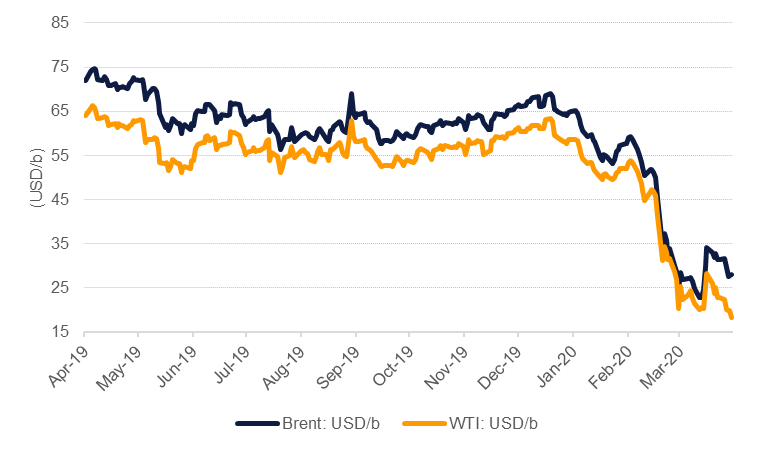

Oil prices extended their losses last week as the OPEC+ production cut agreement has yet to have an impact on the market. Brent futures were down nearly 11% to settle at USD 28.08/b while WTI lost almost 20% to close at USD 18.27/b. Since the start of the year Brent has lost 57% while WTI is down around 70%.

The energy ministers of Saudi Arabia and Russia delivered a joint statement in which they said they were prepared to take “further measures” if needed to support oil markets. If the OPEC+ deal carries on last previous iterations we would expect to see voluntary Saudi over-compliance, i.e., cutting more than its share of the deal provided that other producers make an effort to cut output as well. However, demand projections released from the IEA and OPEC earlier in the week show just how severe demand has been affected and what kind of cuts would be required to truly bring markets into balance.

The IEA estimates the call on OPEC crude (the level needed to balance markets) at just 8.5m b/d in Q2. Anything above that level will feed into inventories. Meanwhile, OPEC was more optimistic, estimating the call on its own crude at a little under 20m b/d for Q2. Nevertheless, both levels are still well below the target level for OPEC producers even after agreeing a 9.7m b/d cut in cooperation with others.

Market structures continue to reflect—and weaken—as a result of this surge of supply overwhelming what little oil demand is out there. Front-month time spreads ended the week in a contango of USD 3.5/b in Brent, almost 30% wider in a single week. The contango in WTI widened as well to USD 6.76/b in 1-2 month spreads from just over USD 6/b a week earlier.

The drilling rig count in the US continues to show the most immediate impact of lower prices ravaging the oil industry. E&P companies took 66 rigs out of service last week, taking the total to just 438. The Permian is still taking the brunt of the cuts while the oil-focused rig count in Canada is now just 7, compared with more than 170 in February. The Canadian government has pledged around USD 1.7bn in support for the country’s oil sector which may help to stabilize production at a base level as companies get some liquidity relief.

Source: Emirates NBD Research

Source: Emirates NBD Research