The risks to global growth posed by trade protectionism and geopolitics have intensified over the last few weeks, even as monetary policy has tightened further. Higher energy prices in H1 pose a challenge for EM economies and OPEC, but have provided room for GCC governments to boost spending and tackle some structural reforms.

- Global macro: The global context remains a complicated one whereby on the one hand the growth picture looks encouraging, particularly in the U.S., but on the other hand there are multiple distractions and risks which are preventing a wholehearted resumption of confidence and may even lead to an eventual slowdown.

- GCC macro: Increased government spending in the GCC should help to mitigate the impact of VAT and higher fuel prices in the UAE and Saudi Arabia.

- MENA macro: Egypt’s IMF reform programme is progressing apace, while those of Jordan and Tunisia are facing increasing hurdles as inflation rises.

- Sector focus: GCC’s maritime strategy enters a new era.

- Interest rates: The Fed and the ECB made further progress on normalizing their monetary policies.

- Credit: GCC bonds were boosted higher by the falling benchmark UST yield curve even though credit spreads widened somewhat during the month.

- Currencies: Supported by renewed expectations of four Fed rate hikes in 2018, the dollar is on target to rise for a third consective month, with EM currencies losing out the most.

- Equities: In the last month, headwinds facing global equity markets have gathered pace. The domestic political issues in Europe, Brexit uncertainty and a trade war between the US and rest of the world continue to weigh on markets.

- Commodities: OPEC’s spare capacity buffer is narrowing as long-term investment shortfalls and damage to producers’ infrastructure takes their toll. Over the long run, this should help to put a floor under oil prices.

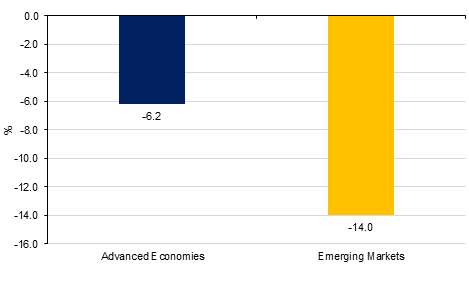

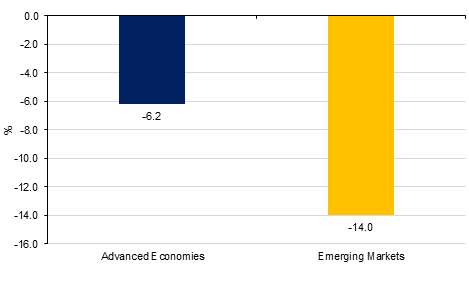

World Bank's estimates of the percentage decline in global trade from increased tariffs by 2020

Source: World Bank, Emirates NBD Research

Source: World Bank, Emirates NBD Research

Click here to Download Full article

.jpg?h=457&w=800&la=en&hash=6E7D7050A1CDCDEBA2EE0BEE84429538)