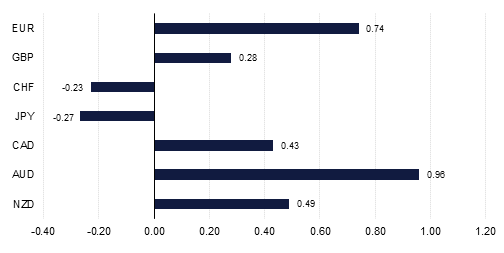

Risk appetite continued to recover last week, but this time G10 currencies performed better at the expense of the USD as confidence that a global recession could be avoided grew. The JPY and the CHF were the exceptions to this but this was also consistent with reduced demand for safe havens. US 10-year bond yields rose by 6bps to 2.56% while equity markets also fared well at the end of the week as corporate profits improved. Despite the IMF downgrading its growth outlook to 3.3% from 3.5% in January, more contemporaneous economic data appeared to signal that concerns over the world economy might have been overdone.

Once again Chinese economic data provided a welcome surprise with exports rising by 14.2% y/y in March, even as imports were weaker falling by 7.6% y/y. Much of this improvement was probably still a degree of catch-up from very weak January data, but nonetheless it helped the mood which is already lifting as a result of optimism over the trade talks. Other data that was constructive included US initial jobless claims which fell to a fresh 49-year low, and higher than expected US inflation numbers.

While trade negotiations with China remain uncertain, trade tensions are however surfacing between the U.S. and the EU mainly because of subsidies to their respective aviation companies. President Donald Trump said that the US would impose tariffs on $11 billion worth of goods from the EU, mainly on farm products and autos, in response to EU’s aid to Airbus. On the other hand, the EU is considering its own retaliatory tariffs against the U.S. over subsidies to Boeing Co.

The extension of the Brexit process, with a new October-31 deadline, should take it away from the headlines, with the UK having, for now, avoided a disorderly no-deal exit from the EU. The main focus will now be on efforts by the government and the opposition Labour Party to find a compromise around the existing Withdrawal Agreement, which will probably revolve around the UK remaining in the EU customs union in the post-Brexit world, with GBP likely to remain underpinned while this negotiation plays out. The UK will still be obliged to participate in EU elections in May unless a deal is agreed and approved by parliament quickly, but much of what PM May might be forced to accept to get a deal could cause her to lose her job and may in the long term see the Conservative Party lose power.

Trading will be light this week with the U.S., Canada, the UK, several European and Asian markets closed for holidays at the end of it, and with much of Europe remaining closed the following Monday. The U.S. economic agenda includes retail sales, production, and trade, along with a slew of corporate earnings figures. China has Q1 GDP, March industrial production, retail sales, and fixed investment, while Japan releases March trade and national CPI figures. Europe will look to confidence reports now that Brexit and the ECB are momentarily out of the spotlight.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg