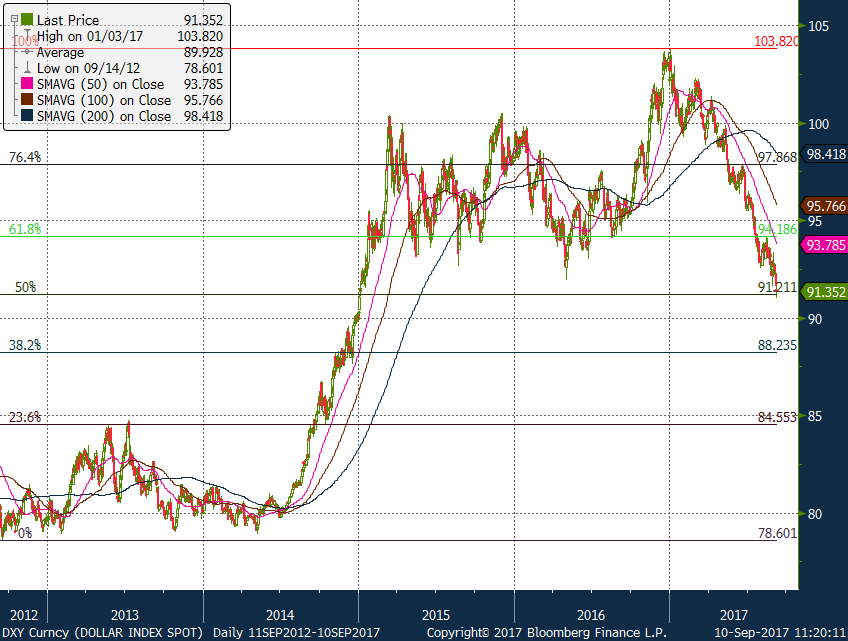

After gaining during the early part of the week on the back of Fed Chair Yellen’s hawkish testimony to Congress, the dollar struggled to sustain its rally instead falling back even in spite of strong US economic data. Its mixed performance once again highlights the divergence between what is going on in the real economy and the threat posed by the intrusion of the political world, which is increasingly affecting the sense of certainty about the economic outlook. Markets are simultaneously trying to reconcile an increasingly constructive economic picture with an apparently dysfunctional political one, whereby political developments and events can at any given time potentially override economic ones.

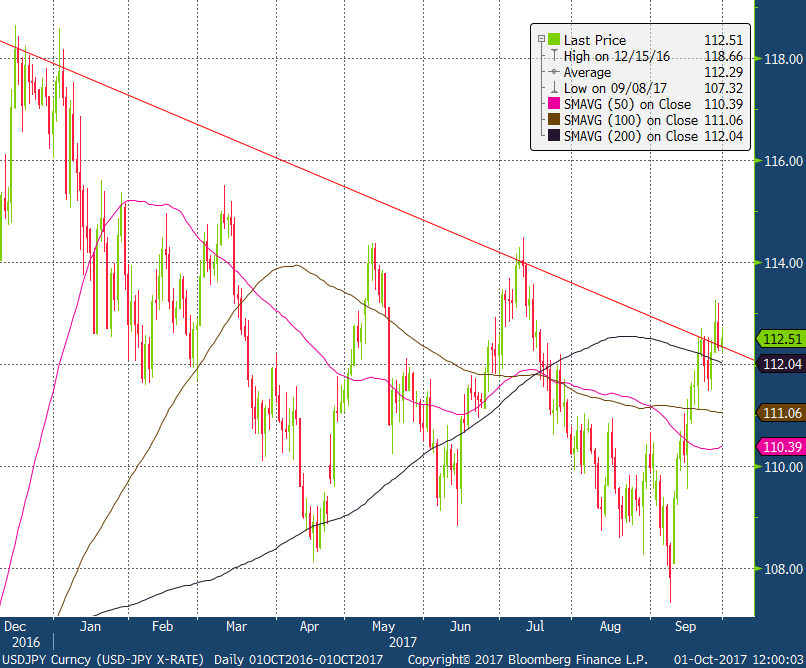

This situation is not only true of the U.S. but of other major countries and regions as well. The UK’s experience with Brexit is a case in point, whereby markets are by and large waiting for the UK economy to stumble this year or next on account of the UK pulling out of the EU. The Eurozone also faces similar challenges, with recently improved economic performance at risk of being undermined by the oncoming elections in its major member states. The net impact has been for relatively short lived FX moves in the G10 space so far this year, with the exception of the JPY which has shown the most consistency in variously pricing risk in and out.

