US treasury curve continued its flattening trend with the gap between the longer-term and shorter-term yields narrowing further during the week. Yields on 2yr, 10yr and 30yr closed the week at 1.72% (+4bps), 2.34% (-6bps) and 2.78% (-9bps) respectively. 2yr10yr spread is now at 62bps, its lowest level since the financial crisis of 2008/2009. Long term government securities in Europe were on firmer grounds with 10yr yields on Bunds and Gilts closing lower at 0.36% (-6bps) and 1.29% (-3bps) respectively.

With reduced volatility in oil prices and expectations of stable economic growth, corporates in the developed world had little to worry. Credit protection costs were lower during the week. CDS levels on US IG and Euro Main closed down by a bp each to 56bps and 52bps respectively.

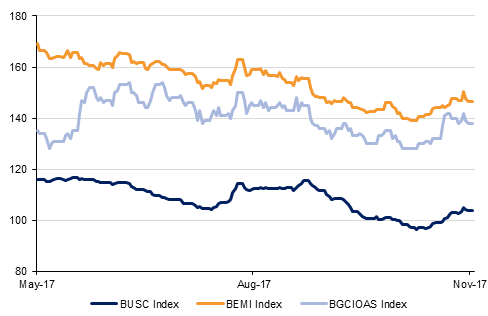

GCC bonds were mostly stable as investors sat on the sidelines, having little catalyst to induce trading. In line with lower longer term UST benchmark yields, the Barclays GCC index closed the week at average yield of 3.55% (-2bps) on unchanged credit spreads at 138bps.

Much in sync with the negative action on the Oman sovereign, several bond issuers from Oman are also seeing rating downgrades. S&P downgraded Bank Muscat from BB+/negative to BB/stable during the week. However bond prices were range-bound as the downgrade was much expected. BKMBOM 21s closed with yield at 3.44%, only 2bps wider than last week.

EA Partners I and EA Partners II said they expect to pay December bond coupons if non-defaulted companies keep contributing to the liquidity pool that funds the interest payments. In response, EAPART 20s rose more than a point in price to $74.52 and yield of 18.58% (-61bps). Last month, Fitch had downgraded EAPART bonds to CC, merely two notches above default.

Ezdan Holding bonds continued their slide downwards after the downgrade of rating into the junk category in the previous week. Even though the company announced plans to reduce costs via 15% cut in work force, investors remained skeptical, causing bonds to fall another four to five points. ERESQD 22s were down to $90.48 and yield of 7.46% (+150bps w/w).

Solid quarterly results with 3QW net rising to AED 1.51bn from AED 1.15 bn last year and the successful IPO of its development business had little impact on EMAAR bonds. EMAAR 26s closed the week at YTW of 3.90% (unchanged).

With involvement of senior executive from Al Baraka in the Saudi corruption purge, perpetual security of the Al Baraka Banking Group, BARKAB Perp, saw Z-spread reach to its highest level ever to 1016bps. Bond price fell more than two points and yield closed at 9.97% (+66bps).

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

S&P during the week stated that it’s too early to assess what impact the ongoing geopolitical conflicts and the corruption curb will have on the Saudi economy and therefore too soon to assess impact on KSA’s A-/stable rating. Bonds issued by the KSA sovereign as well as GREs such as SECO gained half to a point in price. KSA 27s closed quarter point up with yield at 3.50% (-4bps) and KSA 46s closed with yield at 4.59% (-6bps).

UK Court upheld the legality of the contracts in the Dana Gas sukuk case, though final judgement on the issue and further clarity will take more time until the UAE court has had the hearing on 25th December. Holders of DANAGS sukuk were comforted with the defaulted DANAGS 9% rising five points to close the week at $82.62, yield of 10.89% (-75bps).

Primary markets were quiet amidst increased uncertainty and volatility in the region with no new deal offered.