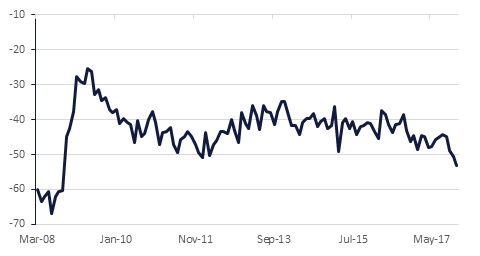

The US trade gap widened to USD53.1bn in December, the largest deficit since 2008. This was driven in part by higher commodity prices, but also strong domestic demand. Demand could strengthen further in future releases on the back of recent tax cuts, as already seen in ISM data released on Monday. The news will likely draw the ire of President Donald Trump given his commitment to narrowing the trade deficit as part of his ‘America First’ agenda, and could lead to more protectionist policies.

US equity markets made a modest recovery yesterday, but volatility remains elevated. It was likely concerns over faster-than-expected wage growth leading to more than three hikes this year that prompted the initial sell-off, so all eyes will be on Jerome Powell as he starts his new job as Fed Chair. It was announced yesterday that he is due to testify on the interest rates outlook to the House Financial Services Committee on February 28.

Staying in the US, the likelihood of a renewed government shutdown from February 8 is diminishing as the House passed a bill extending spending to March 23. The bill was passed 245-218, largely along party lines, and will now go to the Senate, before likely returning to the House for a final passage. While contentious immigration law has not been included in the current debate, there remain differences over Republican plans to extend defence payments to September 30, for which Democrats want concessions on domestic spending on issues such as drug addiction and infrastructure.

The Reserve Bank of Australia kept its benchmark cash rate unchanged at 1.50% yesterday, in line with expectations. Slightly more dovish language than expected led to a modest weakening in the Australian dollar in the wake of the announcement, but the currency has firmed again today. The MPC’s communique made clear that it still holds concerns over persistently low inflation and wage growth, in common with other developed markets. It does expect these to pick up, making a hike later in the year likely, but it stressed that progress would be gradual.

US Treasuries reversed gains in the previous session following a rebound in equities and decline in the VIX index. Yields were higher across the curve with 2y USTs, 5y USTs and 10y USTs yielding 2.10% (+8 bps), 2.53% (+10 bps) and 2.80% (+10 bps) respectively.

Regional bond markets closed flat. The YTW on the Bloomberg Barclays GCC Credit and High Yield index remained at 3.98% while credit spreads widened 1 bp to 150 bps.

First Abu Dhabi Bank has sought shareholder’s approval to issue any type of debt up to USD 7.5bn. The primary issuance calendar continues to build further with Damac in talks with banks for a USD sukuk.

Egypt’s Central Bank governor said that the central bank plans to start easing monetary policy once it is convinced that inflation has been reined in.

NZD has softened after mixed employment data. Reports released by Statistics New Zealand showed that the unemployment rate fell from 4.6% in Q3 2017 to 4.5% in Q4 2017, beating market expectations for an increase to 4.7%. However, during the same period, average hourly earnings slowed from 1.2% q/q to 0.8% q/q, subtracting from inflationary pressures one day before the RBNZ holds its first meeting of 2018. As we go to print, NZDUSD is trading 0.47% lower at 0.73076, wiping out half of yesterday’s gains. We expect support at 0.7260, close to the 61.8% one year Fibonacci retracement (0.7261).

Developed markets equities closed mixed in what was a volatile day of trading. Most equity indices recovered from day’s losses and the US equities actually closed in the green. The S&P 500 index added +1.7% while the Euro Stoxx 600 index dropped -2.4%. The VIX index touched a high of 50 before dropping -20.0% to close at 30.0.

Regional markets closed lower across the board as investors reacted to moves in developed markets. The DFM index and the Tadawul lost -1.5% and -1.6% respectively. The losses were broad based with market heavyweights taking the hit.

Oil prices continued to lose ground overnight, falling three days in a row which for both Brent and WTI is their longest slump since November 2017. In line with improvements in equity markets, oil futures are up slightly this morning with Brent at USD 67.34/b and WTI at USD 63.90/b. The API reported a decline in overall crude stocks of 1.1m bbl last week and gasoline inventories fell. However, there was a large build in diesel inventories, 4.6m bbl, at odds with what has been reportedly a cold winter in North America.