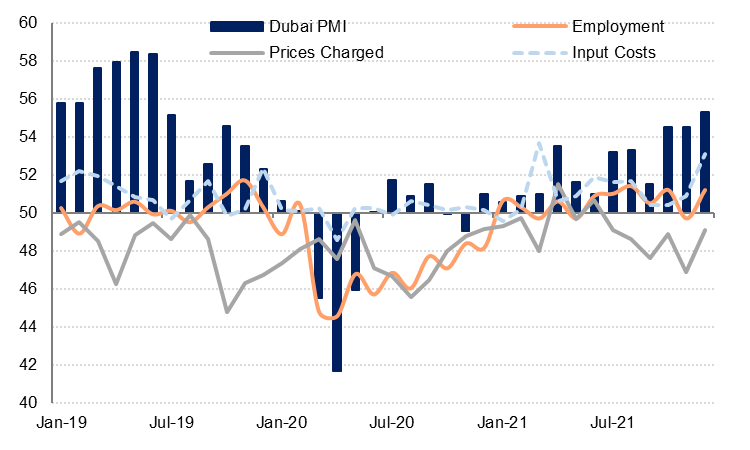

Dubai’s PMI rose to a two-and-a-half year high of 55.3 in December, from 54.5 in November. The main drivers were strong growth in new work and business activity, which firms attributed to the relaxation of travel restrictions and Expo 2020 which helped to boost tourism in the final month of 2021. Panellists also noted that domestic demand was also strong.

Private sector employment increased modestly last month but job growth still appears to lag the sharp acceleration in business activity and new orders in Q4 21. IHS Markit reported that backlogs of work rose again in December “as firms struggled to complete their orders.”

Input costs rose at the fastest rate in nine months in December, with firms citing higher raw material and energy costs. Supplier delivery times were broadly unchanged, and stocks of inventory declined slightly. Despite the increase in purchase costs, firms reduced selling prices in December, but the degree of price discounting was the weakest since July.

Overall, businesses were optimistic about the outlook over the coming year, but there was uncertainty about the potential impact of the Omicron variant on travel and tourism. Only 12% of firms expected their output to be higher in a year’s time, with the majority of firms expecting no change.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The travel and tourism index averaged 54.8 in Q4, the highest average since the pandemic began. Business activity and new work both increased sharply in December as travel restrictions eased in time for the peak holiday season. However, firms in the sector kept staffing largely unchanged from November.

Input costs increased at the fastest rate since March 2019, but firms still offered some incentives and price discounts on average across the sector, according to the survey. Despite the strong December performance, firms in the sector were the least optimistic about the outlook since August 2021. This was likely due to heightened uncertainty about the impact of Omicron on tourism in the coming months.

The wholesale & retail trade sector index slipped slightly in December to 55.0 from 55.5 in November, on softer – but still strong – growth in business activity. New orders increased at the fastest pace in more than two years. Employment in the sector rose modestly last month but firms may be cautious on hiring as their margins remain under pressure – input costs rose sharply in December but selling prices declined for the 17th consecutive month. Business expectations about future output were the lowest since July 2021, albeit still in positive territory.

The construction sector index benefitted from a sharp increase in business activity and the strongest new order growth since February, rising to 53.8 in December from 52.0 in November. Businesses in the construction sector were overall more upbeat about the outlook for 2022 than firms in the retail or tourism industries.

Input costs in construction rose modestly in December, but there was slight price discounting in the sector regardless. Prices charged declined for the first time in four months, and this may have helped firms to secure new work.

The Dubai PMI survey supports our view that the emirate (and the whole UAE) benefitted from an acceleration in GDP growth in the final quarter of 2021. While there are some near-term headwinds to growth, we expect the non-oil sectors to continue to recover from the pandemic in 2022. Read more about our outlook for the UAE here.