The US Federal Reserve cut its benchmark Fed funds rate by 25bps at its final FOMC meeting of the year yesterday, taking the upper bound down to 4.50%. A cumulative 100bps of cuts has now been implemented since the initial 50bps move lower in September. There was one dissension, with Cleveland Fed President Beth Hammack preferring to remain on hold. The cut was well anticipated, meaning that the focus was on the post-meeting press conference by Jerome Powell and the revised quarterly Summary of Economic Projections (SEP) both of which were more hawkish than seen previously.

In his statement, Powell observed once again that the risks to the Fed’s dual mandate on price stability and maximum employment were ‘roughly in balance’, and that they were attentive to both sides. Nevertheless, he said in the press conference that the decision to cut was a close call and that the central bank was now ‘at, or near a point’ to pause or slow its easing, and in his responses to questions it was apparent that inflation is the more pressing concern to the Fed at present.

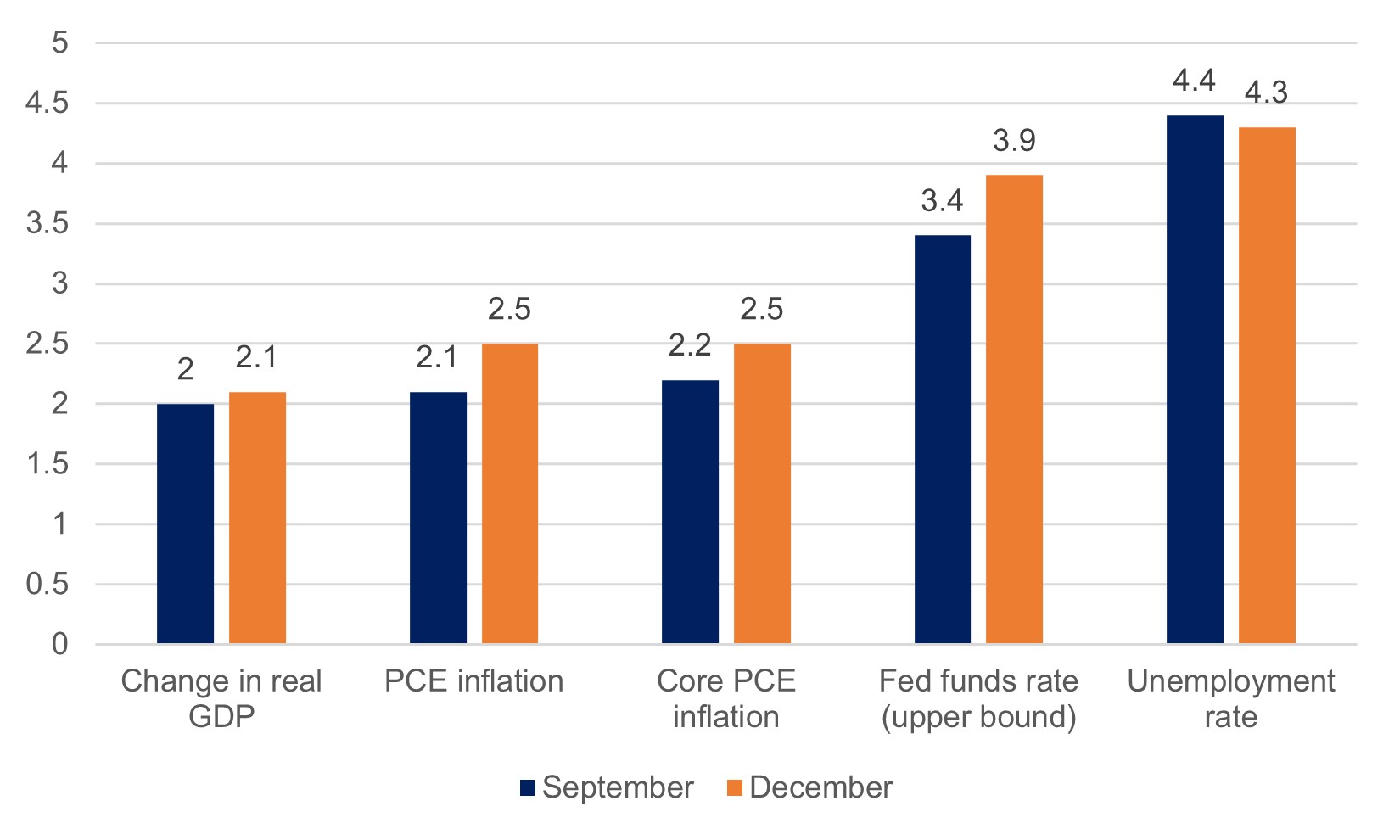

On the labour market, Powell noted that indicators such as job creation and job finding were pointing towards a slowdown but that it was still essentially solid. The monthly NFP readings have been thrown out over recent prints by weather events and strikes, but the three-month average of 173k net gains per month is materially lower