A proposal from Chinese oil companies to form a collective importing bloc could disrupt the trading relationship between China and the major oil exporting countries in the Middle East. Asia’s long-running position as a price taker, absorbing oil price volatility and export levels linked to Middle East economic objectives, could come to an end if group purchases of crude from the region take hold.

Despite efforts by these companies to offset China’s reliance on crude oil imports, growth in China’s domestic oil production has stalled in recent years. Total output rose just 1% to 3.84m b/d in 2019 (BP), meeting less than 30% of domestic consumption. China is by far the world’s single largest oil importer, taking in more than 10m b/d in 2019 compared with less than 7m b/d by the US (which on a net oil import basis is an even smaller importer). As for the origin of China’s imports, it relies on crude from Middle East exporters for around 44% of its total imports of which Saudi Arabia is the single largest supplier at 16% of total imports (the UAE is a relatively small share of China’s oil import slate at just 3%).

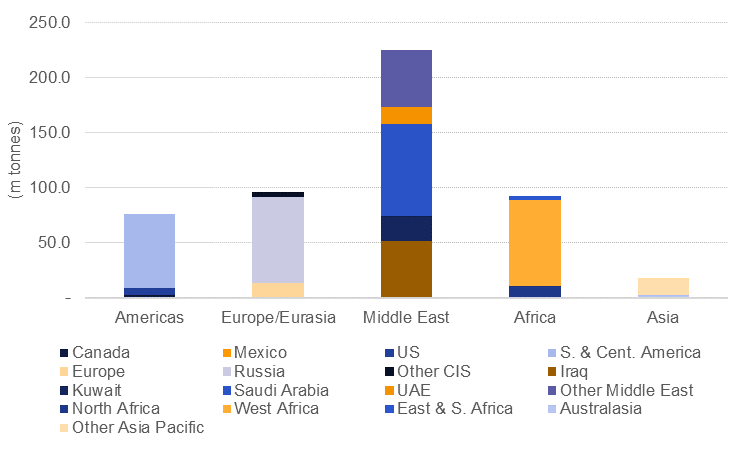

Source: BP Statistical Review of World Energy 2020, Emirates NBD Research.

Source: BP Statistical Review of World Energy 2020, Emirates NBD Research.

China—and indeed other Asian economies—are highly exposed to the dynamics of Middle East oil exporters and need to absorb the effects of policies meant to diversify regional economies away from relying on crude oil exports. Fixed exchange rates, high socio-economic expenditure and heavy infrastructure spending are all essentially financed by Asian motorists. Long-run efforts at diversification, while showing some success, run up against short-term spending requirements and mean that Middle East exporters rely on changes to production levels to push oil prices high enough to support domestic economies.

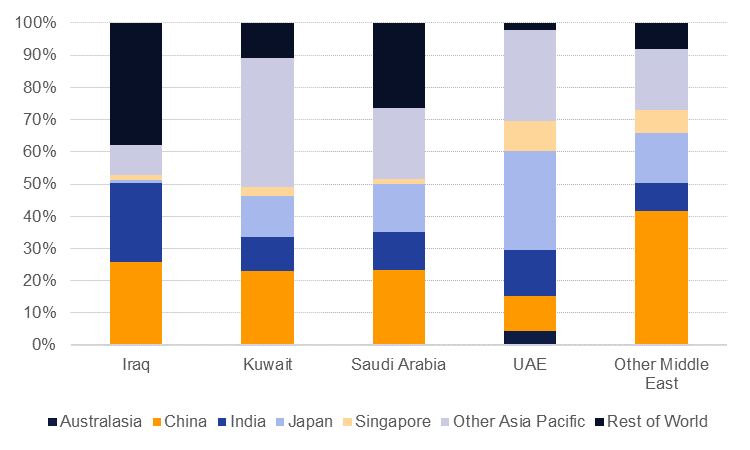

Oil importers historically haven’t had an ability to hedge risks encountered along the Middle East’s bumpy path to diversification but by pooling purchases China’s oil companies may be able to exert pressure on exporters for more favourable terms. China may be reliant on importing crude from the Middle East but the region is just as dependent on China as a baseload consumer of its exports. Iraq is highly exposed to China with more than 25% of its total exports landing there while Saudi Arabia and Kuwait see around 23% of their shipments end up in China.

Source: BP Statistical Review of World Energy 2020, Emirates NBD Research.

Source: BP Statistical Review of World Energy 2020, Emirates NBD Research.

Were the Chinese companies to prove successful in getting better terms in long-term offtake agreements (eg, holding a preferential position to other importers during periods of OPEC+ restraint or winning bigger discounts on large volumes) other Asian importers may be tempted to follow suit and club together on importing. China may be important for Middle East exporters but Asia as a whole is essential. Nearly three-quarters of Saudi Arabia’s total crude exports end up in Asia while in the UAE it’s 98%. Moreover, Asian importers—including China—have been able to benefit from alternative sources of crude that are unimpeded by OPEC+ decisions. Asian importers have been major importers of US crude since restrictions on exports were lifted.