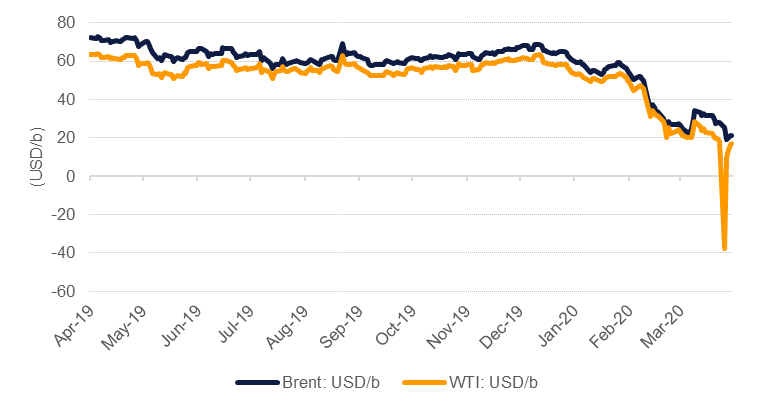

Oil markets will long remember last week as the one where futures crossed the Rubicon and moved into negative territory for the first time (although for many market participants it may have felt more like crossing the Styx!). Following the roller coaster to start the week, prices ended the week lower with Brent futures falling almost 24% to settle at USD 21.44/b while WTI closed its roller coaster week at USD 16.94/b, down 7.3%. Both contracts are now down around 70% since the start of the year: Brent by 67% and WTI by 72%.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Prices could again test sub-zero levels if the supply/demand fundamentals stay poor, speculative market positioning in front month futures remains concentrated in a few participants and time spreads (a reflection of the cost of storage) endure at wide levels. We aren’t optimistic that demand will improve suddenly over the next few months even as some economies experiment with ending their lockdowns while supply adjustments from OPEC+ are now starting in earnest. Regulatory action is trying to minimize the impact that position rollovers can have on the market during expiries and the crushing that many retail investors likely experienced this week should make them much more cautious about dipping back into the market. There appeared to have been some bargain hunting this week, however, as another 33k lots of speculative length were added to WTI futures and options.

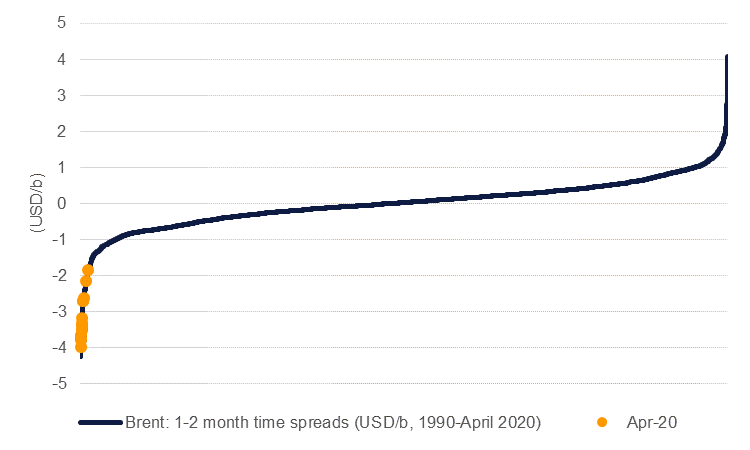

If the market hadn’t been preoccupied with WTI’s descent into negative territory then the extremely wide time spreads, particularly at the front of both the Brent and WTI curves would have garnered most of the attention. Brent’s 1-2 month time spreads last week were among the widest ever dating back to 1990 and reflect the absence of storage availability nearly anywhere in the world. December spreads for both Brent and WTI have lost all of their recent gains and both closed in a contango of around USD 5-5.50/b.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

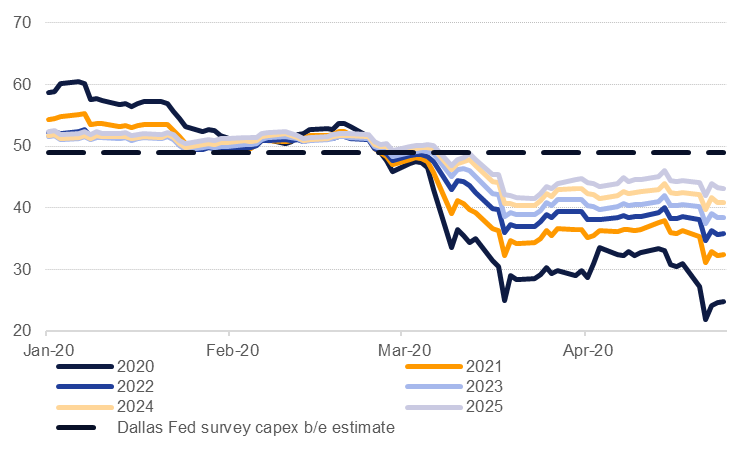

But weakness in forward pricing is not restricted to 2020 alone. Full year calendar swaps for WTI have all pushed substantially lower starting from around the beginning of March. Swaps for 2025—highly indicative to be sure—are at just USD 44/b. That compares with capex breakeven costs of USD 49/b for producers surveyed by the Dallas Fed during March this year. The wholesale collapse in US oil pricing is having an immediate impact on production: output has fallen by 900k b/d between March 13 and April 17. The outlook remains dire as well. E&P companies took another 60 rigs out of service last week, bringing the total down below 400. The recovery cycle may thus be extremely long for US oil producers and it is challenging to find any signs when—or even if—it will indeed begin.

Source: Bloomberg, Dallas Fed, Emirates NBD Research

Source: Bloomberg, Dallas Fed, Emirates NBD Research

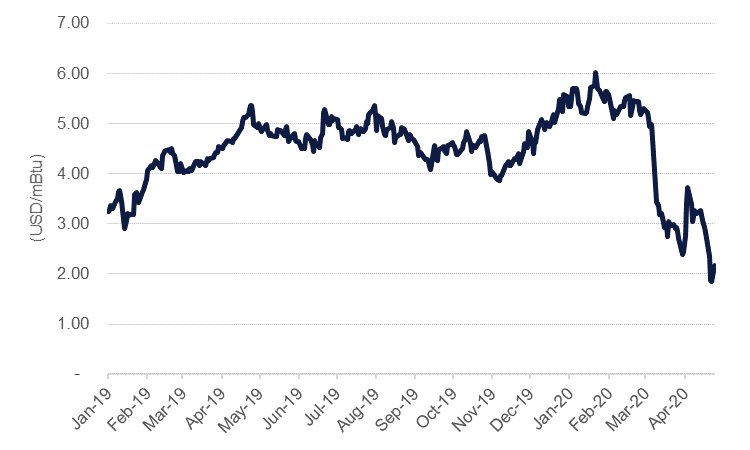

The enormous volatility has shaken the oil market to its core and raised the fear that negative prices could become part of the oil pricing environment. But from a broader energy market perspective crude oil prices have now actually “normalized” with respect to other energy sources. Coal, natural gas and NGL prices had endured a long move lower—with gas and coal close to parity on an energy contained basis. Crude oil had long appeared to be an overvalued outlier and the move downward in the last few months has narrowed its premium relative to other energy products. From a peak of around 6x more valuable at the start of this year, Brent’s premium over Henry Hub has narrowed to around 2x in recent weeks.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research