The second half of the year begins today with greater optimism now that U.S.-China trade talks are ‘back on track’, following the bilateral meeting between Presidents Trump and Xi at the G20 meeting in Osaka. This should be a welcome relief for financial markets which have oscillated since talks were suspended in May. Presidents Trump and Xi have resumed negotiations with Trump announcing that he will impose no new duties on China for the “time being”. In addition, the U.S. President announced that he would allow Huawei to buy some products from the U.S., while in return, China has agreed to buy more agricultural produce from the U.S. However, it remains uncertain how long such relief will last for, and whether the onset of talks in themselves makes a trade deal in the end more likely.

With the trade tensions no longer dominating the headlines, fundamentals can come back into focus and a number of key economic releases are expected this week including U.S. inflation, PMIs, and most important of all employment. A recovery in non-farm payrolls in June is expected after the weak 75k reading in May which might cast further doubt on the inevitability of a July Fed rate cut.

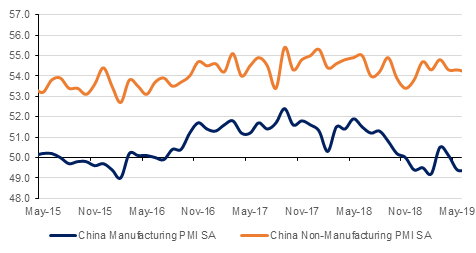

Chinese official PMI data released on Sunday highlight why China might need a deal more than the U.S. The manufacturing PMI stayed at 49.4, in June slightly below the consensus forecast of 49.5 and below the 50-threshold between expansion and contraction. New export orders slipped deeper into contractionary territory and production also slowed. Meanwhile Japan’s Tankan survey showed its large manufacturing index slip to 7 in Q2 from 12 in Q1, whilst the non-manufacturing index improved to 23 from 21.

Saudi Arabia's economy grew 1.66% in the first quarter of this year, government data showed on Sunday, down from 3.6% in the previous quarter. Oil sector growth stood at 1% down from 6% in Q4 reflecting OPEC related cuts in oil production, while non-oil GDP growth stood at 2.1%. After contracting in 2017, the Saudi economy grew 2.2 percent last year, but is likely to grow more modestly this year, with our own forecast being for growth of 2.0% in 2019.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries ended the week higher helped by month-end and quarter-end flows and probable progress on the trade front between US and China. The curve flattened as yields on the 2y UST, 5y UST and 10y UST ended the week at 1.75% (-1 bp w-o-w), 1.76% (-3 bps w-o-w) and 2.00% (-5 bps w-o-w).

Regional bonds continued their positive run following move in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -4 bps w-o-w to 3.59% while credit spreads remained flat at 169 bps.

Dubai Aerospace Enterprise got a USD 440mn credit facility to support its financing needs. A group of 12 lenders participated in the facility which was oversubscribed. Elsewhere, DP World is in advanced discussions to acquire Topaz Energy & Marine.

In terms of new issuance, FAB raised USD 900mn from floating rate notes.

Over the last week, EURUSD was mostly range bound between 1.1350 and 1.1415, with the five day gain of 0.03% seeing the cross close at 1.1373. This means that for a second week, the price closed above the 200-day moving average (1.1342) and the 200-week moving average (1.1348). Earlier in the week, the price had breached the 50-week moving average (1.1390), the first time this has happened in over one year, but the cross was unable to hold onto these gains. A break and close above this level is likely to result in further gains towards the 50% one-year Fibonacci retracement in the medium term.

USDJPY rose 0.51% last week to close at 107.85 and cancel out almost 50% of the decline realized the previous week. Although the cross found daily support at the 107.15 level (23.6% one-year Fibonacci retracement), the price remains below the resistive 38.2% one-year Fibonacci retracement (108.57). While it stays below this level which has provided resistance for the last month, USDJPY remains vulnerable to declines and a break below 107.15 may catalyze a larger decline towards 105 in the medium term.

A 0.32% decline over the last week saw GBPUSD close at 1.2696, not far from our Q2 2019 forecast of 1.27. Technical analysis of the daily candle chart over a one year period reveals that over the last week further declines were consistently halted by the 23.6% one-year Fibonacci retracement (1.2663), however relief after support at this level was short lived. The constant intraday retesting of this support level leave us to conclude that the price does remain vulnerable while there fails to be a weekly close above the 50-week moving average (1.2789) and the 38.2% one-year Fibonacci retracement (1.2800). With the 14-day RSI showing neutral momentum, there is a risk in the week ahead that a break and daily close below the 1.2660 level can expose GBPUSD to a larger decline towards 1.25.

Regional equities started the week on a mixed note. The DFM index was an outperformer with gains of +1.2%. Gains were led by market heavyweights with Emirates NBD and Emaar Properties adding +4.1% and +1.1% respectively.

Oil markets ended the week higher and concluded a strong start to the first half of 2019. Front month Brent futures expired at the end of trading at USD 66.55/b, up 2% on the week and a gain of 21.2% year-to-date. Average prices in Q2 were USD 68.47/b compared with our forecast of USD 67.50/b. WTI futures gained 1.8% on the week, taking ytd gains to 28.8%. WTI hit an average of USD 59.91/b compared with our expectation of USD 57.50/b. As market focus turns to the next quarter, we maintain our forecasts for Brent to record an average of USD 67.50/b and WTI at USD 60/b.

OPEC meets this week with expectation that the production cut deal will be rolled over for at least the next six months of the year. The Russian president, Vladimir Putin, and Saudi Arabia’s crown prince, Mohammed bin Salman, have reportedly agreed on the side of the G20 meeting to an extension of between six to nine months and at current levels of 1.2m b/d. A roll-over of the production cuts into 2020 appears increasingly likely given a still strong supply growth picture outside of OPEC for next year.

Click here to Download Full article