The WTO warned that the Covid-19 outbreak would pose a serious risk to global trade volumes for the start of 2020, compounding a drop in volumes last year catalyzed by the US-China trade war. The governing body for global trade estimated that trade volumes fell by 0.2% y/y in Q3 last year and expected that a modest rebound in the final quarter will have largely been unwound as a result of the viral outbreak. Volumes of trade were running flat to negative across much of 2019, weighing on export-reliant economies as well as impeding commodity demand more generally.

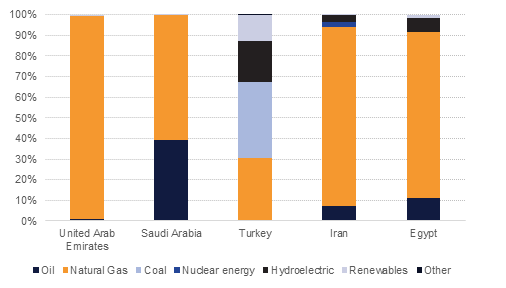

The UAE’s nuclear regulator has issued a license for the Barakah nuclear power plant to begin operation within a few months. This is the first nuclear power facility in the UAE and indeed in any Arab economy. Jointly built with a Korean power sector developer the Barakah facility will have 5.6GW of generation capacity and should meet roughly a quarter of the UAE’s power demand. Currently the UAE has installed capacity of around 27GW, nearly all of which is powered by natural gas. But the power sector is receiving investment across nearly all fuel sources: a new gas plant with 2.4GW of gas-fired capacity to be built in Fuajairah while a 2.4GW coal plant is under construction in Dubai along with extensive investment into renewables and pumped hydro.

Saudi Arabia’s energy minister, Prince Abdulaziz bin Salman, said the country was planning to add natural gas to its mix of hydrocarbon exports along with petrochemicals, refined products and crude oil. Currently Saudi Arabia exports no natural gas and is investing to increase its gas production to meet power generation requirements. The minister gave no indication on a time frame for when Saudi Arabia would indeed start exporting gas.

The Reserve Bank of Australia considered cutting rates at its last meeting according to minutes from the decision. However, the RBA chose to keep rates on hold to prevent futher borrowing in an inflated property cycle. The RBA expects to see an underlying recovery in the economy thanks to mining and property investment and noted that the impact of bushfires and the coronavirus were “difficult” to estimate. The bank expects rates to stay low for “an extended period.”

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Regional bonds closed largely unchanged. The YTW on Bloomberg Barclays GCC Credit and High Yield index closed at 2.94% and credit spreads hovered around 140 bps.

Following the decision of DP World to de-list, Moody’s has placed the rating of the company on review for downgrade. The rating agency said that the proposed minority buyout and dividend payment to Dubai World will increase DP World’s leverage well beyond its guidance for a Baa1 rating. The rating agency said that it expects the rating downgrade could be limited to two notches but will depend on the final take-up of the buyout and the strategy the company intends to implement in order to restore stronger credit metrics.

AUDUSD is trading lower in the aftermath of the release of the RBA minutes from the central bank’s last policy meeting at which the interest rate was kept at a record low of 0.75%. In addition to acknowledging that interest rates were likely to stay low of the foreseeable future, policy makers also shared concerns over the negative impact of the coronavirus, in particular the “material risk on China”. The minutes also showed that policy makers were ready to lower interest rates further if needed. As we go to print, AUDUSD is trading below the 0.67 level at 0.6688 with January’s employment data likely to be the next economic release that determines the direction of the AUD.

It was a sluggish day of trading for developed markets on account of a holiday in the US. European equities closed higher following stimulatory measures by China to boost growth. The Euro Stoxx 600 index added +0.3%.

Regional markets had a positive day of trading. The DFM index added +0.5% on positive follow-through following the announcement by DP World to buy out minority shareholders at a premium to previous closing price. DP World closed limit up.

The Qatar Exchange (-0.4%) was a notable exception as it extended its negative streak to seventh consecutive trading session.

A rally to start the week for Brent appears to have been a false dawn as futures have lost ground in early trade today. A relatively quiet day for markets with the US out on holiday saw Brent close up 0.6% at USD 57.67/b although all those gains have been given back to the market. WTI futures have moved back below USD 52/b.

Click here to Download Full article