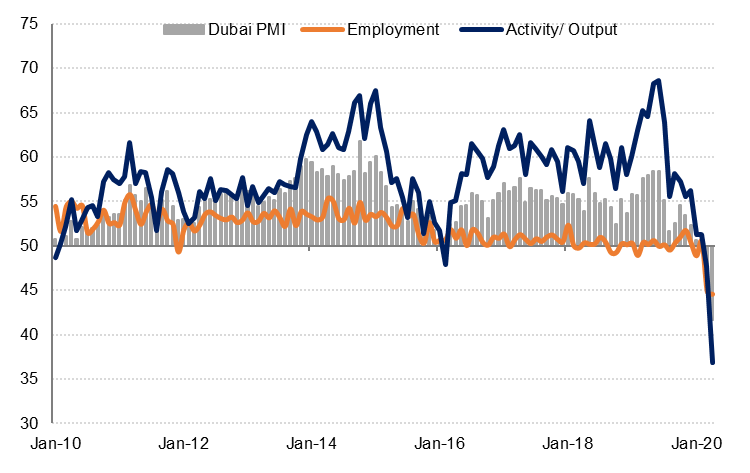

The Dubai PMI fell to a new record low of 41.7 in March, the second consecutive reading below the 50-level that separates expansion from contraction. Both output and new work contracted sharply in April, as non-essential businesses were closed for most of last month and movement was restricted. More than 40% of firms surveyed reported lower new orders in April, while 37% reported declining business activity.

Employment in the private sector declined sharply again in April as firms sought to cut costs. Input costs did decline in April as a result of lower staff costs and lower purchase costs. As a result, firms discounted selling prices again.

Suppliers’ delivery times lengthened sharply in April due to the COVID-19 disruptions to business and trade. This component added 6.3 points to the headline PMI reading as longer supplier delivery times usually indicate a pick-up in demand, although that is clearly not the case this time. Historically, supplier delivery times in Dubai have shortened every month. The deterioration in business conditions in Dubai in April was thus more severe than the headline PMI figure indicates.

Unsurprisingly, business expectations of future output declined in April to a historic low of 51.8, with only 20% of businesses expecting their output to be higher in a year’s time, and 16% of firms expecting their output to be lower in a year’s time.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

Travel & tourism continued to be the worst performing sector of the three key sectors surveyed. The travel & tourism index stood at 36.8, although this was buoyed by much longer delivery times in April, which contributed 6.5 points to the sector index. Output contracted sharply as global tourism effectively ground to a halt, and new work declined sharply as well. Firms in the sector continued to shed jobs in April although at a slower rate than in March. Importantly, the expectations index fell below the neutral 50-level for the first time in the series history, indicating that businesses in this sector are pessimistic about the outlook for travel and tourism one year out.

Business conditions in the construction sector deteriorated at a faster rate in April, with the sector index declining to 41.5, although once again much longer supplier delivery times have artificially boosted the index. Output/ activity declined at a record rate, as did new work. The new work index fell to 29.3 in April from 41.3 in March. Employment in the sector declined for the second consecutive month.

The wholesale & retail sector index fell to 44.2 in April from 52.3 in March, with output and new work both contracting at a record rate. Employment in the sector has declined in five of the last 6 months but the pace of decline was faster in April. Businesses in the sector were neutral about the outlook over the next 12 months, with the expectations index declining to 50.0 from 63.3 in March.

The Dubai PMI data shows the non-oil private sector in sharp contraction at the start of the second quarter. Panellists don’t appear to be expecting a quick recovery either. While the most severe lockdown restrictions have been eased, with retail stores allowed to reopen in the last week of April and movement of people less controlled, activity is likely to recover only gradually in our view.