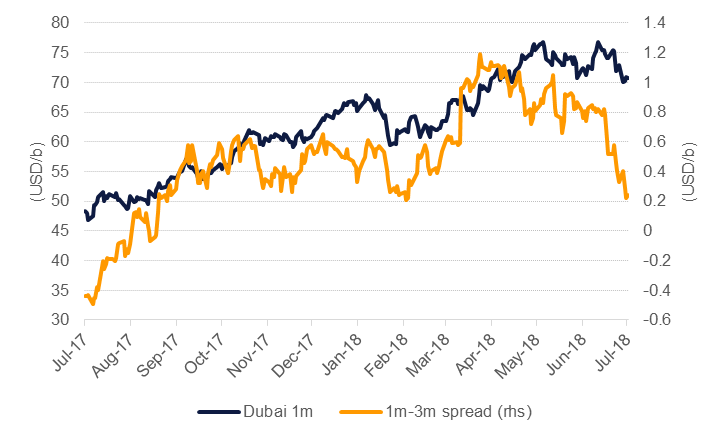

The forward curve for Dubai crude has moved to its flattest level since the start of the year, compressing to around USD 0.20/b of backwardation on the 1-3 month spread. The flattening has accelerated since OPEC announced that it was prepared to increase production at the end of June to compensate for lower output in Venezuela and a pending drop in Iranian volume. Production from Saudi Arabia has already increased to help keep markets in balance going forward and further increases either from Saudi Arabia or UAE and Kuwait are likely to keep downward pressure on the Dubai curve in the short-term.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

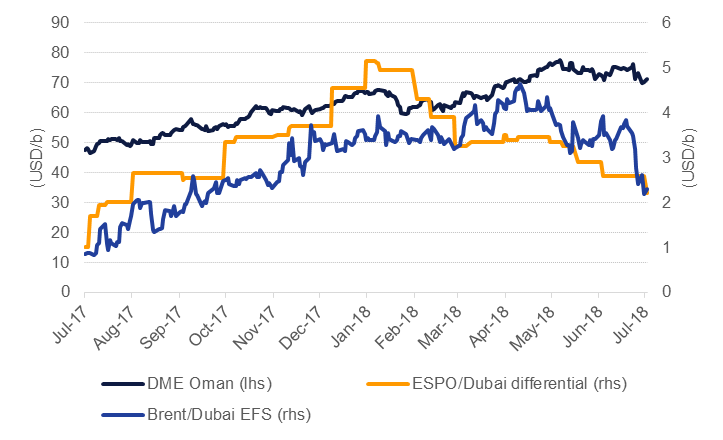

Beyond the supply increase from GCC producers, other factors will weigh on regional pricing. Benchmark Brent futures have sold off sharply over the last two weeks as a twitchy market has responded to, among other factors, headlines on Libyan export volumes, US adjusting its stance on whether it will grant waivers to buy Iranian crude and escalating concerns of a trade war weighing on growth. Falling Brent prices have helped to narrow the Brent/Dubai EFS and make Brent-linked crudes—West African grades for example—competitive against MENA crudes. Export programmes from Angola are expected to be larger for September as producers look to take advantage of better pricing.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

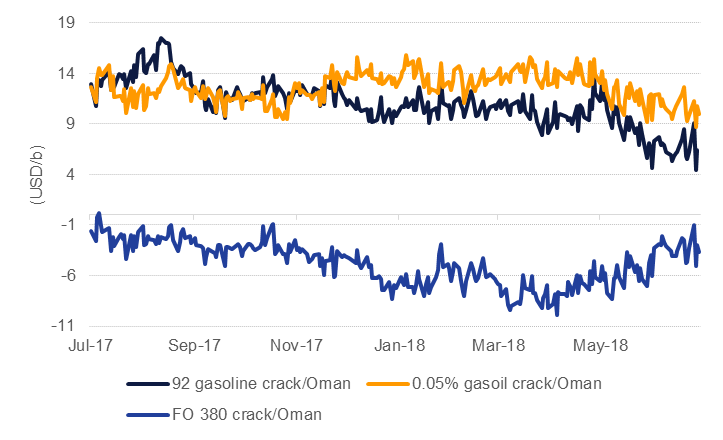

We expect that regional NOCs will be wary of letting the Dubai curve and prices soften too much as Asian demand is also flashing some warning signs. Refining margins in Singapore—particularly against MENA grades—have been softening since the start of Q2 across gasoline and gasoil. Fuel oil cracks are the outperformer here which notionally should be an advantage for GCC producers, such as Saudi Arabia, that are raising output.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.

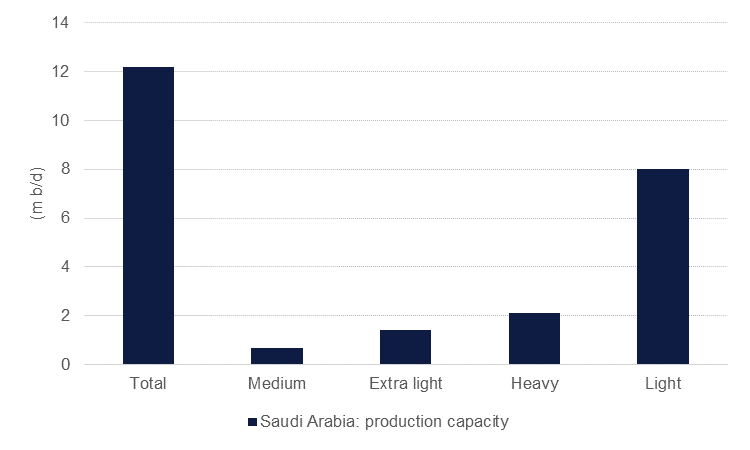

However, most of Saudi Arabia’s spare capacity is in lighter grades, mismatched with where optimum refining margins are at the moment. An increase in output of these crudes will be in direct competition with African and North Sea crudes along with US exports. On a headline basis, crude markets are in need of an increase in output to prevent prices blowing out significantly over the course of H2 2018. However, we would be cautious on how large an increase will be immediately forthcoming from GCC NOCs as market dynamics currently don’t appear in their favour.

Source: EIA, Emirates NBD Research.

Source: EIA, Emirates NBD Research.