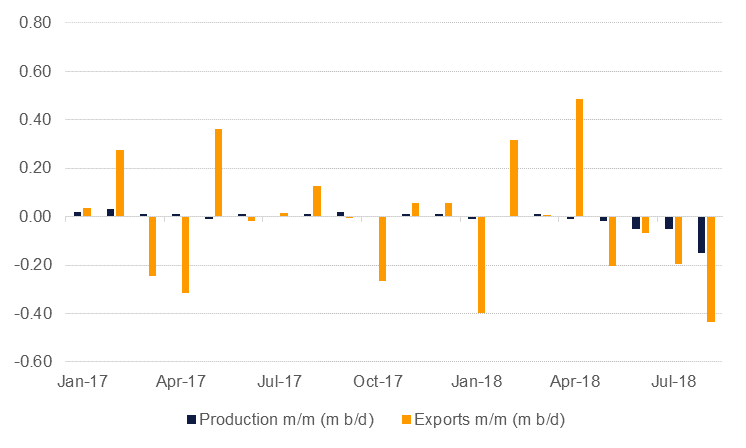

The effect of US sanctions coming back into place on Iran is starting to make itself more and more apparent on oil markets. US sanctions directly affecting Iran’s oil trade come into effect in November with the US State Department expecting that importers to have cut their purchases to zero by that point. Recent market surveys of Iranian output show a sharp decline in production in August—down by 150k b/d according to Reuters—and an even further slump in exports. Shipments fell by more than 430k b/d last month, according to Reuters data, accelerating a downward trend that has been in place since April 2018.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.

Iranian policymakers have been making more announcements that suggest they are prepared to walk away from the terms of the JCPOA, the Iran nuclear deal, making it more difficult for the deal’s European supporters to abide by its terms. EU governments may be put in a position under which they could no longer pretend the deal was in effect and would advise EU-domiciled firms accordingly. But the impact on oil trading and investment has already been felt. European refineries have already sought alternatives to Iranian cargoes while oil and gas majors have essentially cancelled their Iranian investment plans.

Total OPEC production increased in August according to a Reuters survey, hitting a 2018 high of 32.79m b/d. Production in Iraq is steadily increasing—up 110k b/d last month—while Saudi Arabia is maintaining the higher output levels it has been targeting since the June OPEC meeting. We had long expected that several OPEC members would seek to partially compensate for the decline in Iran’s production and that an increase in output over the final months of 2018 and into next year would tighten spare capacity significantly. Eating into Iranian share of export markets will also make achieving consensus between members at future OPEC meetings more perilous and the December meeting is likely to be contentious.

Our initial forecast had been for at least 500k b/d of Iranian exports and production to be at risk from sanctions but that some exports would be allowed to avoid markets tightening too far. However, the current US policy on Iran is more stringent than in 2012 when the sanctions regime allowed some waivers for importers. The interruption to supplies is thus likely to be more than our current conservative estimates and could end up being closer to the 1m b/d of exports that were affected in 2012. Global oil balances are expected to be roughly close to balance in H2 2018 but the pace of decline in Iran’s output so far suggests a deeper deficit could be on the cards for the final months of the year and into the start of 2019.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.

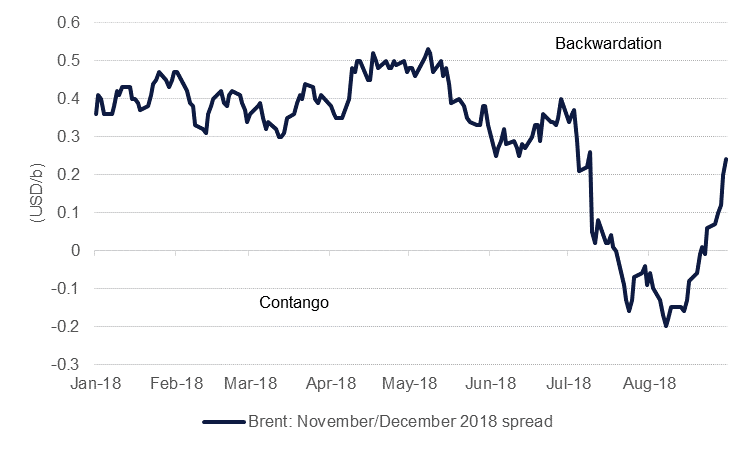

Futures markets seemingly finally took notice last week of the pending shortfall in Iranian production. Brent futures had spent most of Q3 in a shallow contango at the front end of the curve. That contango has snapped and the prompt 1-2 month spread (November/December) has now shifted back into backwardation. The tightening of the curve and improving roll yields—which had lost considerable value in July and August—will draw speculative investors back into the market and increase demand for long calendar spread trades.

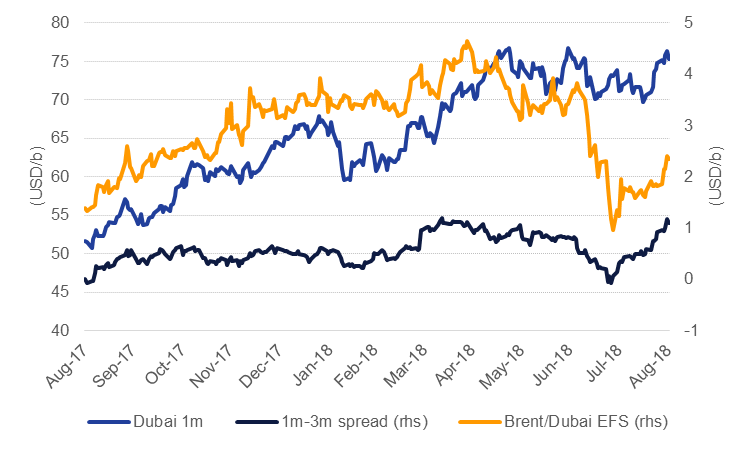

Physical pricing for Dubai is also reflecting the pending tightness in crude markets. After flattening out considerably in response to OPEC’s announcement that it would collectively try to hit 100% compliance with its production target the Dubai forward curve has been steepening into backwardation since the start of August. The 1-3 month Dubai spread has hit USD 1/b, near its highest all year and could push even higher once sanctions come into place on Iran. In 2013 the spread peaked at USD 3.5/b according to swaps figures published by Reuters.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.