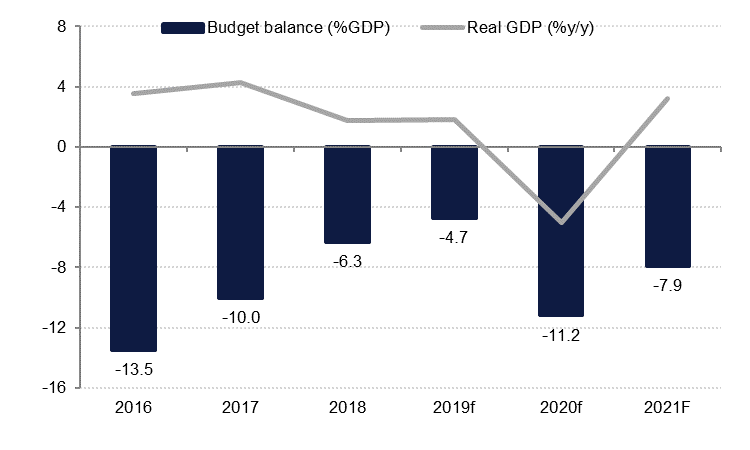

The Kingdom of Bahrain has been one of the most prolific issuer of sovereign debt in the GCC. The Bahrain government increased social spending earlier in this decade to promote peace and prosperity and therefore has been recording budget deficits since 2009 – much before the low oil prices exacerbated the deficit situations. Currently it has about $35.9 billion of debt including $11.3 bn in USD denominated bonds and $3.6 bn in USD denominated sukuk. Bahrain is rated B+/Stable, B2/Negative and BB-/Stable by S&P, Moody’s and Fitch respectively.

Bahrain mainly raises debt via public market issues.

Unlike Saudi Arabian and Omani governments that engage in borrowings in the loan market, Bahrain’s debt is mostly in domestic and international capital markets. International investors are reasonably familiar with the name and therefore access to funding has not been an issue in the past. However, lately Bahrain’s credit rating has been falling, from A/A2 in 2007 to B+/B2 now by S&P and Moody’s respectively, as Debt/GDP has been increasing by circa 10% every year since 2014. In addition expectation of frequent new supply from Bahrain has dampened investors’ enthusiasm and consequently investors’ demand for high return is making it increasingly expensive for Bahrain to raise new debt.

Last month, Bahrain shelved plans to raise debt via longer dated bond issues mainly due to high pricing demanded by investors. However, with over $3.5 billion in projected budget deficit and several upcoming bond maturities this year, we think that new debt offerings will have to surface up again soon.

Source: Emirates NBD Research

Source: Emirates NBD Research

Click here to Download Full article