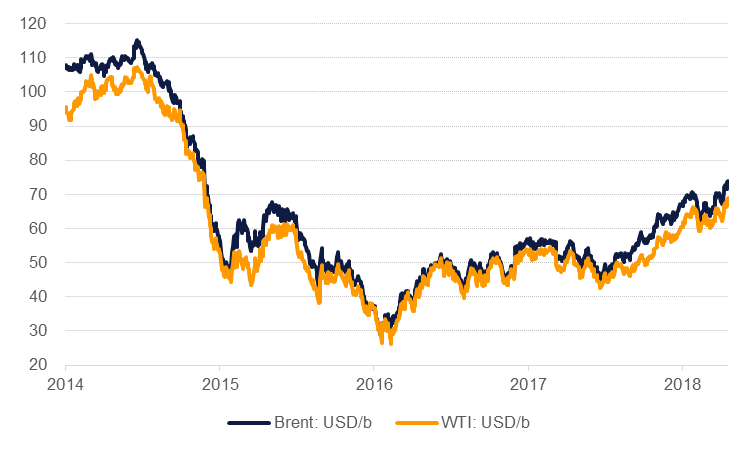

Oil market bears look increasingly endangered in this market. Futures prices are back at 2014 levels and are threatening to push higher thanks to both fundamentals and rumors. Even if there is a slight pullback or correction we don’t expect it would be very deep considering how far markets have pushed higher in recent weeks.

Source: Eikon, Emirates NBD Research

Source: Eikon, Emirates NBD Research

A near uniformly bullish EIA report poured gasoline on an already overheating oil market overnight. Declines in crude, gasoline and distillate stocks along with a bounce in product supplied all helped WTI prices gain nearly USD 2/b overnight and pushing the US benchmark within reach of USD 70/b. Oil production in the US has averaged 1.15m b/d higher than year ago levels so far this year, a relatively slow start considering some of the lofty projections put out by the EIA.