Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

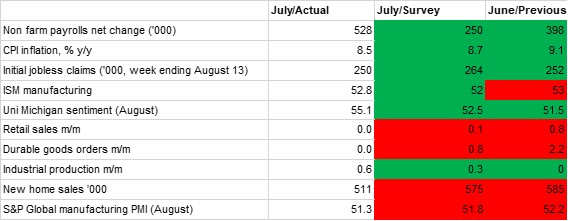

Our macro scorecard for the US shows a little more green than red this month, and even those data points that did not improve on the previous reading were flat rather than showing an outright contraction. Broadly, there is nothing within the recent data that would lead us to expect any significant deviation from the focus on tackling inflation when Jerome Powell makes his address at the annual Jackson Hole symposium on Friday, and we maintain our expectation that the Fed will stick to hiking for now.

With the FOMC’s dual mandate squared on the labour market and inflation, the greater threat is still clearly emanating from price growth as the number of jobs added each month continues to exceed expectations. The net gain in nonfarm payrolls in July was 528,000, smashing expectations of 250,000 and higher than the 398,000 hit in June (upwardly revised from 372,000). That puts the average monthly net gain so far this year at 471,000, and while the aggressive hiking being implemented by the Fed will presumably see this slow in the second half, for the time being the labour market is still firing on all cylinders, with broad-based gains across a range of sectors.

On the other hand, inflation remains high by historic levels, despite having slowed by more than anticipated in July. CPI inflation came in at 8.5% y/y, down from the previous month’s 9.1%, and lower than the consensus projection of 8.7%. Given the lower commodity prices seen over the past couple of months there is a case to be made that inflation in the US has now peaked but is still high nonetheless and the Fed will remain committed to its tightening course for now. Core inflation also came in below expectations, but at 5.9% y/y also remains elevated.

With tightening set to continue apace, the likelihood is that this will start to weigh on some of the other data points to a greater degree, but the pass-through appears to have been comparatively limited in some sectors still to date. Durable goods orders were unchanged m/m on the headline reading, but when stripping out volatile aerospace orders, core orders actually showed a respectable 0.4% expansion, higher than had been predicted given the rise in borrowing costs. The drag of higher rates appears to have been more apparent in the housing sector, where the number of new home sales declined once more, falling from 585,000 in June to 511,000 in July, a six and a half year low. Pending home sales, based on signed contracts, were down -19.9% y/y last month. With construction slowing also, this will have implications for employment and output in the coming months.

Meanwhile, retail sales were flat m/m in July. Lower petrol prices at the forecourt weighed on the measure, and there were encouraging signs in other avenues of spending: online sales in particular held up well, supported by the Amazon Prime Day sales in the middle of the month. The University of Michigan consumer sentiment index rose once more in August as it continued to bounce from the series low hit in June, but it remains severely depressed compared to the average score. As earnings continue to be constrained by higher prices for goods and services, mortgage charges rise, and pandemic savings are eroded, these low sentiment scores will likely start to manifest more clearly in spending data.