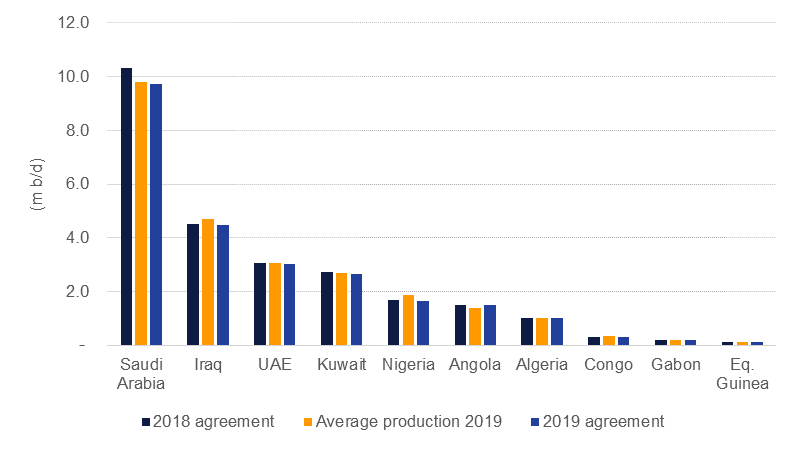

OPEC+ agreed to deepen their current round of production cuts by 500k b/d for the first quarter of 2020 in an effort to limit the oil market surplus from blowing out early next year. The share of the deeper cuts will be borne most heavily by Saudi Arabia, the UAE, and Kuwait among OPEC producers while Russia, Kazakhstan and Mexico are due to take most of the burden for non-OPEC producers. In addition to the official cuts endorsed by OPEC+, Saudi Arabia has effectively made its over-compliance official, pledging an additional 400k b/d of output restraint.

Oil markets responded positively to the announcement from Saudi Arabia that it would continue to over-deliver on cutting production although there appears to be an implicit warning from the Kingdom that its over-compliance allows it the flexibility to increase production to try and enforce better compliance with individual target levels. So far in 2019 aggregate OPEC compliance with production targets has been good but several members have come nowhere close to contributing their share of cuts. The OPEC+ statement stressed commitment from all members to meeting their cut obligations.

At a country level among Middle East producers, Saudi Arabia’s production would be roughly flat on 2019 ytd average levels while the UAE would see output fall by 1.8% to reach its new target level of 3.01m b/d. Kuwait’s production should decline by 0.9% while Iraq sees a much bigger drop of 5% and Algeria’s output falls by around 1%.

Source: OPEC, Bloomberg, Emirates NBD Research

Source: OPEC, Bloomberg, Emirates NBD Research

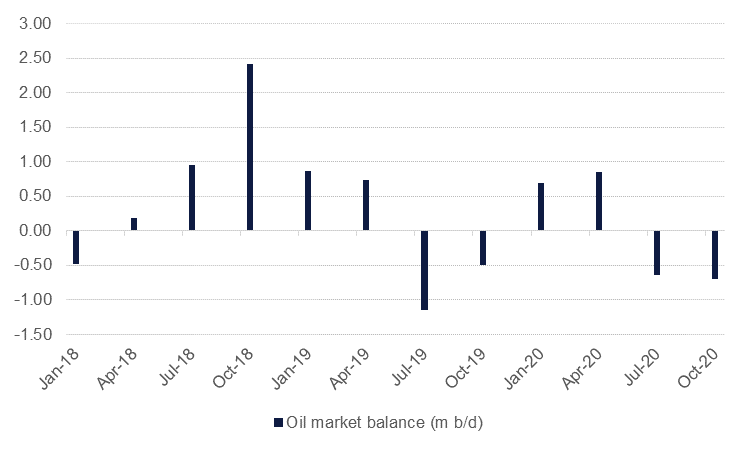

The larger cuts agreed for Q1 are not far off a scenario we outlined in our Oil 2020 Outlook and would bring the market closer to balance on average for 2020 but won’t prevent a surplus developing in H1. The statement from OPEC+ also implies the deeper cuts will only be in effect for Q1 and then evaluated for extension at a market monitoring meeting. Our assumption would be that the cuts would need to be extended in order to prevent OPEC+ from keeping the market in surplus and our projection also assumes Saudi over-compliance remains in place for all of 2020. However, as ever is the issue with OPEC+ production cuts, what is agreed and what gets delivered can be very different. We are of no doubt that Saudi Arabia will stay committed to lower production levels. But OPEC+ now totals 21 countries with individual and varied economic and socio-political requirements. Ensuring compliance is maintained in full and by all members remains the significant hurdle for any production cut agreement.

Source: IEA, OPEC, Emirates NBD Research. Note: assumes deeper cuts held for all of 2020.

Source: IEA, OPEC, Emirates NBD Research. Note: assumes deeper cuts held for all of 2020.

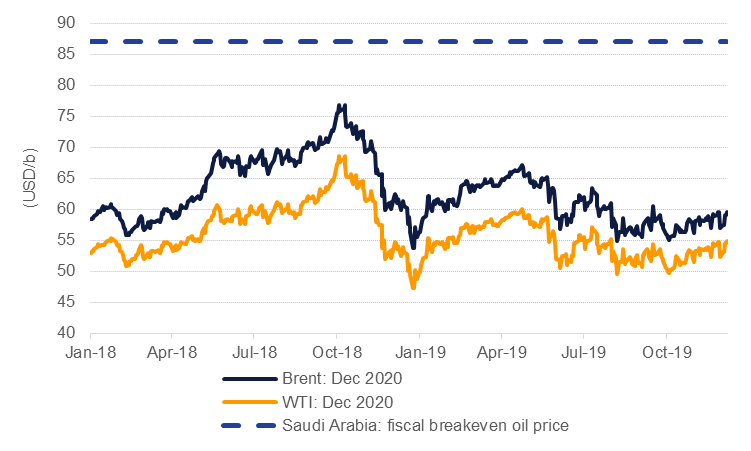

Oil prices rose in response to the news that OPEC+ agreed on deeper cuts but remain bound in the USD 60-65/b range where they have spent much of the past month. Longer-dated pricing is anchored at lower levels. Brent December 2020 contracts have been holding a little under USD 60/b for most of the second half of 2019 with WTI contracts for the same month around USD 55/b. Both are far below our projection for Saudi Arabia’s fiscal breakeven price of close to USD 87/b. In light of the deeper cuts announced by OPEC+ we still view our oil price assumptions for 2020 as appropriate although we note there may be some upside volatility provided compliance is strong across all producers.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.