Yields, data and geopolitics support the USD…

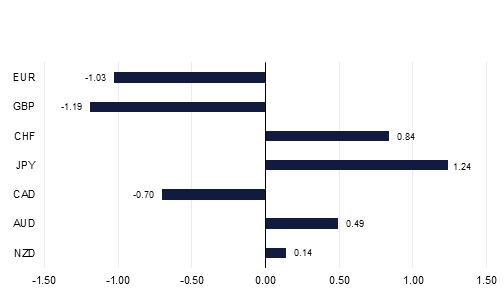

May has seen the dollar add to April’s gains, as sentiment continued to improve amid brighter fundamental support. Investors continued to be bullish on the dollar as 10 year yields climbed above 3% for the first time since January 2014 and sustained these gains even as yields fell back again. A tempering of geopolitical risks over the month helped the dollar’s momentum with concerns over a looming trade war with China also abating. However, with global events, over trade tariffs and geopolitical issues again starting to cast a shadow, following mixed messages from Trump over North Korea and amidst threats of tariffs on cars, a resumption of volatility may be on its way. Emerging markets have been particularly badly hit by the dollar’s strength, with EM debt having quadrupled over the last decade and with much of this dollar denominated.

Over the last five trading days, the Dollar Index has risen 0.66% to reach 94.25. Over the last month, there have been many key technical developments. The index broke above the former resistive 100 day moving average (90.613), for the first time since December 2017 and with this key level providing support, continued to compound additional gains and break above the 200 day moving average (91.947). The same move has resulted in a break of the former daily downtrend that had been in effect since January 2017. Analysis of the weekly candle chart also shows that further gains may lie ahead for the dollar in the short term. On May 18th, the Index closed above the resistive 50 week moving average (92.498) for the first time since May 2017 and has now closed above this level for two weeks. In addition, the weekly close on the 25th of May is above the 61.8% one year Fibonacci retracement (94.197). An additional weekly close above this level will be bullish for U

The main economic data in the week ahead is likely to be dollar bullish, with U.S. non-farm payrolls expected to rise by 195k in April. Q1 GDP growth carries the risk of a small upward revision while survey data (consumer confidence and ISM readings) is likely to be broadly encouraging as well. The market took the minutes of the April FOMC meeting to be a little dovish, but we still see them as consistent with another rate hike next month.

Click here to Download Full article