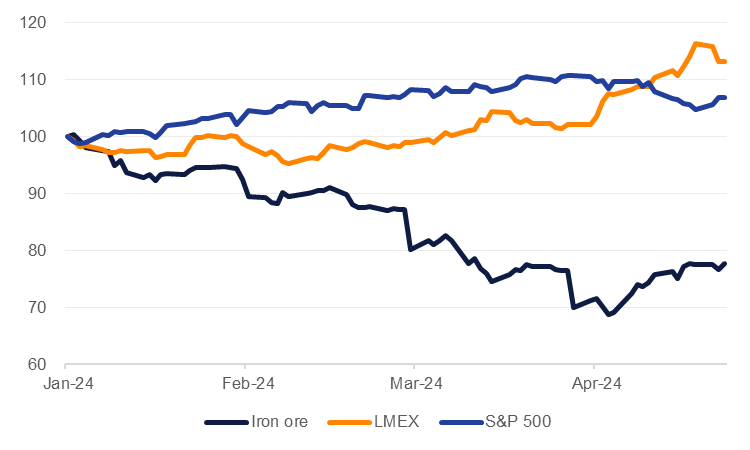

Industrial metals prices have had a strong start to the second quarter. Iron ore futures have pushed up to almost USD 120/tonne by April 24, up almost 20% on the quarter-to-date, while the LMEX index of base metals has risen by almost 11% since the end of March to hit its highest levels since Q1 2023. Copper on the LME has moved within a few dollars of USD 10,000/tonne in the last week, levels it last hit in April 2022 while aluminium has broken and held above USD 2,500/tonne, a level that has been both a resistance and floor in previous price cycles. In comparison, the S&P 500 index has dropped 3.5% since the start of the quarter.

Source: Bloomberg, Emirates NBD Research. Note: values rebase to Jan 1 2024 = 100

Source: Bloomberg, Emirates NBD Research. Note: values rebase to Jan 1 2024 = 100The moves in metals are all the more impressive considering the macro environment has not moved substantially in their favour. The global manufacturing PMI hit 50.6 in March, just marginally above the line separating expansion from contraction. At a country level, China’s manufacturing PMI has been oscillating either side of 50 for the last six months while industrial production data out of the country has also been disappointing. Industrial output in March dropped to 4.5% y/y, falling short of expectations of more than 6% growth. Beyond China, manufacturing remains soft in other major economies. Germany has reported nine consecutive months of contraction in industrial production as of February while in the US manufacturing has been holding up relatively better but did slow in March to 0.5% m/m from more than 1% in February.

At the same time, markets have tempered their expectations on when the Federal Reserve will begin to cut interest rates and also by how much as inflation has shown persistent strength in the US economy. We recently revised our own outlook to two 25bps cuts (September and December) while markets are pricing in less than two cuts by the end of the year. Higher rates for longer will impose more of a toll on economies, raising the cost of funding new capital and metal intensive projects.

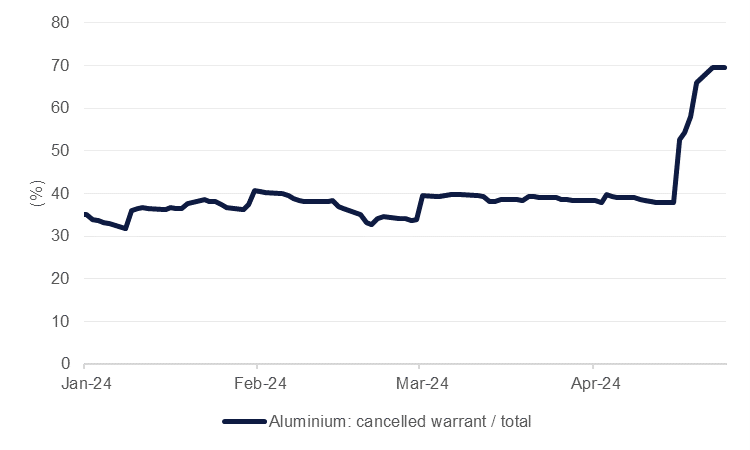

Specific to metals, inventory numbers also don’t appear overly supportive of prices rallying. LME inventories of aluminium and copper don’t look tight by their levels over the last two years. There has been a spike in cancelled warrants for aluminium since the LME changed rules to no longer accepting delivery of new Russian metal produced after April 12.

Source: Bloomberg, Emirates NBD Research.

