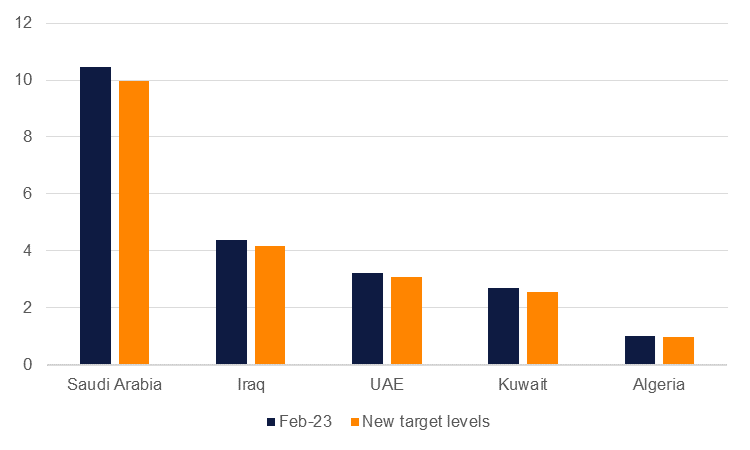

Some members of OPEC+ have announced a surprise production cut to take effect from May and be held until the end of the year. Saudi Arabia will cut output by 500k b/d while several other members will also cut output substantially. The UAE will cut by 144k b/d, Iraq by 211k/d and Kuwait will cut output by 128k b/d. The production changes will mirror “voluntary” cuts of 500k b/d that Russia is making in response to sanctions that have been placed on its oil exports. Including Russia’s cuts, the total reduction from OPEC+ will be about 1.6m b/d though as several members of OPEC+ are already failing to hit their output targets, the scale of the cut is likely to be smaller.

Source: WAM, SPA, Bloomberg, Emirates NBD Research

Source: WAM, SPA, Bloomberg, Emirates NBD Research

The move surprised markets and analyst consensus. Our own expectation was that OPEC+ would keep production unchanged from the levels it set in October last year when it also implemented a supply cut. As recently as February this year, Prince Abdulaziz bin Salman, Saudi Arabia’s energy minister, said that the “agreement that we struck in October is here to stay for the rest of the year,” referring to planned cuts of 2m b/d announced in October last year. Since then, financial markets have endured considerable stress due to the collapse of several institutions in the US along with the descent of Credit Suisse. That strain in financial markets did spill over into oil prices—WTI futures recently hit a bottom of USD 64/b on March 20th—though prices were already on their way higher with WTI ending last week at USD 75.67/b.

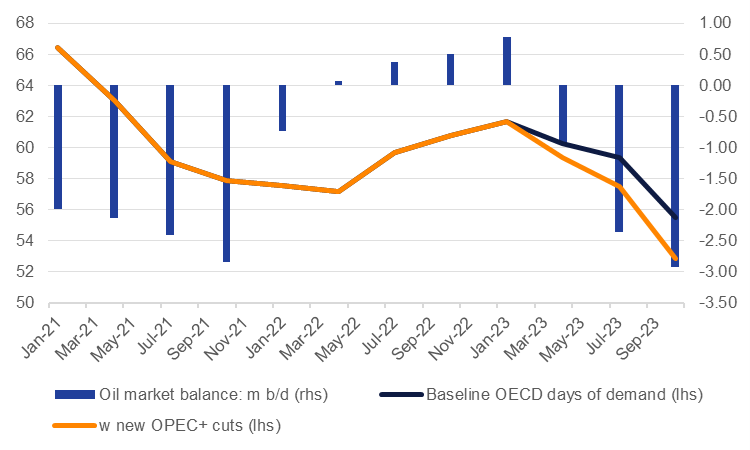

The announced cuts from several OPEC+ members will widen the oil market deficit in the second half of 2023, provided they are held for the full tenure of the agreement. Our prior oil market balance assumptions had a deficit emerging in H2 this year as demand was set to recover strongly from Q2 onward as China’s oil demand normalized. With the new cuts from OPEC+ taken into the baseline, the deficit will near on 3m b/d by Q4 this year and drain inventories down to 53 days of OECD demand. The pre-pandemic average for inventory days of demand had been about 62 days so the cuts will have a meaningful tightening effect on balances.

Source: Emirates NBD Research

Source: Emirates NBD Research

The cuts from OPEC+ ministers reinforce our view that oil prices will recover from recent lows, particularly in H2. For now, we hold our recently revised oil forecasts unchanged—targeting Brent at an average of USD 92.50/b in H2—though the cuts do provide some upside risks to that view. A tighter oil market in H2 will also mean wider backwardations to develop in the structure of the futures market: the 1-6 month spread in Brent futures has opened today at USD 2.55/b, up from less than USD 1.10/b at the end of last week.