than it was a year earlier, albeit still far from net losses. In terms of revisions to the SEP, the adjustments to the unemployment forecasts were among the less material, with the end-2025 rate now projected at 4.3%, down from 4.4% in September. Meanwhile, the real GDP growth forecast for next year was revised up slightly to 2.1%, from 2.0% previously and from a projected 2.5% this year. Taken together, there is no apparent need for rapid easing of policy and the prospect of further 50bps cuts in this cycle, as seen in September, appears slim, but the slowdown is still supportive of lower rates.

Source: FOMC, Emirates NBD Research

Source: FOMC, Emirates NBD ResearchOn the other side of the dual mandate, Powell acknowledged that the Fed’s year-end projection for inflation has ‘kind of fallen apart’ and progress has been ‘sideways’. Recent inflation data has all pointed towards a modest acceleration in price growth, with headline CPI inflation ticking up to 2.7% y/y in November, up from 2.6% the previous month and the highest level since July. The most recent PCE reading saw a y/y gain of 2.3% in October, up from 2.1% in September, with core PCE at 2.8%, up from 2.7%. The inflation projection was one of the key changes in the revised SEP released by the Fed yesterday, with PCE inflation now forecast at 2.5% y/y at end-2025, up from 2.1% at the September meeting. Core PCE has similary risen to 2.5%, from 2.2% previously.

