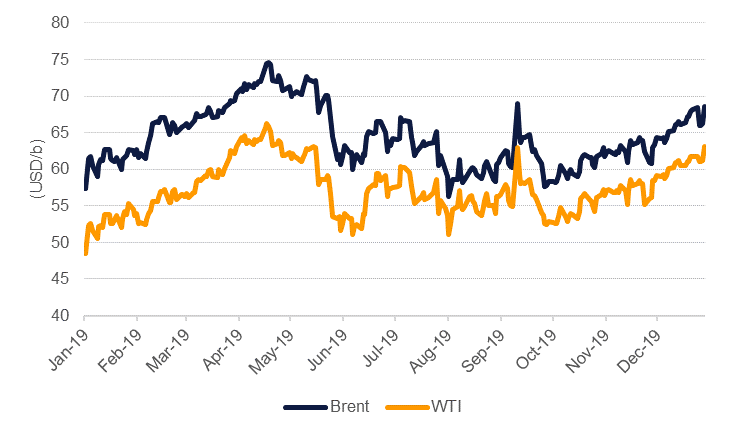

Oil markets snapped back into reality after the start of the New Year as a US airstrike killed a senior Iranian military official. After a 2019 that was peppered with high risk geopolitical events, 2020 appears to be starting as intensely. Benchmark futures prices spiked in response to the news with Brent touching an intraday high of USD 69.50/b and WTI moving up over USD 64/b. Oil futures have gained for eight of the last nine weeks, bolstered by optimism that the China-US trade war would come to an end and now receiving support from a revived geopolitical risk premium.

The immediate fear in oil markets is whether supplies flowing out of the Gulf region or from Iraq are disrupted, either from the Strait of Hormuz being blocked or pipelines being cut. Already the UK has announced its navy will accompany British-flagged vessels moving through the region and the US will be sending more troops into the Middle East. However, like we saw in 2019, the impact of risk events themselves on oil prices can be fairly short-lived if markets do not assess any substantial change to physical flows. Taking the attacks on Aramco’s Abqaiq facilities as a guide, a sharp move higher in spot prices unwound relatively quickly as the market assessed the overall impact on production and considered ample sources of alternative supplies.

Our expectation for Q1 was for benchmark prices to decline as a sizeable inventory build is on the cards. We maintain our view for Brent prices to average USD 59/b this quarter and WTI at USD 57/b although we did note in our Oil 2020 Outlook that unplanned outages as a result of geopolitical tension posed an upside risk to prices. The risk of prolonged tensions between the US and Iran, with the potential for escalation, will act like the US-China trade war in reverse: as markets are wary that further attacks could be forthcoming, prices may have an upside bias in the short-term.

Beyond spot prices, the reaction in oil markets has been relatively measured so far. Freight costs for taking a VLCC from the Gulf to Singapore were little changed while the spread of Brent over Dubai—a gauge for the relative scarcity of either crude—held steady at around USD 2.50b/. Forward curves for benchmarks strengthened in the first few trading days of 2020: Dec spreads for 2020/21 in both Brent and WTI are above USD 4/b in backwardation while near-dated time spreads are holding around recent levels of USD 0.23/b in WTI and USD 0.84/b for Brent in the 1-2 month spread.

The start of 2020 also marks the start of the implementation of IMO 2020. An escalation in tension that could send oil prices, shipping rates and insurance costs higher will hardly be welcome as the global shipping industry adjusts to higher fuel costs.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research