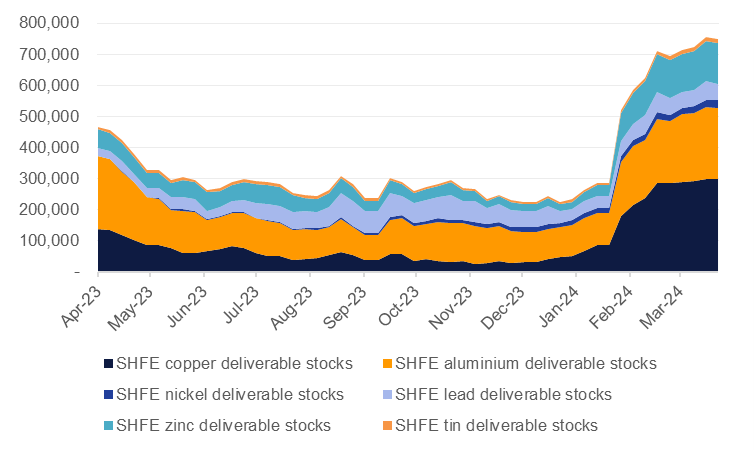

Source: Bloomberg, Emirates NBD Research. The overall impact from the rule change may be neutral as metal that was in LME warehouses prior to the rule change can still be traded. Outside of the LME, stockpiles have been building in Shanghai Futures Exchange warehouses, though most of the gain took place ahead of recent price gains.

Source: Bloomberg, Emirates NBD Research. Note: tonnes.

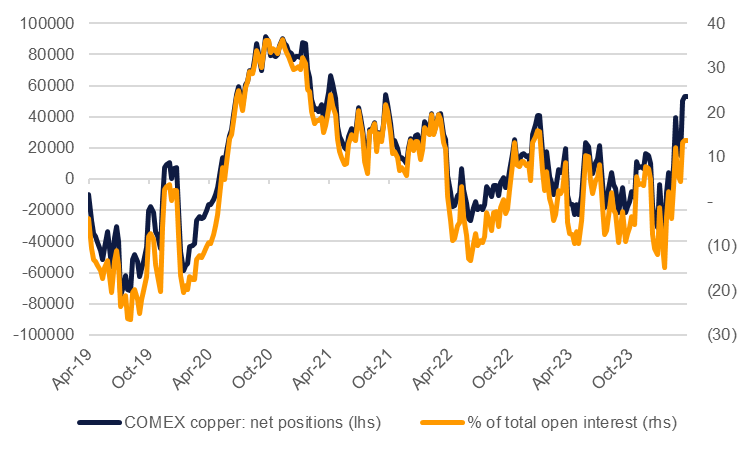

Source: Bloomberg, Emirates NBD Research. Note: tonnes.The rally in prices may partly be explained by at least one of the factors that otherwise should be a negative. Commodities are ultimately a scarcity investment strategy and should major economies like the US endure inflation at moderate to elevated levels for a prolonged period then more inflation-resistant assets like commodities would stand to receive investor interest. Speculative interest in COMEX copper futures has risen in the last few weeks to almost 14% of total open interest, its highest level since early Q1 2023.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.We had a constructive outlook on base metals for this year as we assumed that interest rate cuts would help to provide a tailwind to economies, later on in the year. We maintain a positive outlook on metals for 2024 though some of the current spike in prices may be premature. We are bringing forward some of the gains we had expected for later in the year across the base metals complex.

| 24-April-2024 | Q2 24 | Q3 24 | Q4 24 | Q1 25 | Q2 25 | Q3 25 | Q4 25 | |

|---|---|---|---|---|---|---|---|---|

| Aluminium | 2,579.00 | 2,400.00 | 2,500.00 | 2,500.00 | 2,600.00 | 2,600.00 | 2,650.00 | 2,650.00 |

| Copper | 9,706.50 | 9,000.00 | 9,000.00 | 9,250.00 | 9,250.00 | 9,500.00 | 9,500.00 | 9,750.00 |

| Lead | 2,184.50 | 2,143.03 | 2,143.03 | 2,172.79 | 2,172.79 | 2,202.16 | 2,202.16 | 2,231.13 |

| Nickel | 19,060.00 | 18,000.00 | 18,000.00 | 19,000.00 | 19,500.00 | 20,000.00 | 20,000.00 | 21,500.00 |

| Tin | 31,938.00 | 30,000.00 | 30,000.00 | 32,500.00 | 33,000.00 | 33,000.00 | 34,000.00 | 34,000.00 |

| Zinc | 2,792.50 | 2,607.98 | 2,607.98 | 2,680.43 | 2,680.43 | 2,752.87 | 2,752.87 | 2,825.32 |