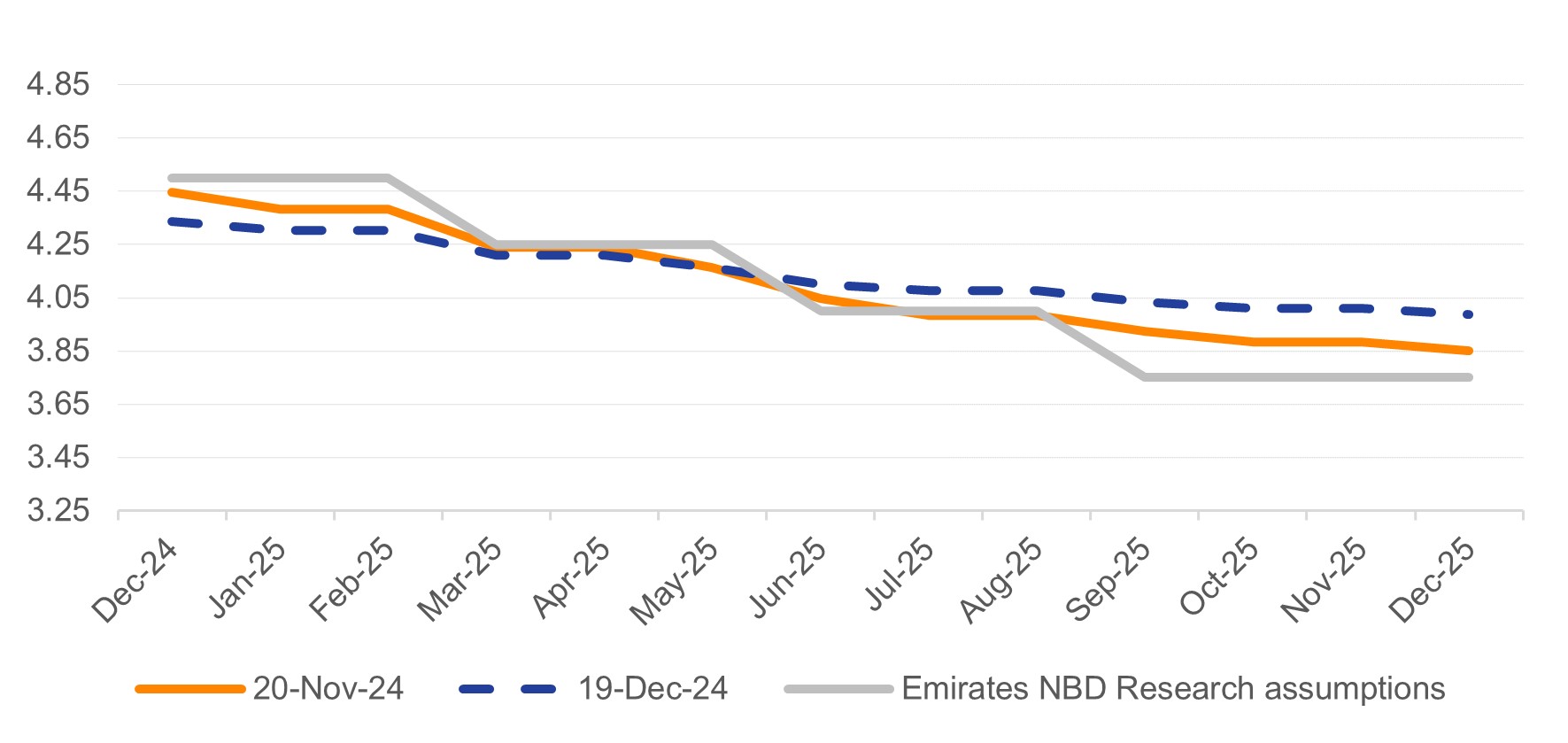

On the back of this, the median forecast by FOMC members is now for the upper bound of the Fed funds rate to end 2025 at 3.9%, implying just two further 25bps cuts next year, in contrast to the 3.4% projected by the dot plot back in September. Markets meanwhile have turned even more hawkish, with only 0.32pp of cuts implied next year, or just over one quarter-point lower, from a previous expectation of three cuts. Powell still sees the Fed ‘on track to cut’ and we still expect that the Fed will look to make policy less restrictive over the course of the year, forecasting three 25bps cuts in 2025. While we are cognisant of the potentially inflationary influence of President-elect Trump’s agenda, we expect this would only be observable towards the end of the year. Powell cautioned that it was too soon to say what the effect of these policies might be, stressing that the Fed would remain data dependent.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Market reaction

There were sharp market reactions to the hawkish messaging yesterday, especially in equity markets. Expectations of monetary easing combined with the so-called ‘Trump trade’ and its expectation of deregulation and an extension of tax cuts have spurred strong gains in equities over the past several months, but some of that was reversed yesterday. The tech-heavy NASDAQ, with many interest rate-sensitive growth stocks, led the losses as it ended the day 3.6% lower, but the blue chip Dow Jones and the S&P 500 also fell, both ending the day down 3.0%. Expectations around higher-for-longer rates, and greater interest rate differentials with peers, have also boosted the dollar recently and the DXY index closed up 1.0% yesterday to its highest level in over two years. We expect the US dollar to maintain momentum in 2025. Yields on US treasuries also continue to head back up, with the 2yr and the 10yr yield ending the day up 11bps and 12bps respectively. The 10yr is now at 4.5201%, levels last seen in late May this year and 90bps higher than the low recorded in September.

Implications for the GCC

The central banks of the GCC largely followed the Fed in its rate cut yesterday, with the UAE, Saudi Arabia, Bahrain, Kuwait, and Oman all reducing their benchmark rates by 25bps, while Qatar cut its deposit rate by 30bps. While monetary policy in the GCC may well end 2025 tighter than we had previously anticipated, by our current projections rates would still be 175bps lower than they were earlier this year. This should be supportive of growth in the regional non-oil economy, and we forecast GCC weighted average non-oil GDP growth of 4.2% in 2025, compared with our projection of 3.8% growth this year.