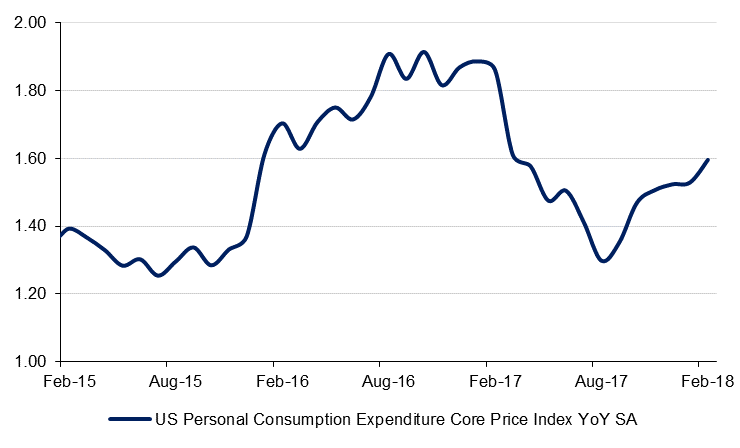

Economic data out of the US last week was somewhat mixed. US PCE inflation in February came in with headline rate at 1.8% and core at 1.6%, higher than the 1.5% core recorded in the previous month. The US Chicago PMI index fell to 57.4 in March from prior 61.9, well below expected 62 and the University of Michigan final sentiment index was revised down to 101.4 from original estimate of 102.0. However, the Atlanta Fed revised the estimate of 1Q GDP growth up to 2.4% from 1.8%. Overnight the Japanese Tankan index showed a slight dip in the large manufacturer’s index to 24 in Q1 from 25 in Q4, while the non-manufacturer’s index was steady at 23.

China has imposed tariffs, which will take effect today, of up to 25% on 128 U.S. products, worth $3 billion. China has suspended its obligation to the WTO to reduce tariffs on 120 US goods and said that the new tariffs were a retaliatory measure in light of President Trump's decision to raise duties on steel and aluminium imports. The White House claims that it is acting to counter unfair competition from China’s state-led economy and may impose further tariffs on good worth $60 billion. In retaliation, China could tax US tech companies like Apple, but for the time being negotiations are still ongoing in the hope that such measures can be avoided. Meanwhile China’s Caixin/Markit manufacturing PMI slipped to 51.0 in March from 51.6 in February, in contrast with the official PMI over the weekend that showed the manufacturing sector expanding.

Early results indicate that incumbent President Abdel Fattah el-Sisi has won a second term in Egyptian presidential elections last week, garnering as much as 92% of the vote. A victory for President Sisi was never in much doubt, but the authorities may be disappointed with turnout which reportedly dipped to around 40%, from 47% in 2014, despite incentives and threats of charges for those who did not cast their vote. Preliminary results indicate that Saudi Arabia’s economy endured a fourth consecutive quarter of negative growth in Q4 2017, contracting by 1.2% y/y in real terms. The oil sector, which accounted for 26.8% of the economy in the period, contracted 4.3% y/y. However, the non-oil private sector was also weak, posting marginal growth of only 0.4%.

Mixed economic data out of the US and safe haven bid on the back of volatility in equity markets fuelled a mini rally in government bonds last week. UST yield curve shifted downwards. The curve flattened with yields on 2yr, 5yr, 10yr and 30yr treasuries closing the week at 2.27% (unchanged), 2.57% (-8bps w/w), 2.74%(-11bps w/w) and 2.97% (-11bps w/w) respectively.

GCC bonds had a constructive week mainly as a result of benchmark yield tightening. Yield on Bloomberg Barclays GCC index tightened two bps to 4.26% even though credit spreads widened 5bps to 173bps last week. Despite oil prices rising during the week, average spread were wider as investors showed no motivation to add GCC exposure due to expectations of large new issue pipeline.

In the primary market, Noor Bank, Damac, SIB, all have mandated banks for issuance of sukuk.

Currently, the Dollar Index is trading at 89.99, after posting a 0.60% gain last week and breaking back above the 50 day moving average (89.74). This appreciation in the index has nullified most of the losses of the previous week and leaves the price testing the resistance trend line that has halted advances since 15 December 2017. A sustained break of this level (90.01) is required in order for USD to realize and hold onto further gains.

GBPUSD declined for a third day on Friday, reaching an 8 day low of 1.4035. Cable looks to test a key support level at the 50 day moving average (1.3993), a level which has held since breached on 12 March 2018. Should this level hold, further gains towards 1.42 can be expected. However, should it break additional declines towards 1.38 are not unrealistic.

Regional equities started the week on a mixed note. The DFM index (+0.9%) and the Qatar Exchange (+1.1%) closed higher while the Tadawul closed lower.

The strength in Qatari stocks was on account of reports that more companies are looking to raise foreign ownership limits. Qatar Petroleum said it will lift non-Qatari ownership limit in energy sector companies and in its subsidiaries listed on the exchange to 49%.

Oil prices gained towards the end of last week to cap a strong month. ICE Brent futures and WTI future rose +5.4% each in March 2018 as possibility of OPEC extending output curbs beyond this year gathered steam. Additionally decline in the US rig counts also helped bullish sentiment. According to data released by Baker Hughes, the US oil rig count dropped by 7 to 797 rigs at the end of last week. This was the largest drop since November 2017.