The US, UK and French airstrikes in Syria over the weekend don’t appear to have overly unsettled markets, and the risk of further (military) escalation at this stage appears contained. Asian equity markets are mixed this morning with Chinese indices down and the Nikkei a touch firmer.

Consumer confidence in the US (University of Michigan index) released on Friday declined to a lower than expected 97.8 in April, although it remains at a relatively high level by historical standards. Volatility in equity prices and the protectionist rhetoric on global trade likely weighted on consumer sentiment. Despite the decline in sentiment, consumption is likely to be a driver of growth this year, supported by tax cuts and job growth. US retail sales and the Empire Manufacturing Index are due to be released today.

The UAE is planning to introduce a new entry visa for transit passengers to allow them to sightsee while on stopover, in a bid to boost the tourism sector. The report follows a broader range of measures announced by UAE PM and ruler of Dubai HH Sheikh Mohammed to boost growth in the Emirate by streamlining administrative processes, reducing the cost of doing business, supporting SMEs in bids for government projects and other initiatives to support tourism and technology sectors.

Separately, the UAE central bank has implemented its new methodology for calculating the interbank rate. The number of banks on the rate setting panel has been reduced to eight from ten and contributors will need to use a wider range of transactions as a basis for their submission. The 3m EIBOR rate increased on Sunday under the new methodology, and is likely to be more volatile.

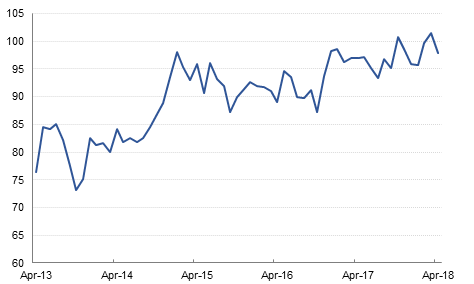

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US treasuries closed lower across the curve as risks faded in the second half of the week. Yields on the 2y USTs, 5y USTs and 10y USTs closed at 2.35% (+9 bps), 2.67% (+9 bps) and 2.82% (+5 bps) respectively.

Regional bond markets were dominated by significant sovereign issues from Saudi Arabia and Qatar. Both these issues saw huge demand with the order book exceeding USD 50bn for both the issuers. The Kingdom of Saudi Arabia raised USD 11bn in three tranches of 7 year, 12 year and 31 year. Qatar raised USD 12bn in three tranches of 5 year, 10 year and 30 year. The issues last week has pushed regional bond sales to USD 46.4bn so far this year.

Overall the market closed lower as existing issues were re-priced amid increase in benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose +7 bps to 4.33% and credit spreads remained flat at 172 bps.

Saudi Arabia’s sovereign credit rating was affirmed at A1 by Moody’s on expectations that fiscal consolidation will continue over the medium term. The outlook remained stable.

USD softened over the course of the previous week, the Dollar Index falling 0.34% to close at 89.811. Having started the week trading above the 50 day moving average, this support level gave way on 10th April and served as a resistance level over the remainder of the week. While the price remains below this key levels, the most likely outcome is for the index to realize further losses and a retest of the 38.2% five year Fibonacci retracement (88.423) remains a distinct possibility. A break and daily close below this level, increases the chances of a much greater decline towards the psychologically significant level of 85.

Most regional equities closed higher as political tensions over Syria receded following a limited military attack by the US and its allies. The DFM index and the Tadawul added +1.8% each.

Marka (-10.0%) closed limited down after the company announced plans to reduce capital through cancellation of shares on a pro rata basis to extinguish accumulated losses of AED 450mn at the end of 2017. The company also seeks to issue new shares worth AED 250mn.

Oil markets rallied sharply last week, gaining over 8% in Brent futures and nearly 8.6% in WTI. Brent closed the week at USD 72.58/b while WTI was at USD 67.39/b. US and allied intervention into Syria raised geopolitical risks in MENA, helping to keep a bid tone under oil markets while the IEA gave a robust assessment of OPEC’s work in draining inventories, declaring ‘mission accomplished’ in its latest oil market report.

In the US, oil companies added more rigs last week, increasing the country 7 and taking the total to 815 oil-focused rigs. At the same time, investors are growing more and more split on the outlook for Brent vs WTI. Speculative length in WTI fell by 3.3k bbl while positions in Brent gained by 20.5k bbl as the market becomes anxious about supplies from MENA. While we see little direct impact from the attacks on Syria to the outlook for oil production and new US Secretary of State pledged to fix, rather than abandon, the Iran nuclear deal, the geopolitical uncertainty will hang over markets in the near term.

In the metals markets, US sanctions on Russian companies, and Rusal in particular, continue to have an impact. Aluminium prices gained nearly 12% last week and palladium was also up nearly 10%.