing amber to red across most variables suggesting markets will enter 2020 on a softer footing.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

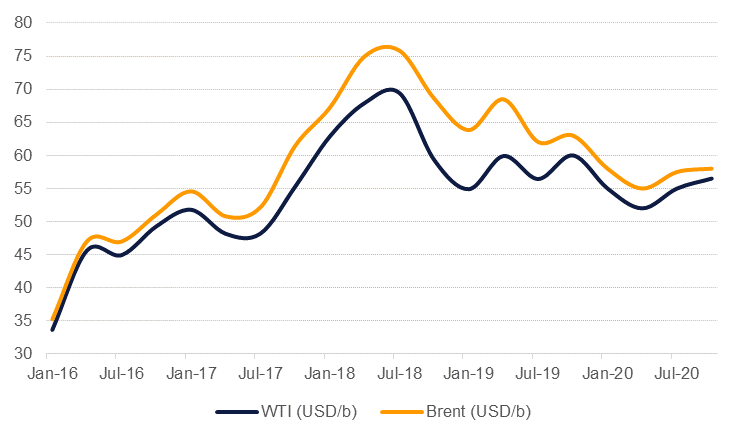

In our view for 2020 oil prices have considerable upside barriers in their way and thus substantial gains look difficult. We expect Brent prices will record an average of USD 57/b, down USD 2.50/b from our previous forecast and a drop of 11% y/y from our 2019 price target. For WTI, we expect prices at around US 55/b, down by USD 1.90/b from our previous expectations and a drop of 5.5% from our 2019 target. The spread between Brent and WTI will remain relatively narrow as investment into pipeline capacity allows crude to flow from producing regions to export facilities and see US crude delivered into international markets.

The Brent/Dubai spread should notionally widen next year as IMO 2020 rules limit marginal demand for heavy, sour barrels and Middle East crudes endure a stick discount to lighter, sweeter grades. However, OPEC+ cuts—as we outlined in our Monthly Insights October report—will keep the heavy, sour market relatively tight, supporting Dubai-linked crudes.

The relationship between inventory draws or builds and the shape of the forward curve does lean toward a contango structure developing in 2020, given our projection for a market surplus. Brent time spreads have managed to hold in backwardation for H2 2019 and the shift into contango could be sudden as forward prices move downward. Normally that would give us concern that a bearish move in prices will prompt an exodus of investors out of long positions, adding to selling pressure. However, speculative positions in both Brent and WTI are relatively modest at the moment and any move down will be caused by fundamentals more than by changes in investor attitudes.

Upside risks to our price view include a quick and comprehensive end to the US-China trade war, a substantial increase in the scale of OPEC+ production cuts, unplanned outages as a result of geopolitical tensions and massive stimulus in China or India in the form of heavy infrastructure spending.

Downside risks to our forecast include slippage in OPEC+ compliance with production cut targets, a further deterioration in trade relations between the US and China (catching other trade-exposed economies in the cross-fire), non-OPEC supply expanding faster than current projections or central banks imposing a tighter monetary policy.

Click here to Download Full article