Comments about trade from various Eurozone and US officials, including President Trump, made the headlines towards the end of last week and reinforced the negative performance of the USD. Trade was high on the agenda at the World Economic Forum in Davos and as NAFTA negotiations resumed last week, with President Trump announcing new import tariffs on certain products largely from Asia. US Treasury Secretary Mnuchin talked about the benefits of a weak dollar, while Commerce Secretary Ross referred to ‘US troops coming to the ramparts’ in relation to trade disputes. The ECB’s Draghi responded at his press conference by criticizing Mnuchin’s comments about the dollar, and attacking the US for flouting the rules against promoting currency wars. In turn Donald Trump replied by claiming he was in favour of a strong dollar ‘ultimately’, but he also talked of countries exploiting free trade at the expense of others.

The bottom line is that trade and protectionism are very much centre stage at the moment, especially as the markets await the Trump administration’s decision regarding NAFTA. Donald Trump will make his first State of the Union Address on Tuesday and it is possible that he make further comments about this issue then. He was also probably talk about his infrastructure spending plans and possibly also immigration, with another government shutdown looming on February 8th unless progress is not made on this issue.

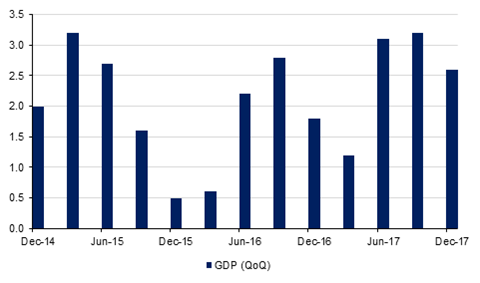

The week will also see the important US jobs data for January, which are expected to show an increase in non-farm payrolls of 180k. Last week saw the first estimate of Q4 GDP in the US and the UK with the former rising by 2.6% on an annualised basis, which was slightly softer than anticipated. In the UK meanwhile growth expanded by a better than expected 0.5% q/q. The Eurozone will release its GDP data in the coming week which are expected to show another healthy expansion of 0.6% q/q. The last FOMC meeting with Janet Yellen at the helm will also take place in the middle of the week, but there are no expectations that the Fed will tighten monetary policy so quickly after the last rate hike.

Shorter dated government bonds sold off during the week as economic data remained strong and tone of major central banks turned less dovish. Though no rate hike is expected at the US FOMC meeting this week, yields on 2yr UST climbed 6bps to 2.12%. 2yr Gilts and Bunds yields also closed up to 0.62% (+6bps) and -0.56% (+5bps) respectively. UST curve gave up its steepening bias of the previous week as demand for 10yr USTs remained strong amid absence of higher inflation. Yields on 10yr and 30yr USTs closed at 2.66% (+1bp) and 2.91% (unchanged) respectively.

Economic growth in the world is in uptrend, positive outlooks on ratings are outweighing the negatives and default rates are falling. Oil prices have now spent more than a quarter at the above $60/b mark. In this environment, risk appetite for credit bonds remain high. CDS levels continued their grind tighter and are now 4bps lower over the month to 45bps for US IG and 2bps to 43bps for the Euro Main. Though cash corporate bonds suffer when benchmark yields rise, actual price of the global aggregate credit index rose over a point and half during the week as a result of tightening credit spreads.

Regionally GCC bonds were stable with yield on Barclays GCC index range-bound at 3.87% and credit spreads tightening a bp to 145bps. CDS levels on the six GCC sovereigns tightened two to 6bps with 5yr CCS levels on Abu Dhabi, Saudi Arabia, and Qatar closing the week at 51bps (-2bps), 78bps (-6bps) and 91bps(-3bps) respectively as oil prices maintained strength.

The Dollar Index fell for a sixth consecutive week, losing 1.7% to close at 89.07. The index maintained its daily downtrend, remaining below the supporting baseline and reaching a new three year low of 88.44. Should the 38.2% five year Fibonacci retracement (88.44) break in the coming week, we could see a larger decline towards 85.

USDJPY declined by nearly 2%, closing the week lower at 108.60. This move was accompanied by a break of the psychological 110 area, as well as a break of the 100 week moving average (109.95). Over the course of this week, we expect a test of 108. A break of this level would breach the supporting baseline from September 2012, and lead further losses towards 105.

Regional equities closed lower at the start of the week with the DFM index and the Qatar Exchange losing -0.1% and -0.5% respectively. The focus continued to remain on earnings and reports of settlement in the corruption probe in Saudi Arabia. Kingdom Holding Co. rallied +10.0% after reports that the company’s chairman Prince Alwaleed bin Talal has been released.

After the market closed, ADCB reported Q4 2017 net income of AED 1.07bn, missing analysts’ estimates of AED 1.09bn by 1.8%. The bank did improve the dividend payout to AED 0.42 per share for 2017.

Oil prices rallied to close at their highest level since 2014. Brent oil prices gained +2.8% 5d to close at USD 70.52/bbl while WTI prices gained +4.4% 5d to close at USD 66.14/bbl. While tightening in supply has played a role, oil prices also received an extra boost from weakening USD. The DXY index closed below the 90.0 level at the end of last week.