The IEA has released its first oil market report for 2021 and lowered its demand growth projection in response to a resurgence in Covid-19 cases across many economies. The agency now expects annual growth of 5.45m b/d in 2021, around 300k b/d lower than previously estimated, which will still leave oil demand at the end of the year below where it was at the end of 2019. Most of the downward revision is concentrated in the first half of the year, particularly for developed markets which are enduring enormous Covid-19 case loads.

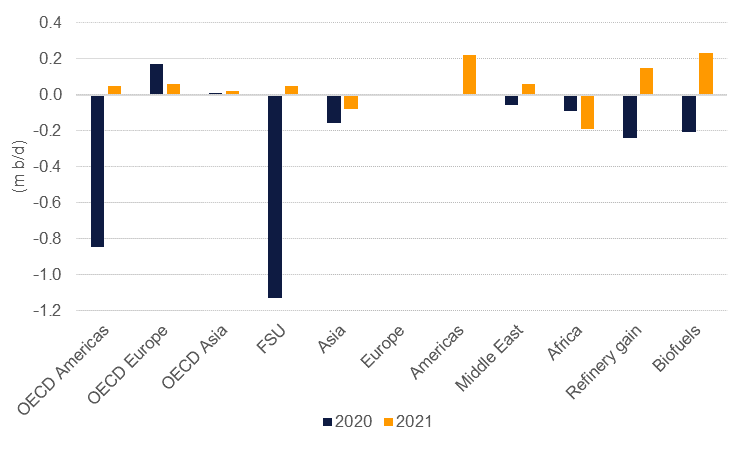

On the supply side of the market, the IEA expects non-OPEC supply growth of close to 600k b/d with Canada, Brazil and Norway making up much of the gains. The agency estimates that total non-OPEC supply (including some countries that do make up part of OPEC+) fell by 2.6m b/d on average in 2020. Projections for US output still point to an annual decline as producers there focus on profitability at the expense of growth, even as prices have recently started to move close to breakeven capex costs for some fields.

Source: IEA, Emirates NBD Research. Note: Middle East is non-OPEC only, FSU - Former Soviet Union.

Source: IEA, Emirates NBD Research. Note: Middle East is non-OPEC only, FSU - Former Soviet Union.

The muted recovery in non-OPEC production leaves the producers’ bloc room to increase market share for the first time since 2016, based on our expectations for production this year. We are assuming roughly 100% compliance on aggregate with the terms of the OPEC+ production rationalization which would imply that some of the current levels of cuts are unwound over the course of the year. However, as OPEC+ has now moved to monthly ministerial meetings there is a high likelihood that short-term price conditions will determine immediate production responses: Saudi Arabia’s decision to cut production by an additional 1m b/d for February-March is a case in point.

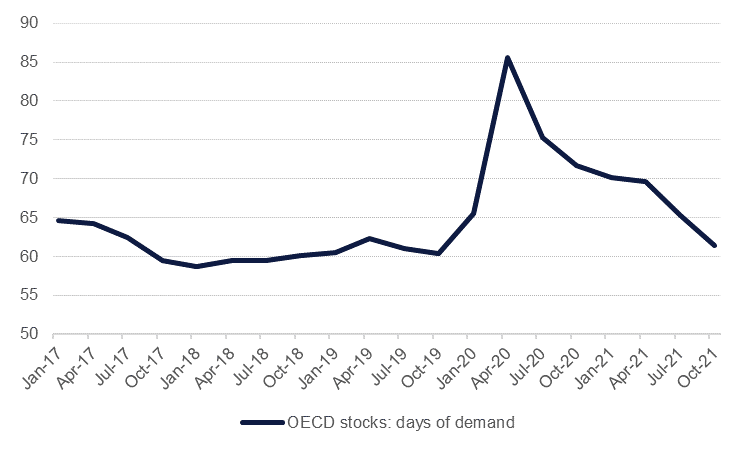

Based on the IEA’s revisions to its demand projections we expect to see inventories draw down in 2021 by an average of 1.3m b/d compared with a near 3m b/d increase in 2020. The biggest question mark to us remains Q2 when OPEC+ countries notionally should add volume back to the market. Even with those barrels coming back in, our projected surplus of 530k b/d is negligible compared with the 6.2m b/d surplus recorded in Q2 2020! But inventories in isolation can’t tell us if a market is truly tight or loose and hence we prefer to look at them through the lens of demand. After peaking at over 85 days’ worth of demand in Q3 2020, OECD stocks should normalize to around 60 days by the end of this year.

Source: IEA, Emirates NBD Research

Source: IEA, Emirates NBD Research

We are holding our 2021 oil price assumptions steady at USD 50/b on average for Brent futures and USD 47/b for WTI. Sustained inventory draw-downs over the course of 2021 should help to keep the forward curve in backwardation. However, the recent flip of the curve since mid-December has been reasonably tentative: 1-12 month spreads in Brent futures peaked at over USD 3/b but have since moved down closer to USD 2/b as the demand outlook remains highly uncertain.