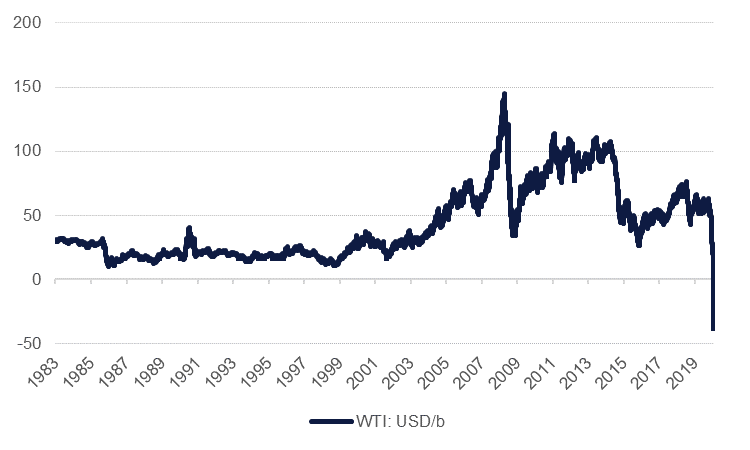

WTI futures sank into negative prices for the first time ever as the market responded to a poisonous cocktail of demand destruction, no storage capacity and an expiring futures contract. After starting April 20th at USD 17.73/b, May WTI futures closed at USD -37.63/b. Negative prices have been an anomaly in some physical pricing hubs for natural gas and oil in the past but have not occurred in futures markets since WTI futures were launched in the early 1980s.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Both the demand destruction and storage shortage variables have been known to markets for some time and had been acting as a weight on oil markets. Brent and WTI futures kept pushing lower even as OPEC+ announced their 9.7m b/d production cuts earlier this month. However, the contract expiry—as well as a surge of inflows into oil-focused funds, likely by non-institutional investors—served to amplify the distortion in the market.

Oil markets are not broken but we would argue they are severely distorted. Demand is in shock: the demand line has literally fallen off the chart—ie, down and to the left on a traditional supply/demand graph—as economies in lockdown have no need for oil or petroleum products. Meanwhile supply hasn’t reacted quickly enough to the negative demand conditions and the market has had to find equilibrium outside of what we can now call its ‘normal’ or ‘orthodox’ quadrant.

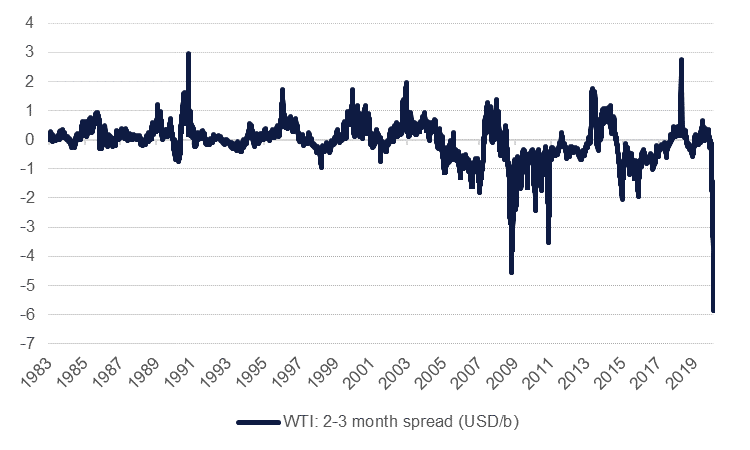

While the descent of spot prices into negative territory is unprecedented in futures markets, the enormously wide contango in the WTI and Brent market structures gives another strong indicator of how distorted markets have become. Spreads for the 2-3 month in WTI (skipping the expiring May contract) have moved to their widest ever contango at around USD 6/b while 1-2 month in Brent (which won’t be affected by expiry for another fortnight) is near to USD 4/b.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

There is a serious risk that oil prices could again retest negative prices or indeed drag Brent prices down as well. Demand is not responding to the signal that low oil prices are giving as coronavirus-related lockdowns are preventing any consumption reaction. Until there is any clearer indication of the timeline for the reopening of major economies (the US, Japan, India, parts of Europe) low prices will persist.

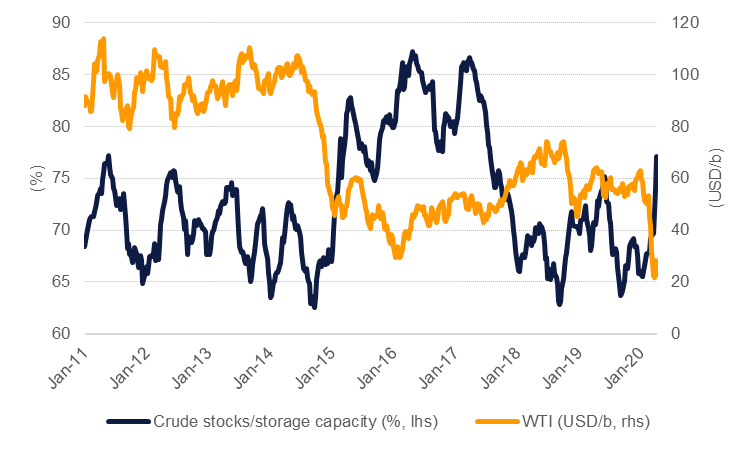

Storage can offer an alternative to consumption but has physical upper limits. The US assesses its total storage capacity twice a year and based on its estimate of working storage capacity of 653m bbl then the build in inventories in the last few weeks—almost 50m bbl in the last month—has pushed use of stocks in the US to more than 77% of total capacity. International storage data are less readily available but elevated shipping prices suggests that tankers are being used to hold crude on water.

