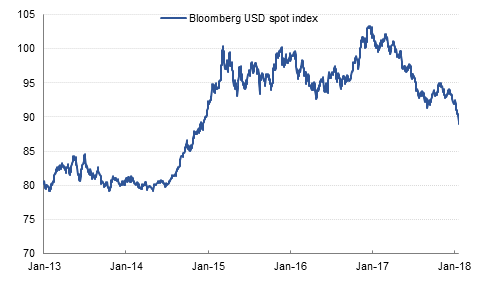

The USD index reached its lowest level in three years after Treasury Secretary Steve Mnuchin signalled that a weaker USD would be good for the US economy, and concerns about US protectionism increased this week. President Trump is expected to reinforce this view when he speaks at the World Economic Forum in Davos tomorrow. The Bloomberg dollar index is down more than -13.5% since the start of 2017, and -3.5% this month alone.

The renewed weakness increases uncertainty about the stance the ECB will take at today’s meeting. The minutes of the last meeting suggested that the ECB would provide more forward guidance about monetary policy, and most analysts were expecting the ECB to signal a slightly tighter stance today. However, given the recent strength in the euro, the ECB’s options today may be more limited.

Economic data released yesterday was largely positive however. The Eurozone composite PMI rose to 58.6 in January, higher than forecast and up from December’s reading, signalling strong growth in the bloc at the start of this year. UK employment surged +102k in the 3 months to November, compared with forecasts for a decline of -12k, and average wages rose 2.5% y/y. The composite PMI in the US slipped slightly in January to 53.8 and existing home sales in December were slightly weaker than expected.

Finally, Saudi Arabia’s finance minister said in an interview in Davos that the planned IPO of Saudi Aramco would take place “when the time is right” although he still hoped it would happen this year. He also indicated that higher oil prices would help to finance this year’s planned expenditure but that it would not change the government’s medium term spending plans.

Source: Emirates NBD Research

Source: Emirates NBD Research

US Treasuries closed lower as they look lead from equities and FX in late session trade. The belly of the curve marginally outperformed with 5s30 steepening by 1.5 bps. Yield on the 2y USTs, 5y USTs and 10y USTs closed at 2.07%, 2.43% and 2.64% respectively.

Regional bonds continue to take lead from move in benchmark yields with the YTW on the Bloomberg Barclays GCC Credit and High Yield index rising to 3.87% and credit spreads remaining flat at 147 bps.

Regional banks are looking diversify to their funding sources. Qatar National Bank raised AUD 700mn from Kangaroo bond sale while Emirates NBD raised USD 285mn from Formosa bond sale.

The outlook for primary issuances continues to remain strong. Dubai Islamic Bank mandated banks for a fixed-rate senior Sukuk offering.

The dollar declined against all the other major currencies yesterday following comments from Treasury Secretary Steve Mnuchin (see macro). Over the course of the day, the Dollar Index fell 1.02% to close at 89.206, a three year low. As we go to print, USD softness continues and the index has fallen a further 0.27% to reach 88.975. As mentioned in our monthly insights (page 15), we expect the next level of support to come in at 88.423, the 38.2% five year Fibonacci retracement.

NZD has also been sold off following easing inflationary pressures. A report from Statistics New Zealand showed inflation slowing to 0.1% q/q in Q4 2017, down from 0.5% the previous quarter and missing market expectations for a 0.4% gain. The latest data re-affirms that the RBNZ is still a way from its price target and hence the normalization of monetary policy.

Developed market equities closed lower amid mixed corporate earnings and rising concern over trade wars. The S&P 500 index and the Euro Stoxx 600 index lost -0.1% and -0.5% respectively.

Regional markets closed mixed with the DFM index losing -0.4% and the Qatar Exchange adding +1.1%. Much of the gains in Qatar were driven by announcement of strong dividend payouts from Doha Bank (+4.2%) and Medicare Group (+4.5%).

Oil prices rallied to new highs after US crude stockpiles declined for a consecutive 10th week. Oil prices also received a boost from a sharp drop in the USD. Brent prices closed at USD 70.53/bbl (+0.8%) and WTI at USD 65.61/bbl (+1.8%).