The US shed 20.5mn jobs over the course of April, taking the unemployment rate to 14.7%, the highest level since the Great Depression. Even this heady figure is likely undervaluing the total given many workers will have taken themselves out of the workforce for the time being owing to illness or caring for others, or general pandemic-related restrictions. Over 33mn Americans have now lost their jobs since the pandemic hit the US, equivalent to around a tenth of the total population. Job losses have been broad based across all sectors, but hospitality in particular has been hard hit, shedding 7.7mn jobs in April. President Donald Trump has said that he is in ‘no rush’ for introducing more stimulus measures for now.

Saudi Arabia’s finance minister, Mohammed al-Jadaan has announced plans to boost VAT threefold to 15% from July 1. This comes alongside over USD 25bn of austerity cuts, including the removal of the cost of living allowance, as the government looks to alleviate pressure from both the spending and revenue side of the fiscal equation. As Kuwait on Sunday entered a strict 24-hour curfew for the next 20 days as it looks to curb the spread of the coronavirus in the country, the Emir called for an economic reboot in a televised address. He cautioned that Kuwait was facing twin challenges from the virus and the ‘decline in oil prices and the value of investments and assets, which will have a negative impact on the financial solvency of the state’, and called for diversification efforts and rationalisation of spending.

The Bank of England struck a particularly bearish note on Thursday when it cautioned that unemployment could double to 9% in the current crisis, and that GDP could contract by 14% in 2020 – which would be the sharpest annual contraction since 1706. Newly installed governor Andrew Bailey did however allow some optimism for next year, contending that the economy could recover with a 15% expansion. In terms of its actions, the BoE left the bank rate on hold at the record low of 0.1% and there was no increase in quantitative easing, though two members of the nine-member board did vote for an immediate GBP 100bn increase to the current GBP 645bn.

Egyptian inflation rose to 5.9% in April, from 5.1% in March. Real rates remain positive at 3.4% but we expect that the central bank will remain on hold at the next several meetings. Meanwhile, FX reserves fell by a further USD 3.1bn in April, following the record USD 5.4bn decline in March. Diminished inflows from tourism, remittances, and canal duties, alongside an outflow of portfolio investment have contributed to the decline.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed mixed last week after the US Treasury unveiled the debt sale program which leaned more towards the long-end of the curve. The broad risk-on tone despite weak non-farm payrolls failed to drive USTs higher. The curve steepened with yields on the 2y UST and 10y UST ending the week at 0.15% (-3 bps w-o-w) and 0.68% (+7 bps w-o-w) respectively.

Regional bonds saw sustained interest from investors as oil prices continued their previous momentum and hunt for yield trade gathered pace. The YTW on Bloomberg Barclays GCC Credit and High Yield index closed at 3.90% (-11 bps w-o-w) and credit spreads tightened 11 bps w-o-w to 317 bps.

Bahrain raised USD 2bn in two tranches of 10y bonds and 4.5 year sukuk. The 10y paper was priced to yield 7.375% while the sukuk was priced to yield 6.25%. The Bahrain 29s at the end of last week traded at 7.11%.

S&P affirmed Qatar’s rating at AA- with stable outlook.

Despite making some fair gains over the course of the week, the dollar's DXY index lost steam on Thursday and Friday to drop below the crucial 100.00 mark and end at 99.423, marking an increase of only 0.35%. The wave of job losses in the U.S. has been particularly devastating, with some traders speculating the possibility of negative policy rates implemented by the Fed. With this the JPY made some modest gains, reaching 107.63, an increase of 0.26% from last week's closing price.

The Euro had a bearish run last week and remains frail over concerns about the European Central Bank's quantitative easing programme. The currency slipped by 1.29% to finish at 1.0840. Sterling was similarly negative, but met support at the weekly low of 1.2266 and rebounded to finish at 1.2407 on Friday. An announcement by U.K. PM Boris Johnson about slowly relaxing lockdown measures has been anticipated for some time now and he is set to make one on Sunday outlining his plans. Still it is looking likely to be prolonged after the U.K. became the first European country to record more than 30,000 deaths from the pandemic.

Meanwhile the AUD and NZD shook off their largely middling movement in the middle of the week to increase over 1.75% and 1.20% respectively.

Regional equities traded mixed at the start of the week. The DFM index lost -1.1% while the Tadawul gained +0.8%. Weakness in banking sector stocks led the on the DFM with Dubai Islamic Bank dropping -1.7%. Emirates REIT said it has found evidence of irregular trading activity that has contributed to the low share price. The company said its board was in final stages of evaluating options to increase share liquidity and trust value.

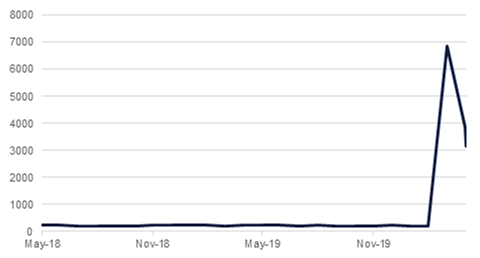

Oil futures managed to gain a second week running on signs of more and more economies reopening, whether cases of Covid-19 are under control or not, and early indications that supply restraint from OPEC+ is helping to take some excess crude out of the market. Brent futures added more than 17% and ended the week just shy of USD 31/b while WTI settled at USD 24.74/b, up more than 25% during the week. Brent futures have gained more than 60% since hitting their bottom of USD 19.33/b in mid-April while WTI’s turnaround from negative pricing has been tremendous.

Saudi Aramco cut the discounts on its OSPs for delivery to Asian markets, at odds with market expectations for further cuts to pricing. The reversal in pricing strategy reflects Saudi Arabia’s participation in the OPEC+ production cuts: more cuts would have essentially sent a message that the country was still participating in a price-war/market-share strategy and could have prompted retaliation from other producers, notably Russia, Iraq or other MENA exporters that have steep obligations to cut output. However, the increase in pricing (narrowing of discounts) comes amid still elevated regional inventories and depressed refining margins: gasoil crack spreads for Dated Brent or Dubai crudes are at their lowest level in the past year.