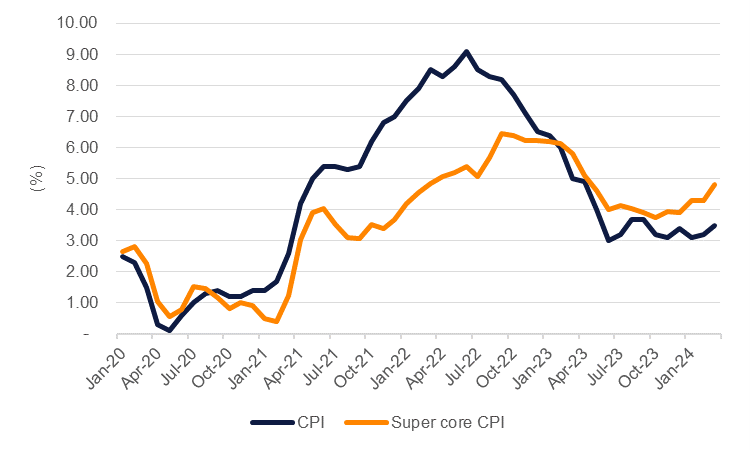

Another hotter than expected inflation print in the US for March is providing more support for the Federal Reserve to take a patient stance on when it can ease policy rates and by how much. Headline CPI rose by 3.5% y/y in March, ahead of market estimates, and the fastest annual pace since September last year. On a monthly basis, inflation rose by 0.4% for the second month running in March. Core price pressures also remain relatively hot with the annual core CPI index up by 3.8% y/y in March and maintaining a monthly pace of 0.4% for a third month in a row.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

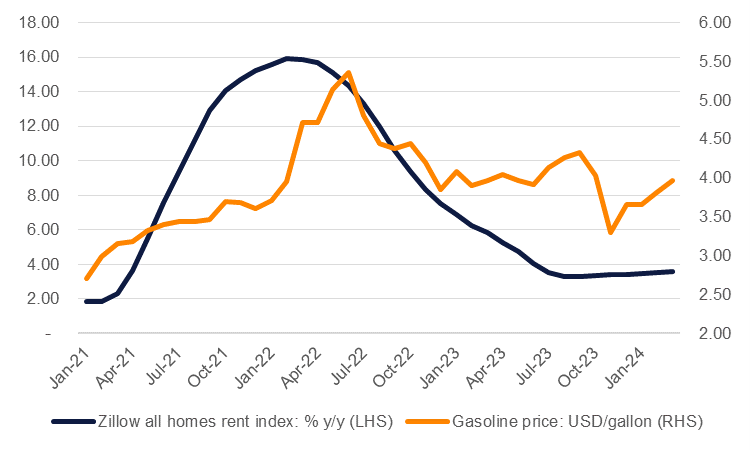

Higher shelter and gasoline prices accounted for more than half of the monthly increase in March according to the US Bureau of Labor Statistics, confounding expectations that shelter prices would start to drag the CPI index lower. Rental inflation has moved materially lower from where it was in 2022 but the disinflation in rents looks to have stalled out around the 3.5% level according to data from Zillow, an online real-estate platform.

Energy prices look set to remain volatile but will be supported near their current levels in the immediate term by the fraught geopolitical environment. On an annual basis gasoline prices are presently about 1% lower y/y than they were in April 2023 but that base will start to fall out soon, meaning energy price inflation could be poised to rise in the coming months. That creates a scenario where headline CPI could accelerate over the next few months and make rate cuts look out of kilter with the status of the economy.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

While inflation has been running hotter than expected, other indicators from the US economy continue to show robust performance. The labour market keeps beating expectations: the March non-farm payrolls report estimated 303k jobs were added, its strongest print since May last year, while the household survey of employment rose to 469k in March from 150k a month earlier. Labour market numbers have been prone to downward revision in subsequent estimates and future prints could be distorted by seasonality adjustments but the overall momentum in the jobs market appears positive. Activity data is softer—the ISM services index fell to 51.4 in March from 52.6 in February—but is nevertheless managing to avoid outright signs of contraction. Retail sales also reported a strong 1.1% m/m increase in control group sales for March.

With that macro backdrop in place there looks to be little imminent need for the Federal Reserve to start easing policy. With an eye on how inflation develops in coming months we are revising our outlook for the Fed Funds rate this year to two 25bps cuts taking place in September and December. That is a later start and fewer cuts than our initial projections for this year (three cuts starting in June).

Holding rates an elevated level could prompt some strain in the US economy but the Fed will want to avoid the risk of having to backtrack on policy if it were to ease policy too soon. At the same time we think there is a high bar for the Fed to consider tightening policy from here. A sustained move higher in core inflation metrics accompanied by strong labour market or wage data could prompt chatter about keep rates higher for longer first before actually pushing to hike once again.

| Central bank policy rate forecasts | Last | Q2 24 | Q3 24 | Q4 24 | Q1 25 | Q2 25 | Q3 25 | Q4 25 |

|---|---|---|---|---|---|---|---|---|

|

Fed Funds rate (upper bound) |

5.50 | 5.50 | 5.25 | 5.00 | 4.75 | 4.50 | 4.25 | 4.00 |

| ECB deposit rate | 4.00 | 3.75 | 3.50 | 3.25 | 3.00 | 2.75 | 2.50 | 2.25 |

| Bank of England bank rate | 5.25 | 5.25 | 5.00 | 4.75 | 4.50 | 4.25 | 4.00 | 3.75 |

| Bank of Japan unsecured overnight call rate | 0.10 | 0.10 | 0.20 | 0.30 | 0.40 | 0.50 | 0.60 | 0.70 |

| Saudi Central Bank reverse repo | 5.50 | 5.50 | 5.25 | 5.00 | 4.75 | 4.50 | 4.25 | 4.00 |

| Central Bank of the UAE base rate | 5.40 | 5.40 | 5.15 | 4.90 | 4.65 | 4.0 | 4.15 | 3.90 |