The outlook for crude oil production in the Middle East and North Africa over the next few months will largely be set by US sanctions policy on Iran. US sanctions on trading in Iranian crude went into effect in November last year although their impact on oil market balances was neutralized to a degree as the US government offered waivers to importers. Those waivers are due for expiry in May and if sanctions are enforced in full then crude markets will likely tighten considerably over the next few months.

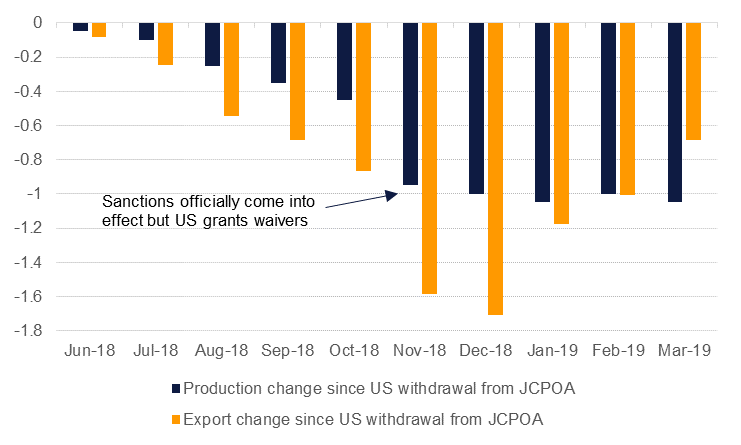

Iran’s production has fallen sharply since the US government announced its withdrawal from the JCPOA in May last year. Output is down more than 1m b/d since May 2018 and has hit a low of around 2.75m b/d as of March 2019. Production has actually declined faster since May 2018 than it did in 2012 when the last round of US sanctions targeting energy trade with Iran were enforced.

More significant than production alone, exports have also collapsed as importers avoided taking Iranian barrels even ahead of sanctions taking effect in November 2018. Iran exported an average of 2.2m b/d in H1 2018, declining to 1.4m b/d in H2 and has shipped 1.3m b/d so far this year. Exports stemmed their decline to a degree after the waivers were announced but still remain significantly lower y/y as several importers of Iranian crude have cut their purchases to zero for fear of falling foul of the intention of US sanctions.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

US rhetoric on Iran has escalated in 2019 and our expectation is that the administration will take a hardline approach to the country. How that unfolds in practice, however, is more uncertain. If the US enforces sanctions in full as markets currently expect (without waivers) we would expect Iranian production to decline further by the end of the year and exports will also push lower. In public statements the US administration is targeting zero Iranian exports: cutting 1.3m b/d from global markets without any offsetting would help send oil prices sharply higher. Even with full enforcement of the sanctions, some limited trade in Iranian crude is likely to continue, either in defiance of the sanctions or outside of dollarized payments (alternative currencies or barter trade have been used in the past).

An alternative to full enforcement could be if the US extended waivers to countries highly reliant on flows of Iranian crude (eg, India or China) and at a reduced rate compared with the waivers offered in November. In that scenario market balances would still tighten although not as severely as under full enforcement. Whatever the US decision on sanctions, we don’t forecast a situation in which Iran’s production and exports increase going forward.

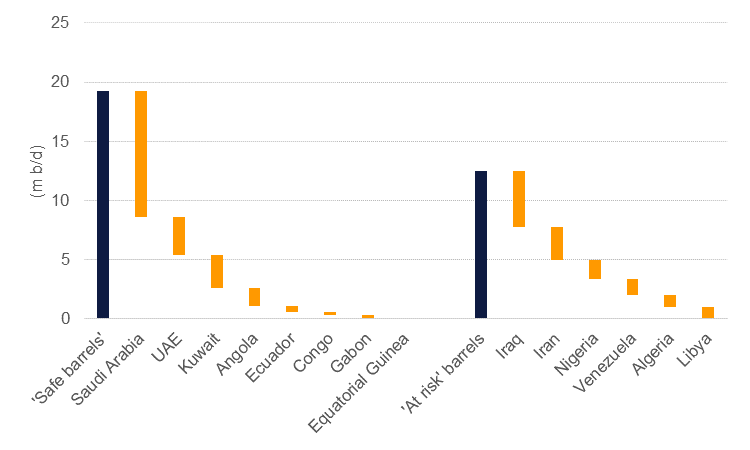

We doubt that the US would be preparing to fully enforce sanctions on Iran without having received some assurances from other major producers that they would step up production to offset the decline in Iranian output. Where that offset comes from, however, is limited to a few countries within OPEC. Production from OPEC+ has declined since the start of the year thanks to voluntary output cuts, helping to give headline spare capacity of 2.8m b/d when we strip out Iran. However, that spare capacity narrows to less than 2.5m b/d when we remove producers we classified as politically at risk (see our note “OPEC production: exposed” published on March 13). The ability to offset Iranian declines therefore falls largely on Saudi Arabia, the UAE and Kuwait who collectively hold 2.45m b/d of spare capacity.

