Current IMF head, Ms Christine Lagarde is confirmed to become the next President of the European Central Bank after current President Mario Draghi’s term ends later this year. Ms Lagarde is seen as dovish, raising maket hopes that the ECB will loosen monetary policy in the coming months by cutting its deposit rate in September and re-launching QE before year-end.

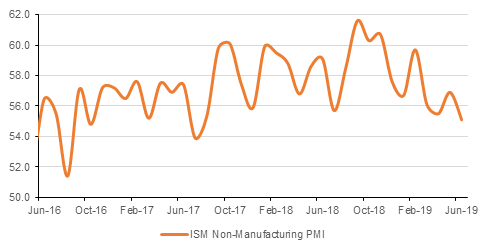

Meanwhile economic data out of the US painted a dismal picture. The ISM non-manufacturing index fell to 55.1 last month from 56.9 earlier, reflecting a sharper decline than expected. This is the lowest level since July 2017, however, still equates to GDP growth in the 2.25% - 2.5% range. All components of the index reflect weakness. Business activity fell, new orders fell and the employment fell. Also, the ADP employment change showed additional 102k jobs in June while trade balance increased to negative USD 56 bn

In the UK, June Services PMI fell to 50.2 vs 51 in the prior month and composite PMI at 49.7 fell into the contraction category from 50.9 last month. That said, Euro area June Services PMI surprised on the upside albeit only marginally, coming in at 53.6 vs expectations of 53.4. Euro area June Composite PMI at 52.2 also came in stronger than last month’s 52.1. At the country specific level composite PMI in Italy and Germany came in better than last months’ while that in France fell to 52.7 from 52.9 last month.

Turkish CPI inflation fell to 15.7% y/y in June, the slowest pace since July last year, when the country’s financial meltdown and lira sell-off began in earnest. This was the third consecutive month that inflation slowed, and came in under expectations of 16.1%, paving the way for a rate cut later this month at the TCMB’s July 25 meeting. The benchmark one-week repo rate has been static at 24.00% since September, but the marked slowdown in inflation and a strengthening lira give the central bank considerable leeway to act.

Pakistan received a loan of USD 6 billion from the IMF of which USD 1 billion can be released immediately to help the country manage its balance of payment crisis. This will be the 22nd such aid that Pakistan will receive from the IMF since becoming its member in 1950.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Government bonds extended gains globally ahead of the U.S. holiday as investors weighed the prospect of more dovish appointees to two of the world’s major central banks. Yields on 2yr, 5yr, 10yr and 30yrs USTs closed lower at 1.76% (unch), 1.73% (-1bp), 1.95% (-2bps) and 2.47% (-3bps) respectively. Across the pond, yield on 10 yr Gilts dipped another 3bps to 0.69%, and those on 10yr Bunds declined 2bps to -0.39%, the lowest on record. Nevertheless credit protection costs remained range bound with CDS spread on US IG and Euro Main closing at 52bps (-0.5bp) and 49bps (-1bp) respectively.

Falling US treasury yields helped lower the average yield on Bloomberg Barclays GCC bond index by 6bps to 3.49% even though credit spreads only declined by a bp to 163bps.

In the primary market, Bank of Bahrain and Kuwait issued USD 500 million in 5yr bonds at 5.5% i.e at MS+375bps.

GBP was Wednesday’s softest performing major currency slipping to near six month lows after Bank of England Governor Mark Carney warned on the risks of Brexit and protectionism and the potential of trade tensions to shipwreck the global economy. Over the course of the day, GBPUSD declined by 0.15% to close at 1.2574. Currently trading at 1.2582, there is a risk of further declines towards the 1.25 level before the end of the week.

Global stocks made decent gains with several indices reaching record highs. Dow Jones and S&P closed up by 0.67% and 0.77% respectively amid holiday shortened day. U.S. stock investors piled into high dividend-yielding sectors like utilities and REITs after 10-year Treasury yields dipped to the lowest since November 2016. Euro Stoxx and FTSE 100 were also in the green, rising 0.9% and 0.66% respectively. Enthusiasm in Asia remained intact with Nikkei and Hang Seng trailing up by 0.29% and 0.10% in early morning trades.

Regional equities were mixed with Dubai index falling 0.48% led by 1.13% fall in Emaar shares. However, Abu Dhabi main index gained 0.21% while Tadawul closed largely flat.

Oil markets are struggling this morning as inventory data from the US was less bullish than expected. Brent futures are down 0.7% at USD 63.37/b while WTI is off by 0.59%. US inventories fell by 1m bbl last week while there were builds in distillates and mixed performance across the rest of the barrel. US production remains above 12m b/d while exports are still holding close to 3m b/d.

Time spreads across WTI, Brent and Dubai have all given a shrug to OPEC+ extending their production cuts. In Brent, 1-2 month spreads are at their lowest since March this year while the Dubai curve has continued to weaken toward contango.