.jpg) Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

A significant takeaway of the week is how little firmer U.S. economic data (including February Fed surveys, January CPI and retail sales) combined with more hawkish rhetoric from the Fed, is capable of benefiting the dollar right now. Yellen said that further policy adjustment will likely be needed if the economy remains on track, and added it would be ‘unwise’ to wait too long before tightening. The markets now see an increase in the chance of a Fed rate hike in March at 34%, and yet the USD is mostly lower over the week as a whole.

This is because concerns about Trump’s economic policy have returned, just as the political environment in Washington DC appeared to deteriorate in the wake of the sacking of National Security Adviser General Mike Flynn. The week ended with the USD steadying a little, but its moves are hardly convincing, with JPY strength illustrating that bigger concerns remain.

Markets certainly want to see more detail about the upcoming fiscal stimulus package that has been promised in coming weeks, as the contents of this will help determine what the Fed does next month and how strong the economy will be in the second half of the year. At the moment the current and projected strength of inflation and of growth look likely to justify at least two interest rate hikes this year, with the third of the Fed’s dot plot looking likely to depend on how the economy evolves based on the expected stimulus. The markets have begun to price in a third rate hike by the end of the year, but it could quickly vanish if the Trump stimulus fails to get delivered on time.

This week will see the minutes of the February FOMC but it is unlikely that these will add much colour beyond what Yellen already said last week, especially as the recent stronger economic data was not known then.

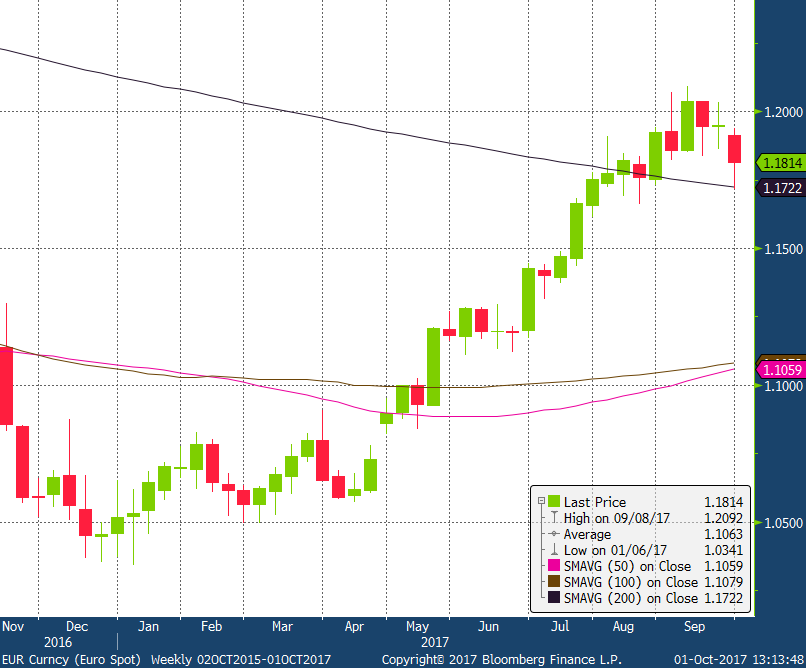

The EUR is noticeably struggling to benefit from the dollar’s latest lapse as it has issues of its own to contend with. French bond yields are pushing higher as investors are starting to fear a Presidential victory for the far right’s Marine La Pen. Elsewhere attempts to resolve Greece‘s debt problems are continuing with a Eurogroup meeting due to discuss it on Monday. Any fall back in the flash Eurozone PMI data could also harm the EUR, with IFO and consumer confidence both predicted to fall. At the very least it will probably struggle to make headway against the USD even if the US currency remains fragile.

GBP was caught out last week by a surprising fall in January UK retail sales,-0.3%, following on from a revised -2.1% drop in December. This brought the pound off from highs of the day around 1.2500, and earlier in the week it stumbled from 1.2550 as inflation data was slightly softer than expected at 1.8%. The second estimate of Q4 GDP is due out this week and may be revised slightly higher, which could go some way to stabilizing GBP. However, the focus is now more on the current year and the CBI survey data for February will be a truer test for UK the pound.

As mentioned earlier JPY strength was a theme last week, and has been one of the most consistent themes of the year rallying 3.65% versus the USD in an environment of steadily building uncertainty. US yields fell back over the course of the week as equity markets held their ground. The Japanese trade balance data and PMI readings are the main economic releases in the coming week, with the January unadjusted trade balance expected to move into a deficit from a surplus of JPY641.4bn in December. Of interest with the provisional manufacturing PMI data will be whether sentiment is starting to be affected by the stronger JPY after the consistent series gains since last summer, and the JPY’s consistent strength since the start of the year.

