As the GCC is trying to pivot to the East with a focus on the Western Indian Ocean (including the Suez Canal, the Red Sea, the Bab-el-Mandeb, the Gulf of Aden, the Gulf of Oman, the Arabian Sea, the Arabian Gulf) a new era dawns in terms of energy exports, trade and new market routes. Focused on economic diversification, the GCC’s post-oil economic strategy aims to boost foreign direct investment (FDI) by attracting funds and international partners for infrastructure projects in the region. Saudi Arabia and the UAE pursue a more active geopolitical role that has to be supported by increased maritime power and seafaring expertise. On the other shore of the Arabian Gulf, Iran still seeks economic recovery and industrial modernisation after years of international sanctions. GCC’s maritime competition in the Western Indian Ocean dictates new alliances with Eastern African and Asian players, adding to the traditional map of rivalries in the Indian Ocean (China vs India, India vs Pakistan). This competition can be traced along three routes of geostrategic influence, namely through commercial ports, military agreements and bases, and blockage or choke points (e.g. Hormuz Straight, Bab-el-Mandeb, Suez Canal, etc.)

The development of commercial ports and the establishment of Special Economic Zones (SEZs) can be the driver of economic industrialization and growth. GCC’s focus on maritime infrastructure supports a new pattern of urban development, that of commercial ports combined with new planned cities and mega projects. This includes city transforming investments such as the newly constructed King Abdullah Economic City (KAEC), NEOM in Saudi Arabia, and Duqm in Oman. In this context, innovative infrastructures, such as global container ports and free zones have become drivers of post-oil economic diversification and growth.

Last month, US President Trump implemented his promised trade tariffs, imposing 25% and 10% on steel and aluminum imports; with new US tariff regulations, targeting Chinese goods estimated at between USD 50-60bn, according to Stratfor Global Intelligence (SGI). As the GCC is one of China’s major trading partners, this recent fallout implies that Chinese imports will become more expensive across the region. China is the UAE’s second largest trading partner, accounting for 7.3% of its total trade value in 2017 (USD 35.8bn). Chinese imports to the UAE reached USD 23.6bn and imports from Hong Kong at USD 3.25bn for the same period, according to Bloomberg data.

Similarly, as concerns of a global trade war escalate and other countries adopt a more protectionist stance, demand for some of UAE’s exports will fall. Demand for GCC’s energy products depends largely on the needs of Chinese industrial and commercial producers, which is the region’s biggest customer for crude and increasingly for gas too. Potential fluctuation in the financial markets is another factor that could impact the UAE, whose AED currency is pegged to the USD.

The rising demand for freight handling and logistics, as well as the expansion of the leisure sub-segment, are the main drivers in Dubai’s maritime sector growth, helping Dubai to strengthen its position as a global industry leader. That is, Dubai’s maritime industry accounted for roughly 7.0% of Dubai’s GDP in 2017, a 25.0% increase over 2011, according to latest government estimates. The sector is composed of more than 5,500 companies engaged in some 13,000 activities and providing 75,000 domestic jobs, from shipbuilding, maritime engineering operations, container logistics and dry bulk cargo handling to port services, and dredging. As an international shipping hub, in recent years Dubai has experienced slower trade, amidst lower oil prices and a global oversupply of container shipping capacity. However, compared with many other maritime clusters, Dubai appears to be well positioned to endure the current period of relatively slow growth.

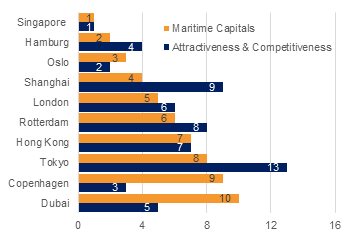

Evidence to that, Dubai was ranked as the most competitive maritime capital in the MENA region for 2017 and the tenth most competitive overall, up three places compared with the 2015 report, according to the latest international maritime industry report by the Norway based, Menon Business Economics Group. Dubai was also the fifth most competitive maritime cluster globally for the same year with the report assessing maritime facilities of various cities in terms of attractiveness and competitiveness, finance and law, technology, ports and logistics, and shipping. Based on the same report, Dubai is expected to further grow in importance in the near future, becoming the sixth most dominant maritime capital globally, by 2022.

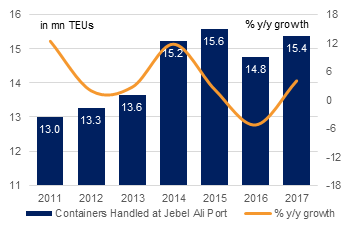

Much of the increase in Dubai’s maritime trade and logistics has been driven by its largest ports and logistics company DP World, posting robust figures in freight handling last year. DP World’s international network of terminals handled 70.1m standard twenty foot equivalent units (TEUs) of containers in 2017, up 10.1% over the previous year. Handling activity in UAE grew by 4.1% y/y to 15.4m TEUs. Performance in DP’s global network was also positive, Australia and Americas segment grew by 18.8% while Middle East, Europe and Africa operations expanded by 7.6% y/y driven by strong performance in Europe and recovery in the UAE. Market conditions in the Asia Pacific and Indian Subcontinent region were generally positive with container volume growth doubling to reach over 10m TEUs, boosted by the consolidation of DP World’s Pusan terminal in South Korea.

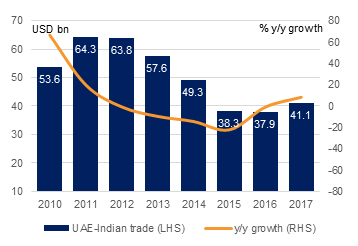

As one of the fastest growing markets for international trade, Dubai seeks to strengthen its ties with India by investing in logistics and shipping infrastructure projects throughout the country. Earlier this year, Dubai signed a memorandum of understanding (MOU) with DP World and the regional government of Jammu and Kashmir to jointly explore and develop a multi modal logistics hub and park in Jammu, including facilities for the transfer of containers, bulk and break-bulk cargo. This agreement followed the USD 1.2bn invested by DP World during the expansion of the Nhava Sheva Gateway Terminal at Mumbai’s Jawaharlal Nehru Port, back in 2014. These developments pave the way for a futher increase in bilateral trade between India and the UAE, which rose by 8.3% in 2017 to reach USD 41.1bn, targeted to reach USD 100bn by 2020, according to DP World. Efforts to further strengthen trade ties will be facilitated by the latest agreement between India and the UAE earlier this year to conduct transactions directly in each other’s currencies, eliminating the need to use USD as an intermediary currency.

Given Dubai’s strong presence in the transport and logistics segments, efforts are being made to diversify the maritime industry into other areas in order to solidify Dubai’s overall maritime position globally. A segment of significant growth potential is the leisure sector, with officials targeting the development of yachting services, construction, maintenance and berthing facilities. Dubai Maritime City Authority (DMCA) has recently unveiled the features of ‘Sea Dubai’ initiative, an instrumental project for the development of the maritime leisure sector in Dubai. The ‘Sea Dubai’ initiative aims to facilitate recreational maritime activities with a focus on creating high quality tourism services and new jobs within the maritime leisure sector. In January last year, Meraas Holding announced plans to construct a new 1,400 berth marina at Dubai Harbour, a nearly 50% increase on Dubai’s existing 3,000 berthing slots. The marina will have the capacity to accommodate some of the world’s largest private yachts, including vessels up to 85 metres in length. In addition, Dubai Properties launched another marina in March this year, with the 157 slip facility to be located on the Dubai Canal, close to the centre of the city and part of a larger mixed purpose waterfront development.