Oil markets will be watching out for commentary from the major forecasting institutions this week as the EIA, OPEC and IEA all release their monthly reports. We would expect the focus to be on the current run higher in oil prices, and energy commodities more generally, with both Brent and WTI futures hitting multi-year highs in the last few weeks. The IEA may call on OPEC+ to accelerate its pace of production increases although we don’t expect any material response from members of the exporters’ bloc.

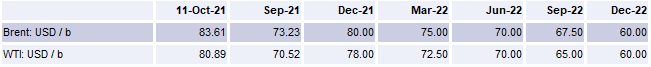

The upward push in oil prices has been brought about largely by factors outside the oil market. Tight natural gas inventories in Europe, Chinese provinces aggressively targeting emissions and the general recovery, if uneven, in economic activity have all conflated to squeeze energy markets at the start of Q4. Specific to oil has been the OPEC+ decision to err on the side of keeping prices higher for longer by maintaining its supply increases at a pace of 400k b/d per month for November. We expect oil prices will remain well supported for the rest of the year and are revising our Q4 average price assumptions higher—to USD 80/b for Brent from USD 70/b previously and to USD 78/b for WTI from USD 65/b previously. That brings our annual average for 2021 to USD 71/b for Brent and USD 68/b for WTI compared with USD 68/b and USD 65/b previously.

Tightness to persist in winter months

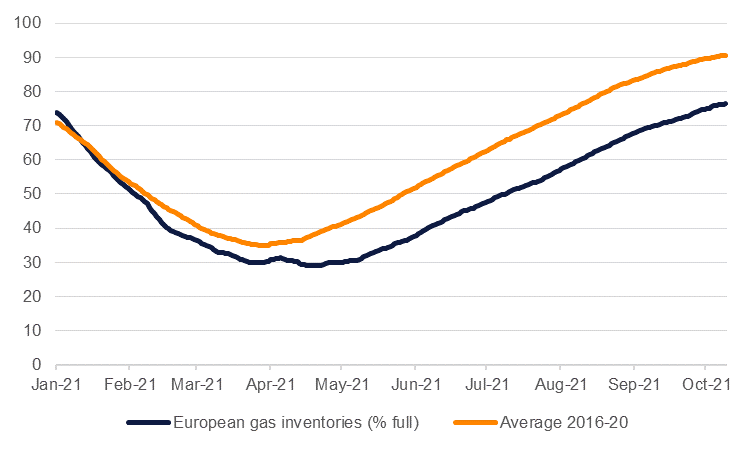

We don’t expect the current phase of energy market apparent tightness to dissipate quickly and some of it will bleed into early 2022. In particular, natural gas storage in Europe is critically tight—at just 76% of total capacity in early October compared with five-year average levels of more than 90% for this time of year. Coal inventories in China are also running at tight levels compared with historic average levels and have prompted an aggressive bid for energy commodities into China. With no material easing of that tightness apparent and the outlook for heating demand dependent upon the upcoming winter weather, fuel switching to oil (particularly gasoil) generation could help to give an additional boost of the hump of 2021/22.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Oil prices could then benefit from one of the upside risks we noted in our 2022 oil outlook—namely a colder winter prompting greater heating demand—and we are adjusting our H1 price assumptions higher accordingly. That brings our annual price assumptions for 2022 to an average of USD 68/b for Brent compared with USD 65/b previously and USD 67/b for WTI compared with USD 63/b previously.

Source: Bloomberg, Emirates NBD Research. Note: average of quarter.

Source: Bloomberg, Emirates NBD Research. Note: average of quarter.

We still, however, expect oil prices to decline over the course of 2022 based on OPEC+ returning its barrels to the market, and potentially even accelerating if they respond to diplomatic pressure to increase output at a faster pace at upcoming meetings. There will also be a recovery in non-OPEC+ supplies. US oil production has recovered nearly all of its lost output caused by hurricanes in Q3 and the drilling rig count in the country continues to expand. While the pace of production gains in the US is likely to fall short of previous years, US output is still expected to end 2022 at a higher level than 2019.