USDCHF finished the week almost unchanged, having appreciated 0.02% to 1.0026. However, a study of the daily candle charts shows that over the course of the week, an attempt to break above the 50 day MA of 1.0104 was strongly repelled on the 15th of February followed by a close below the 100 day MA of 1.0026 the next day, before the pair recovered its losses. More interestingly, a study of the two hour candle charts shows that the pair has been in an uptrend, supported by a rising baseline since the start of February and we expect this to continue with scope for further gains in the week ahead. We expect a break and daily close above the 50 day MA of 1.0104 to be followed in quick succession by a successful beak of 1.0132, the one year 76.4% Fibonacci retracement. Such a development would pave the way for further gains towards our Q1 2017 forecast of 1.03.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

NZDUSD ended the week on slightly softer footing after depreciating 0.1% to close at 0.7182. While the overall scope of the move does not appear significant, the pair’s movement during the week reveals a degree of technical vulnerability. Despite bouncing on the 61.8% one year Fibonacci retracement of 0.7135, the pair was unable to advance beyond any technically significant levels or break out of the downtrend that is clearly visible on the two hour candle chart (see chart). This leads us to believe that further losses can be expected in the week ahead, with the potential for a larger decline, should certain conditions be met.

The 0.7110-0.7135 zone is an area of vital support for the pair. This zone includes the 61.8% one year Fibonacci level (0.7135), 50 day MA (0.7110), 100 day MA (0.7130) and 200 day MA (0.7129). In addition, the zone contains the two year 61.8% retracement (0.7127) and the supporting base line from the original daily uptrend since 26th December 2016 (see below). A break of these levels risks a rout in NZDUSD price, which could lead to a retest of the December lows of 0.6862.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

| FX Forecasts - Major | Forwards | |||||||

|

| 17-Feb | Q1 2017 | Q2 2017 | Q3 2017 | Q4 2017 | 3m | 6m | 12m |

| EUR | 1.0616 | 1.0500 | 1.0200 | 1.0000 | 1.0000 | 1.0659 | 1.0710 | 1.0830 |

| JPY | 112.84 | 116.00 | 120.00 | 122.00 | 124.00 | 112.41 | 111.91 | 110.69 |

| CHF | 1.0026 | 1.0300 | 1.0500 | 1.1000 | 1.1000 | 0.9973 | 0.9913 | 0.9775 |

| GBP | 1.2412 | 1.2200 | 1.1800 | 1.2500 | 1.3500 | 1.2438 | 1.2470 | 1.2546 |

| AUD | 0.7664 | 0.7300 | 0.7200 | 0.7000 | 0.7000 | 0.7648 | 0.7635 | 0.7614 |

| CAD | 1.3096 | 1.3500 | 1.3400 | 1.3200 | 1.3000 | 1.3086 | 1.3072 | 1.3033 |

| EURGBP | 0.8561 | 0.8607 | 0.8644 | 0.8000 | 0.7407 | 0.8578 | 0.8597 | 0.8640 |

| EURJPY | 119.81 | 121.80 | 118.32 | 120.00 | 122.00 | 119.81 | 119.81 | 119.81 |

| EURCHF | 1.0644 | 1.0815 | 1.0710 | 1.1000 | 1.1000 | 1.0631 | 1.0617 | 1.0587 |

| NZDUSD | 0.7182 | 0.6900 | 0.6700 | 0.6500 | 0.6500 | 0.7162 | 0.7145 | 0.7114 |

| FX Forecasts - Emerging | Forwards | |||||||

|

| 17-Feb | Q1 2017 | Q2 2017 | Q3 2017 | Q4 2017 | 3m | 6m | 12m |

| SAR | 3.7503 | 3.7500 | 3.7500 | 3.7500 | 3.7500 | 3.7510 | 3.7537 | 3.7640 |

| AED | 3.6729 | 3.6700 | 3.6700 | 3.6700 | 3.6700 | 3.6751 | 3.6774 | -- |

| KWD | 0.3053 | 0.2900 | 0.2900 | 0.2900 | 0.3000 | 0.3052 | 0.3065 | --- |

| OMR | 0.3850 | 0.3800 | 0.3800 | 0.3800 | 0.3800 | 0.3862 | 0.3880 | 0.3933 |

| BHD | 0.3770 | 0.3760 | 0.3760 | 0.3760 | 0.3760 | 0.3774 | 0.3776 | 0.3785 |

| QAR | 3.6414 | 3.6400 | 3.6400 | 3.6400 | 3.6400 | 3.6455 | 3.6495 | 3.6605 |

| EPN | 16.1493 | 18.0000 | 18.5000 | 18.7500 | 19.0000 | 17.1200 | 17.5925 | 18.4000 |

| INR | 67.020 | 68.000 | 66.000 | 65.000 | 65.000 | 67.7200 | 68.5100 | 70.1100 |

| CNY | 6.8665 | 7.0000 | 7.1000 | 7.2000 | 7.4000 | 6.9340 | 6.9918 | 7.1040 |

*Denotes USD peg