Brent futures have climbed back to USD 60/b, a level last seen in July 2015, thanks to growing market consensus that OPEC will extend its current production cut agreement beyond March 2018. Saudi Arabia’s crown prince, Mohammad bin Salman, gave a strong endorsement of an extension of the cuts last week, helping to add fuel to crude’s rally since the start of H2 2017. This followed statements earlier in the month from Russia’s president, Vladimir Putin, in favour of a longer supply cut. Market scrutiny of OPEC’s upcoming meeting at the end of November will be high as any deviation from extending the cuts for all of 2018 risks disappointing markets and sending prices back lower.

From a fundamental perspective, the production cuts have been working in drawing down inventories and pushing the current market balance into deficit. We would still classify the current level of stocks as ample, certainly when measured against even the strong demand growth we’ve seen this year. However, as far as managing the optics of rebalancing, the cuts have been effective in cutting back on the excess inventories. Moreover, compliance with the cuts has been good compared with previous OPEC agreements. Compliance by OPEC’s partners to the deal has also been strong although in the past two months compliance by Mexico was artificially high thanks to hurricane-related disruptions to production.

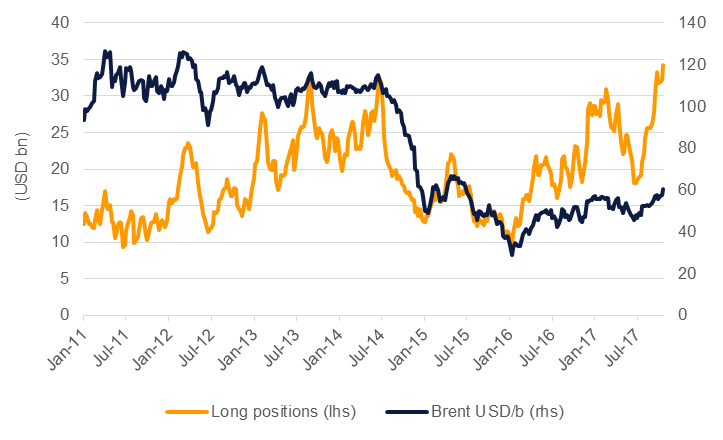

With encouraging fundamentals and statements dominating the oil market news flow, speculative positions have become heavily one-sided in the last two months. Brent long positions (including futures and options) outnumber shorts but a factor of nearly 10 to one and in absolute terms are close to record levels. In currency terms, total speculative funds invested in long Brent positions are at an all-time high of around USD 34bn. Commodities generally have performed well in H2 thanks to good global growth prospects, supply management and a sagging dollar, at least for most of Q3. However, positioning in oil look particularly stretched even amid positive conditions.

The scale of long positioning in the market looks crowded and may prompt some unwinding. While Brent futures have surprised on the upside in October, how much more upside is left in a market where OECD inventories still account for around 65 days of demand and non-OPEC production is poised to increase by more than 1.5m b/d in 2018 (according to the IEA)? Without a political risk—for example an escalation of tensions in Iraq or the re-imposition of US sanctions on Iran—there are no new fundamental developments we can identify to sustainably shift the market out of the USD 55-60/b range Brent has settled in.

The risks to OPEC disappointing markets also still appear high to us. Were OPEC and its partners to fail to endorse a full extension of the cut either at OPEC’s upcoming meeting in November or leave an exit strategy vague, as it currently remains, we would expect to see a similar sell-off to what happened in May when OPEC rolled over its deal but didn’t deepen or broaden the cuts.