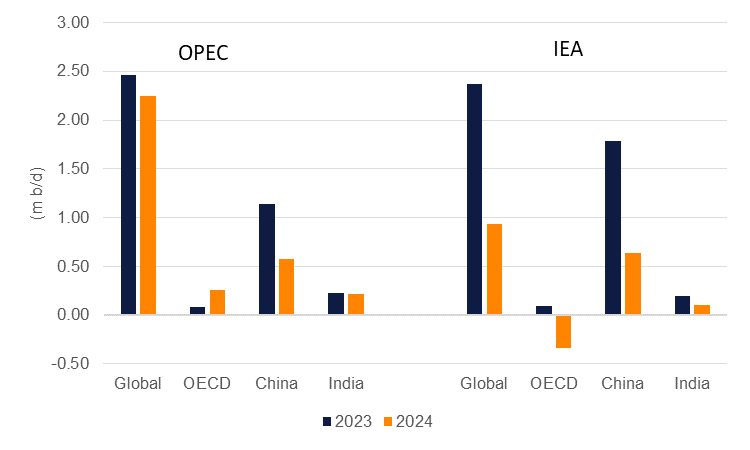

Both the IEA and OPEC have released their latest oil market reports and have set out sharply different views on how demand will develop in 2024. Both forecasting agencies are roughly aligned on 2023 having been a strong year for demand: the IEA estimates global demand growth of 2.37m b/d while OPEC’s projection is for 2.46m b/d compared with longer-term trend levels around 1.5m b/d. Both the IEA and OPEC point to strong growth in China’s oil consumption this year, even amid negative macro headlines on the near-term trajectory for China’s economy.

But for 2024 the outlooks are vastly different. OPEC has projected another robust year for demand growth for a global total of 2.25m b/d with both OECD and emerging economies seeing demand rise. China and India will be among the single largest contributors next year but OPEC still sees about 140k b/d of demand growth in the US. The IEA is sharply more negative, expecting demand growth to slide from 2.37m b/d to just 0.93m b/d in 2024. OECD economies will see an outright contraction in consumption of 0.34m b/d while demand growth in emerging economies will slow to 1.27m b/d thanks to much slower Chinese demand.

Source: IEA, OPEC, Emirates NBD Research

Source: IEA, OPEC, Emirates NBD Research

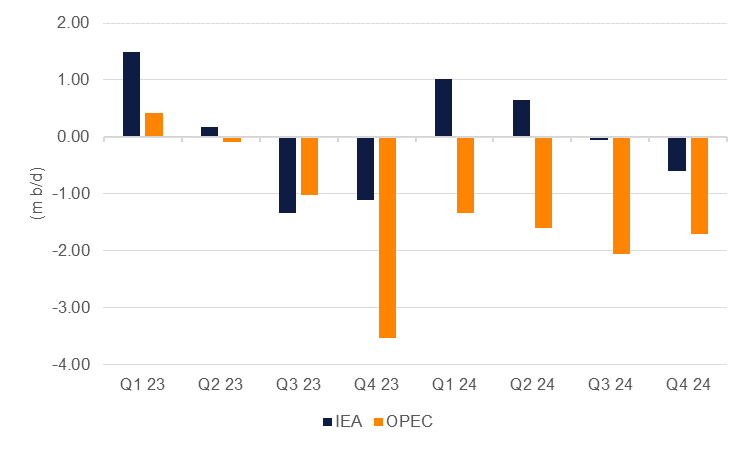

The IEA and OPEC are reasonably aligned on supply growth. For 2023, the IEA estimates 2.1m b/d of non-OPEC supply against 1.8m b/d from OPEC and for 2024 both have a slowdown in activity pencilled in of 1.2m b/d for the IEA and 1.4m b/d for OPEC. That leaves the demand forecast as the major variable in determining oil market balances for 2024. Based on the IEA’s demand projections and OPEC+ extending its supply cuts for at least the early part of 2024 we estimate a small market surplus in H1 2024 that gives way to a modest deficit in H2 2024. The OPEC numbers generate a much deeper deficit that is consistent across all of 2024.

Source: IEA, OPEC, Emirates NBD Research.

Source: IEA, OPEC, Emirates NBD Research.

This divergence of views on the relative tightness or looseness of global oil markets won’t help a market already beset by volatility sparked by the geopolitical tension in the Middle East. Oil prices have sagged in recent weeks with front month Brent futures down by USD 14/b since hitting a 2023 peak of USD 96.55/b at the end of September. Prompt contracts are trading early 2024 expiry and some of the losses in recent weeks may be pricing in a pending surplus in oil market balances for early next year. With markets focused on an easing demand picture for next year, it reinforces our view that OPEC+ will endorse extending production restraint at the upcoming ministerial meeting at the end of November.