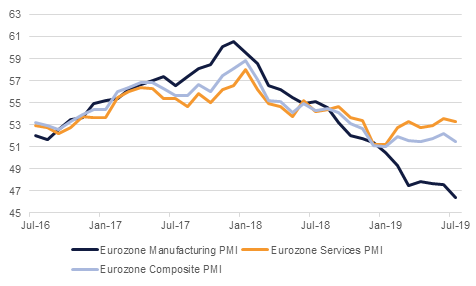

Eurozone PMI data released yesterday highlighted the dire state of manufacturing in the region, and reflected a broadening malaise which is also beginning to take in the services sector. The preliminary July manufacturing PMI fell back to just 46.4 in July from 47.6 in June indicating a deepening recession in a sector that has been hurt by the global trade wars and ongoing Brexit uncertainty. The services PMI still suggests expansion, but it also fell back to 53.3 from 53.6, leaving the composite at a three months low of 51.5. The manufacturing PMI is now at a 79 month low, and the manufacturing output reading is at a 75 month low. With Eurozone M3 money supply also slowing to 4.5% y/y in June, from 4.8% in the previous month, the data will add to pressure on Draghi to act decisively with the market increasingly seeing the possibility of a 10bp ECB rate cut at today’s meeting, not just a shift to dovish guidance. It is this prospect that is weighing on the Euro, as a crucial week for monetary policy begins.

The changes in the UK government made by new Prime Minister Johnson yesterday mark a decisive shift towards the pro-Brexit wing of the Conservative Party signalling the seriousness with which he is going to seek to negotiate with the EU for a new Brexit deal. Johnson highlighted the importance of maintaining the possibility of leaving the EU without a deal when he spoke on becoming Prime Minister, and with few if any government departments being run by ‘Remain’ supporters anymore the markets can expect a more combative approach by the new government in its dealing with the EU and probably a greater amount of volatility as a result.

U.S. June new home sales rose 7.0% to 646k, a little better than expected, but there were downward revisions to the prior two months, with May falling 8.2% to 604k and -5.1% to 658k in April. The preliminary U.S. manufacturing PMI fell however to just 50.0 in July from 50.6 in June, although the service sector PMI improved to 52.2 from 51.5 allowing the overall composite index to improve marginally to 51.6 from 51.5. Meanwhile in Washington the Mueller testimony was something of an anti-climax after expectations had been raised that it might give the opposition Democrats new evidence with which to indict President Trump.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries rallied as weak manufacturing data from the US further strengthened the case for rate cuts by the Federal Reserve. The curve bull flattened with yields on the 2y UST, 5y UST and 10y UST closing at 1.81% (-2 bps), 1.80% (-3 bps) and 2.04% (-4 bps) respectively.

Regional bonds gained as they tracked moves in benchmark indices. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -3 bps to 3.40% and credit spreads tightened 2 bps to 146 bps.

According to reports from Bloomberg, India is considering to raise as much as USD 10bn in its maiden foreign currency bond. The issue could be in EUR, JPY and USD or a combination of all three.

EURUSD fell back to reach 1.1127 yesterday from 1.1155 earlier, while USDJPY moved to 108.28 highs from 107.94 and cable managed to to recover on short covering, to reach 1.2525 before falling back to 1.2474 currrently. The focus remains on the ECB today with the chances of a small rate cut appearing to increase following poor Eurozone PMI data in July. The pound’s rally following Boris Johnson’s arrival at Number 10 Downing Street was shorrtlived, especially with his cabinet appointments hinting at a more assertive approach to EU negotiations and maintained the possibility of a no-deal Brexit.

Developed market equities closed h even as earnings remained mixed. The optimism over renewed trade talks between the US and China helped sentiment. The S&P 500 index and the Euro Stoxx 600 index added +0.5% and +0.1% respectively.

UAE bourses continue to outperform their regional peers. The DFM index added +0.8% on the back of sustained strength in Emaar-related names. Emaar Properties and Emaar Malls added +1.2% and +3.4% respectively.

Oil prices fell overnight as a large draw in US crude stocks was matched by only limited declines in product inventories. Brent futures fell 1% and WTI was off nearly 1.6% to close at USD 63.18/b and USD 55.88/b respectively.

The EIA reported a drop of 10.8m bbl in crude inventories last week but just 226k bbl decline in gasoline and builds across much of the rest of the barrel. A drop in refinery utilization also helped to raise concerns over the strength of demand in the US.

India’s crude imports in June fell to their lowest level since February 2017, underlying a weaker trend of demand in the country. Monsoon rains have been lower than average this year but still enough to deter the need for extra diesel which is used to fire generators for irrigation.

Time spreads at the front of the Brent curve dipped into contango for the first time since March. While the spread only narrowly moved into a discount against second month contracts it reflects a worsening fundamental picture for crude, even as geopolitical risk in the Middle East remains elevated.

Click here to Download Full article