News that Russia has recognized two breakaway regions of Ukraine as independent states and will also move troops into them has shaken already anxious commodity markets. Energy prices have moved higher with oil prices now more seriously threatening USD 100/b after a few days of drifting lower on apparent positive diplomatic developments. While markets await the diplomatic response of the US, EU and other nations as well as any follow up from Russia itself we would expect oil and energy markets to price in much more supply insecurity.

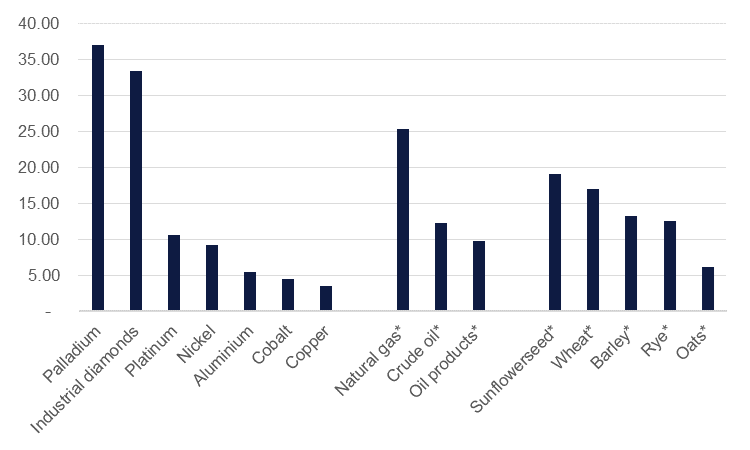

Oil markets are acutely tight in Q1 this year as demand growth has remained robust while supply increases have been haltingly slow. We do still expect to see a moderation in demand later this year help to push markets back into surplus but with oil prices threatening USD 100/b, six months down the line may seem an eternity to markets and consumers facing higher prices now. The principal connection to energy markets from the crisis in Eastern Europe would be if Russia came under sanctions that restricted its ability to export oil and gas to key markets in Europe or Asia. Russia accounted for around 12% of global crude oil exports in 2020 (the last year for when full global export data is available) and nearly 10% of total oil product exports. Its share in gas markets is larger, accounting for a full quarter of global natural gas exports.

Source: USGS, USDA, BP Statistical Review of World Energy, Emirates NBD Research. Note: * represents share of export markets.

Source: USGS, USDA, BP Statistical Review of World Energy, Emirates NBD Research. Note: * represents share of export markets.

However, Russia’s influence in commodity markets stretches beyond just energy. The country is a major producer of industrial metals and has a dominance in several key products. Russia is the third largest source of mined nickel ore with the refined metal used in steel alloys and an important component of battery manufacturing. Russia is a major source of palladium, used in hydrocarbon catalytic conversion while it is also a large supplier of aluminium to global markets.

Beyond metals and energy Russia is a substantial exporter of agricultural commodities as well. It accounted for nearly 17% of global wheat exports in 2020/21 and more than 10% in feed grains like barley and is a dominant supplier of sunflowerseed used in vegetable oil production.

At a time when many major economies are already enduring decade high inflation, the threat of a major supplier of raw materials being sidelines from markets due to sanctions would add further upward pressure on prices. A further escalation of the crisis into a conflict may delay some of the expected monetary tightening to help assuage nervousness in financial markets but the macroeconomic outcome from a conflict is still likely to end up being inflationary.