Source: EIA, Bloomberg, Emirates NBD Research

Source: EIA, Bloomberg, Emirates NBD Research

Supply will need to adjust lower and adjust faster to ensure prices can normalize at positive levels. US production is still holding at around 12m b/d—admittedly down 800k b/d in around a month—but will need to keep moving lower to prevent crude overwhelming storage facilities and refinery demand. The OPEC+ cuts have yet to have a noticeable impact on markets and as a first step the deep level of 9.7m b/d of cuts may need to be extended beyond the first two months of the agreement, at least for the remainder of the year if they are to have any effect in getting markets closer to balance.

We don’t hold out much hope of a ‘pop’ when lockdowns are lifted. Consumption patterns will likely change substantially in a post-coronavirus world with transportation—whether for work or pleasure—likely to see significant shifts. Short-term trips (disposable travel such as weekend city breaks) may become infrequent while meetings that once took place face-to-face can now move to being held virtually. Consumers may also respond by preferring firms that are more local—for food or medical supplies for instance—cutting down requirements for extended global supply chains. These will represent long-term shifts lower in demand for crude oil and products while stimulus plans in some economies—particularly in the EU but not limited to it—look likely to contain a high degree of green/sustainable stimulus that will be a further constraint on oil demand.

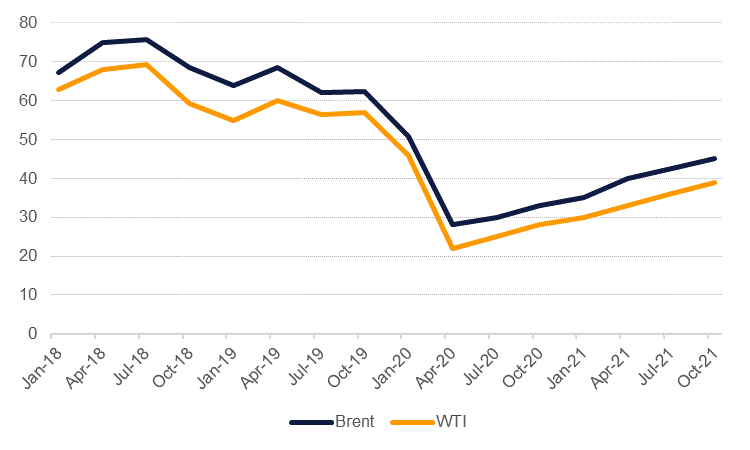

With market conditions so distorted and the coronavirus a highly volatile variable in any fundamental calculation, taking a conviction view on oil prices at the moment is perilous. What we can be certain of is that volatility will remain high and the bias for markets appears strongly lower. We now expect to see WTI prices at an average of USD 30/b in 2020 (from USD 38/b previously) based on a tentative improvement in the second half of the year from the extreme conditions in Q2. For Brent we expect an average of around USD 35/b in 2020 (USD 43/b previously). However, we note that there are multiple downside risks to these forecasts and the potential for further downward revision remains high.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

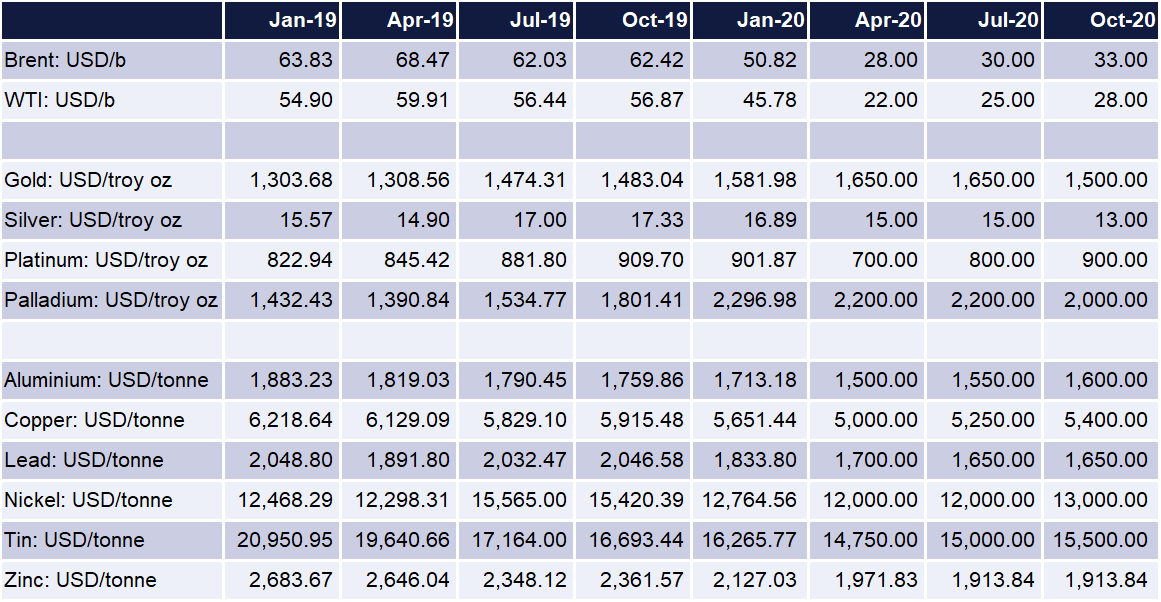

Source: Bloomberg, Emirates NBD Research. Note: average of period.