The market focus remains squarely on EM currencies and markets, with some consideration starting to be heard about whether the turmoil will slow the pace of Fed policy normalization. In the past under the Janet Yellen Fed external factors like EM stress sometimes played a part in deterring the FOMC from tightening, and of course the ‘taper tantrum’ of 2013 was an early warning about the risks of premature Fed tightening for the rest of the world. That was five years ago, however, and in 2018 it cannot be said that EM economies have not had plenty of warning about what is on its way. As far as the upcoming 26th September FOMC meeting is concerned it does not appear as if the Fed will deviate from its tightening trajectory, but there are some doubts about whether a further move later this year will be seen.

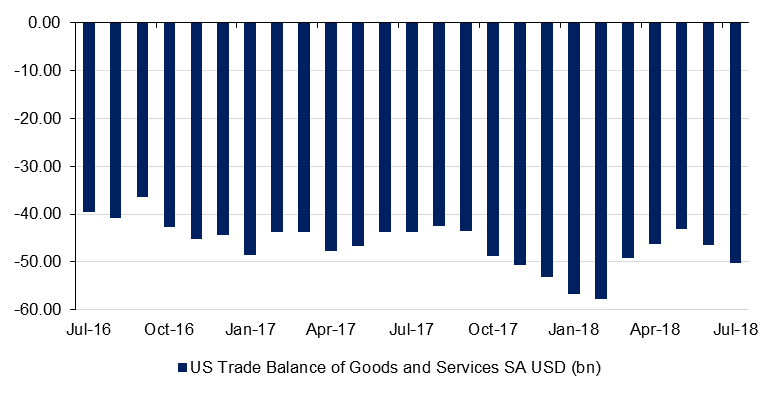

Important for both US markets and global ones in the next 24 hours will be the US employment report, which is expected to be strong and will likely add to expectations about another near-term US rate hike. At the same time the markets will be watching to see if the ending of the public comment period of the proposed USD200bn of US tariffs on Chinese goods, which concludes today, will trigger another round of tariffs on those imports. Ominously yesterday saw the US trade deficit widen by more than expected to USD50.1bn in July and a 5-month high, with exports falling by 1.0%, while imports were up 0.9% on the month. Ominously the deficits with China and the EU surged to record highs, likely compounding the risks that President Trump strikes out again.

Net foreign reserves at the Egyptian central bank rose to a new record of USD 44.4bn in August, compared to USD 44.3bn the month before. Egypt has managed to maintain its high level of reserves even while maintaining a stable currency in the midst of the ongoing EM sell-off, and contending with a departure of foreign investment from local currency treasury bills. Foreign ownership of t-bills fell to USD 16.7bn in June, down from a peak of USD 21.6bn in March, and has continued to fall since according to Central Bank sources. That said, although headline reserves have remained fairly buoyant, the Central Bank’s ‘Deposits not included in official reserve assets’ have declined from a high of USD 15.0bn in April to USD 12.0bn in August.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries traded mixed with the long end slightly cheaper and short end little changed. Yields on the 2y UST, 5y UST and 10y UST closed at 2.65% (flat), 2.77% (flat) and 2.90% (+1 bp) respectively.

Regional bonds closed marginally higher. The YTW on the Bloomberg Barclays GCC Credit and High Yield index declined -1 bp to 4.47% and credit spreads tightened 1 bp 173 bps.

According to reports, Bahrain raised USD 500mn from a private placement of bonds with five regional banks. The issue is said to be priced at 330 bps above the three-year midswaps. Elsewhere, a group of creditors to EA Partners hired Dechert LLP ahead of a possible debt restructuring.

Despite firmer than expected economic data, the AUD is softer in the Asia session. A report from Australian Bureau of Statistics showed that compared with expectations for a narrowing to AUD 1450m in July, the Trade balance surplus narrowed to AUD 1551m from AUD 1937m the previous month. As we go to print, AUDUSD is trading 0.20% lower at 0.71786, not far above the one year low of 0.7145. A break and daily close below this level may catalyse a further decline, initially to 0.70 and then to 0.6827, the five year low last seen in January 2016.

Developed market equities closed lower amid weakness in technology shares and continued strain in emerging markets. The S&P 500 index and the Euro Stoxx 600 index lost -0.3% and -1.1% respectively.

Saudi equities led regional markets lower with the Tadawul losing -3.1%. Banking sector stocks across the board closed lower with Al Rajhi Bank losing -3.0% and FAB dropping -2.8%. UNB was an exception as the stock closed +11.7% higher as investors continue to react positively to the potential merger news.

Oil markets fell overnight largely on external factors such as the imminent imposition of more US tariffs on Chinese goods. Brent futures closed down 1.1% while WTI futures fell 1.65% as the impact of Storm Gordon lessened. OPEC’s secretary general, Mohammad Barkindo, stated that oil demand may hit as high as 100m b/d by the end of 2018, roughly in line with estimates from the IEA. EIA data has been delayed owing to a public holiday in the US at the start of the week but private sector data showed a decrease in US crude inventories by 1.2m bbl last week and another uptick in refinery demand.

The diverging trend in forward curves remains intact with the backwardation in Brent widening in the 1-2 month spread and compressing in WTI. The Brent/Dubai EFS is holding above USD 3.11/b thanks to the recent recovery in Brent prices to over USD 79/b.