Source: IEA, Emirates NBD Research. Note: total production capacity.

Source: IEA, Emirates NBD Research. Note: total production capacity.

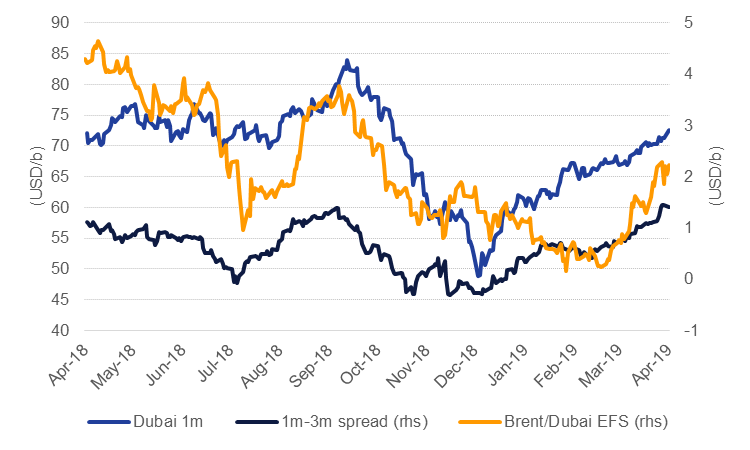

For these core GCC oil producers the next few months offer a window to increase production and exports, taking full advantage of the tightness created by US sanctions policy and market structures in time spreads and quality differentials. Time spreads for Dubai-linked crude have moved into their widest backwardation in the past year, at over USD 1.4/b in the 1-3 month spread. During the last round of US sanctions on Iran (2012-15) the spread moved to almost USD 3.50/b, attractive pricing for GCC national oil companies to raise exports and increase official selling prices.

The competitiveness of Dubai-linked crudes is also turning around. The Brent/Dubai EFS narrowed significantly as heavy sour barrel availability shrank on the back of sanctions-induced tightening (on Venezuela as well as Iran) and OPEC+ cuts. However, that spread has reversed in recent weeks on the back of the strong rally in spot prices as well as more immediate concerns about Libyan supplies.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

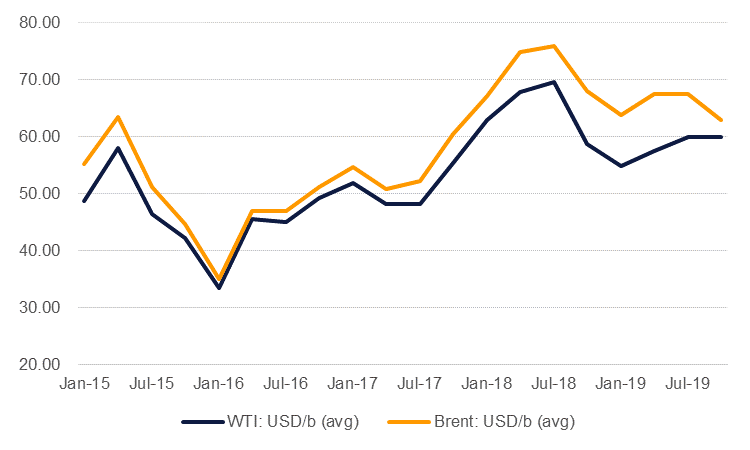

In terms of impact on headline balances and our forecasts we had expected that OPEC+ would begin to increase production in H2 for precisely the reasons outlined above: to compensate for involuntary outages and chase high prices. Already Russia, a core participant in the production cuts, had been signaling its waning enthusiasm for production cuts and was ready to raise output. Nevertheless, we expect the pattern of exclamatory calls for USD 100/b to filter through to markets and risk a short-term spike in prices.

However, past performance suggests that OPEC+ has an enormously difficult task to offset the decline in output exactly (and avoid moving the market back into stockbuilding). While prices may spike in the near term we maintain our view for Brent futures to move lower by the end of the year (Q4 2019 average USD 63/b) as production increases from Saudi Arabia and the UAE, among others, more than offset the decline from Iran.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.