.jpg?h=457&w=800&la=en&hash=79CD707F49D29F203AA3290B255C44BC)

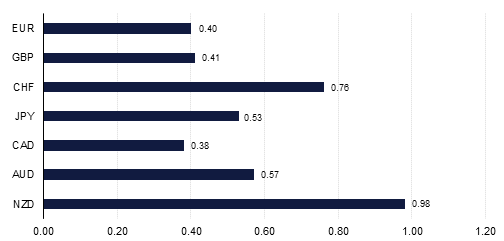

With Fed Chair Jerome Powell validating July rate cut expectations last week the USD sold off. Powell cited concerns over trade tensions, poor business sentiment and sluggish inflation and wage growth, which he saw as overriding the positive jobs data in June. Last week saw US CPI rise 0.1% m/m in June, while the core rose 0.3% m/m, more than expected. On a y/y basis, headline prices slowed to a 1.6% y/y pace versus 1.8% y/y, and excluding food and energy, it increased to 2.1% y/y versus 2.0% y/y before. PPI also saw a 0.3% m/m rise in the core rate, which might also have implications for headline inflation down the road. We had thought it more likely that the Fed would wait through the summer before easing monetary policy, but with its mind seemingly made up the risk is that it begins to be seen as more of a political decision, after vocal pressure exerted by the White House. Powell reaffirmed the independence of the Fed in his latest testimony and stated that he would serve to the end of his four-year term, but it is almost certain that in deciding to cut interest rates later this month Powell will face even greater pressure from President Trump to be more aggressive in cutting rates in the future, especially heading into an election year in 2020. Indeed, the markets are again seeing a decent 20% chance of a 50bps cut at the July meeting, with two rate cuts now fully discounted between now and the end of the year.

This should in turn add to downside pressure on the USD over time, especially with President Trump increasingly arguing for a weaker USD. Much will depend on how the rest of the world responds. There is already considerable speculation about the ECB easing policy at its next July 25 meeting, while the BoE has also turned less hawkish in the context of rising Brexit uncertainty.

There are a number of U.S. economic reports and Fed officials speaking in the coming week, but it is unlikely if any of these will alter the outlook for the July FOMC meeting. Chinese Q2 GDP, industrial production and retail sales data will be monitored for signs that trade tensions are weighing on global growth, with Singapore GDP last week contracting by 3.4% q/q in Q2. The Bank of Korea and Bank Indonesia could both cut interest rates in the coming days, while in the Eurozone it will be a quiet week as holidays take hold. The last full week before the new UK Prime Minister is known will also keep GBP sentiment guarded, but with all the signs pointing to a Boris Johnson victory, maintaining concerns about the possibility of a ‘no deal’ Brexit.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg