The US dollar is on track to end 2024 with some strong momentum. The US economy has been outperforming peers this year with the economy expanding by 2.7% y/y in Q3, ahead of the Eurozone at 0.9%, the UK at 1% and Japan’s economy at 0.9%. That growth advantage looks set to persist in 2025 with projections from the IMF for the US to outperform nearly all major developed economies.

A robust outlook for growth is paired with a higher outlook for inflation, however, and correspondingly a higher expectation for central bank policy rates in the US relative to peers. Inflation is expected to remain above the Federal Reserve’s 2% target level in 2025, based both on market expectations and the Fed’s most recent summary of economic projections.

Goods inflation has been trending lower in the US but core services inflation, particularly for housing, has been much stickier. In recent statements the Federal Reserve has noted that risks to the two parts of its mandate—inflation and unemployment—are growing more in balance but we expect that it will maintain a hawkish bias to avoid inflation running ahead of target levels for a sustained period again.

The outlook for faster growth and inflation has kept expectations high for the Fed to keep US rates elevated relative to peers, in particular the European Central Bank. Market pricing for the Fed Funds rate in October next year has increased by almost 86bps since the start of Q4 to roughly 4% as of the end of November. In contrast, similar pricing for ECB policy rates has been static at about 1.9%, contributing to a more than 90bps increase in the spread between the two rates. A widening premium for the US dollar is also playing out in forward-starting swaps with the EURUSD 1y1y differential sliding sharply in the last several months.

We have revised our expectation for how much the Federal Reserve will cut next year to three 25bps cuts from five as we expect that the Fed will still want to move to a less restrictive stance on policy but will be wary of cutting too much given the generally good performance of the US economy. On a rates differential alone, that should help to support the US dollar against peers where the scope for deeper interest rate cuts is more pronounced.

Trump administration brings new risks

The fundamental case in support of the US dollar appears strong but it has been helped further along by the election of Donald Trump as the next US president. Many of President-elect Trump’s policies are on the surface inflationary—tax cuts, deregulation, a tougher immigration regime—all of which support the view for a higher path for Fed rates in 2025. Further, a major threat to trading partners, and their currencies, comes from the incoming administration’s plan to use tariffs as a revenue raising tool and measure to force changes in policy. This week President-elect Trump announced via social media that he was planning to impose tariffs of 25% on trade with Canada and Mexico in relation to controls over their shared borders with the US. The Canadian dollar sank 0.5% in response to the announcement while the Mexican peso dropped by 1.7%.

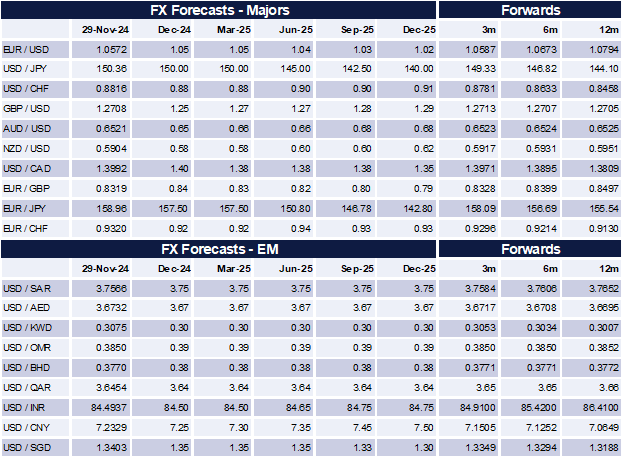

It is still unclear how forcefully the new administration plans to use tariffs or if they will be targeted to specific countries. The threat of their use will keep trading partners to the US on edge and likely be a drag on their national currencies. Most of the pain is likely to be felt in EURUSD where the gap between US and Euro rates is the widest. The Eurozone also runs a large trade surplus with the US, of roughly USD 18-20bn in recent months. That is likely to keep the bloc in focus for tariffs from the new administration. We expect that EURUSD will test lower levels over the course of 2025 and has the potential to move to parity depending on the flow of economic policy.

In Japan we expect that the Bank of Japan will hike rates over the course of 2025 as it works to get inflation to target levels. CPI inflation in October was at 2.3% y/y, ahead of a target level of 2%. Rates moving higher and a narrowing, but still wide, differential to US rates should work with a heavily under-valued yen on an effective exchange rate basis to pull USDJPY lower next year, though our year-end 2025 target of 140 is hardly strong.

For sterling we expect that the Bank of England will need to keep cutting rates in 2025 as the growth momentum in the UK economy has slowed considerably. On a relative basis US-UK rates will be quite close though the risks are more for the UK to cut more and be prone to trade threats from the US. We expect GBPUSD will hold relatively close to current levels in 2025.

Click here to download the full report

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.